bitcoin

- Get link

- X

- Other Apps

bitcoin |

- Bitcoin Price Reaction to Tether Fiasco May Signal Strong Fundamental Strength - newsBTC

- Bitcoin Bulls Drive $20 Million into New York-based Crypto Trust - newsBTC

- This Awful Bitcoin Stat Guarantees It’s Not Crypto’s Future: Mathematician - CCN

- E-Trade One-Ups Rival, Readies Launch of Bitcoin Trading for Millions - CCN

- Bitcoin Cash [BCH] bull Roger Ver denies ownership of ‘@bitcoin’, says allegations are false - AMBCrypto News

| Bitcoin Price Reaction to Tether Fiasco May Signal Strong Fundamental Strength - newsBTC Posted: 27 Apr 2019 12:30 PM PDT  |

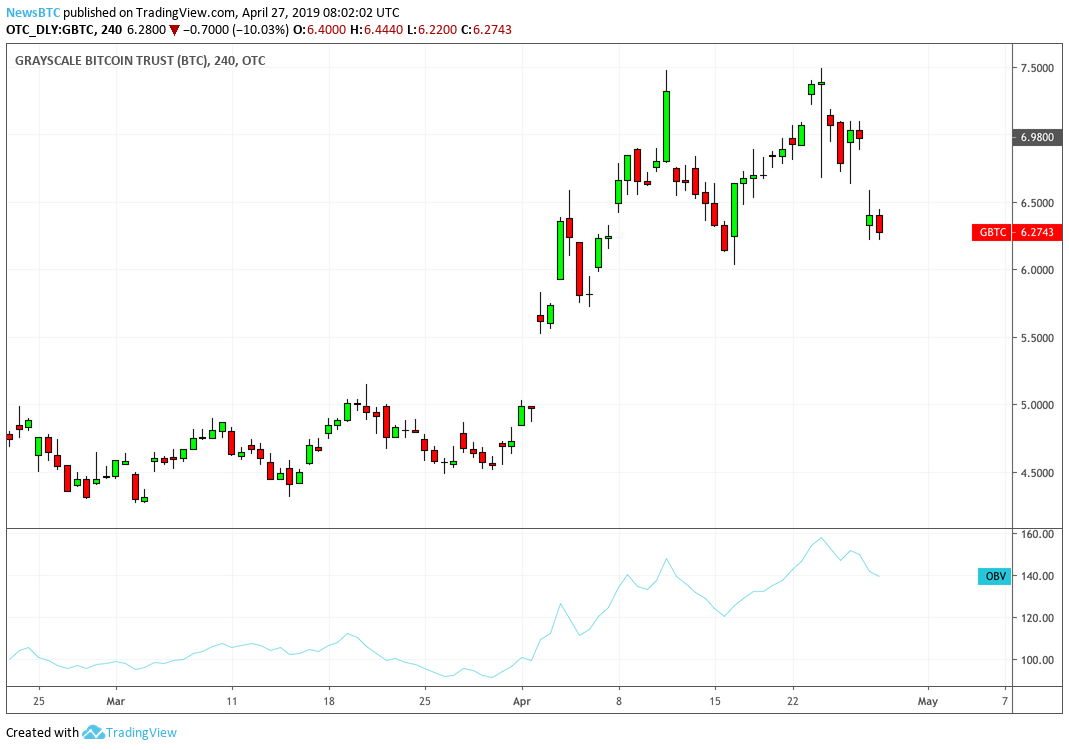

| Bitcoin Bulls Drive $20 Million into New York-based Crypto Trust - newsBTC Posted: 27 Apr 2019 04:00 AM PDT   Greyscale Bitcoin Investment Trust Price Chart | Source: TradingView.comGBTC market's medium-term perspectives fared well. The stock surged more than 100 percent since February 6, 2019, leaving investors with a stronger bullish bias. Greyscale's latest financial report showed that GBTC was 2,721.3 percent up since inception while it's 12-month performance was negative, down 47.6 percent.Greyscale's other cryptocurrency products also posted annual losses, with ZCash, Ethereum Classic, and Bitcoin Cash noting more than 70 percent drop in holdings.Only Accredited InvestorsStrong asset inflows in the medium-term indicate that institutional interest in bitcoin is emerging again following the 2018's decline. Greyscale's clientele includes hedge funds, pensions, endowments, family offices, and high net-worth individuals – and their interest in GBTC, which represents the ownership of bitcoins held by Greyscale, show a stronger bullish bias for the asset.CRYPTO: $GBTC premium to NAV creeping up to 36% on heels of $BTC surge to ~$4,000Rise in premium is a sign of institutional net buying (easier to buy this ETN from @GrayscaleInvest than buy via a crypto exchange)……another sign 2019 way better than 2018 for crypto pic.twitter.com/hdFh8y3sY9— Thomas Lee (@fundstrat) February 19, 2019 The shift came amidst institutions' uncertainty of the cryptocurrency market's future. Security, lack of regulations, and news of fraud were the main obstacles. But with big names in the mainstream financial industry building a crypto-enabled infrastructure, the fears are dropping down. It is already visible in bitcoin's impressive performance in 2019.Yale and Harvard's endowment funds have invested in at least three venture capital funds that deal in cryptocurrencies. Fidelity and Nasdaq have also entered the market with several partnerships and cryptocurrency ventures.Image Credits to Shutterstock Greyscale Bitcoin Investment Trust Price Chart | Source: TradingView.comGBTC market's medium-term perspectives fared well. The stock surged more than 100 percent since February 6, 2019, leaving investors with a stronger bullish bias. Greyscale's latest financial report showed that GBTC was 2,721.3 percent up since inception while it's 12-month performance was negative, down 47.6 percent.Greyscale's other cryptocurrency products also posted annual losses, with ZCash, Ethereum Classic, and Bitcoin Cash noting more than 70 percent drop in holdings.Only Accredited InvestorsStrong asset inflows in the medium-term indicate that institutional interest in bitcoin is emerging again following the 2018's decline. Greyscale's clientele includes hedge funds, pensions, endowments, family offices, and high net-worth individuals – and their interest in GBTC, which represents the ownership of bitcoins held by Greyscale, show a stronger bullish bias for the asset.CRYPTO: $GBTC premium to NAV creeping up to 36% on heels of $BTC surge to ~$4,000Rise in premium is a sign of institutional net buying (easier to buy this ETN from @GrayscaleInvest than buy via a crypto exchange)……another sign 2019 way better than 2018 for crypto pic.twitter.com/hdFh8y3sY9— Thomas Lee (@fundstrat) February 19, 2019 The shift came amidst institutions' uncertainty of the cryptocurrency market's future. Security, lack of regulations, and news of fraud were the main obstacles. But with big names in the mainstream financial industry building a crypto-enabled infrastructure, the fears are dropping down. It is already visible in bitcoin's impressive performance in 2019.Yale and Harvard's endowment funds have invested in at least three venture capital funds that deal in cryptocurrencies. Fidelity and Nasdaq have also entered the market with several partnerships and cryptocurrency ventures.Image Credits to Shutterstock |

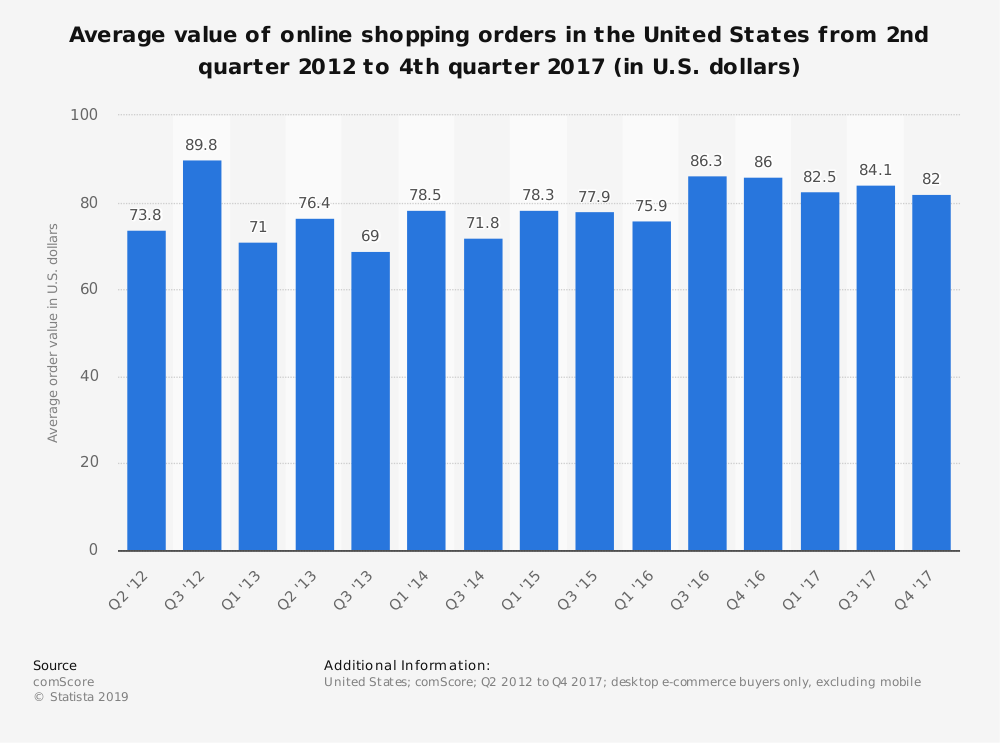

| This Awful Bitcoin Stat Guarantees It’s Not Crypto’s Future: Mathematician - CCN Posted: 27 Apr 2019 07:04 AM PDT By CCN: With all the hype about blockchains and their many uses, we shouldn't forget the original purpose for the Bitcoin blockchain and Nakamoto's great leap forward. Blockchains and cryptocurrencies were created to be decentralized currencies, replacing or complementing fiat currencies. For the most avid crypto fans, crypto is the future of currency and will eventually handle full-scale economies. We dream of the day that we laugh and tell our kids and grandkids that we had physical wallets, paper currencies, and things called "credit cards" ("Grandpa, seriously, you are so old!"). Preparing the Crypto Economy for Mass AdoptionSo what has to happen in order for us to run economies on the blockchain? There are several hurdles we still need to clear, like getting the value of these currencies to be stable, handling privacy in a sensible way, and getting confirmation speeds fast enough for point-of-sale transactions. By far the most glaring hurdle, however, is throughput. We need to be able to handle many, many more transactions per second than any current blockchain is capable of. At 13 transactions per second (a high estimate), Bitcoin can handle just over a million transactions per day. For niche, small economies, this might do the trick. But it certainly won't do it for, say, the US economy. Let's put this into perspective. In 2017, the US gross domestic product (GDP) was almost $20 trillion. GDP isn't a great measure of how much money changes hands during the year, but for our purposes, it's close enough. If about $20 trillion changed hands in the US in 2017, then about $54 billion changed hands every day (20 trillion divided by 365). Ignoring how slowly Bitcoin processes transactions, if it were to handle $54 billion in transactions in one day, transactions would have to be on average about $54,000 (54 billion divided by 1 million). What? Your everyday transactions aren't $54,000 on average? Of course not. Between 2012 and 2017, US consumers spent roughly $80 per transaction online.  Bitcoin doesn't look like a candidate to replace credit cards in the online payments realm. | Source: Statista In 2016, transactions on Amex credit cards averaged about $141, and those on Visa averaged about $80. While it is true that corporations tend to transact in higher dollar amounts, it's still likely that the crypto community is still a few orders of magnitude away from being able to handle all the transactions in an economy on a single blockchain. If, based on the statistics I just gave, we assume that transactions are about $100 on average, then $54 billion would change hands every day in roughly 540 million transactions (54 billion divided by 100). That boils down to about 6,000 transactions per second on average. If we take into account the fact that most people transact during the day, a quick recalculation yields about 10,000 transactions in an average daytime second (instead of dividing by 24 hours of the day, divide by 16 to account for about 8 hours of sleep). This estimate is probably about right. There are roughly 324 million people in the United States, and about 5 million businesses. If we assume that people and businesses, on average, transact 1.5 times per day, then we have about 500 million transactions per day (329 million entities multiplied by 1.5). This is close to our estimate of 540 million daily transactions from before, which gives about 10,000 transactions per daytime second in the United States. Bitcoin Would Need to Increase Transaction Capacity By Four Orders of Magnitude to Replace Visa With Bitcoin's staggeringly-limited transaction capacity, it's unrealistic to believe it can rival Visa or Mastercard – much less both. | Source: Shutterstock Getting back to the original question, how many transactions per second does a blockchain have to be able to handle in order to support the United States economy? Our rough calculation of 10,000 transactions per second is almost certainly not enough, but it does give a base from which we can work. To give perspective, Visa processes about 1,700 transactions per second on average but at peak times it can handle up to about 24,000 transactions per second. Their max limit is just over an order of magnitude higher than the average, in order to handle high-volume days like Black Friday or the post-Christmas wave of returns. Taking Visa's data as an example, since 10,000 transactions per second is our rough estimate for the average, we'd probably need to be able to handle around 100,000 transactions per second to really kill it (one order of magnitude higher than the average, similar to Visa). That's a lot. More precisely, that's about 10,000 times faster than Bitcoin—a whopping difference of four orders of magnitude. To me, this says that our methods of finding consensus on a blockchain are simply not fast or powerful enough to actually use crypto as a viable currency. We need innovations in infrastructure, hardware, and consensus algorithms in order to even hope to reach this threshold. Bitcoin Is Not the Future of CryptoThat is to say that, barring some major changes and improvements, Bitcoin is almost certainly not the future of crypto. Technologies like the Lightning Network attempt to solve the scalability problem, but do so awkwardly and ineffectively. Opening channels to transact off-chain ties up money in extremely inconvenient ways. In practice it incentivizes users to open a single channel with a centralized liquidity provider on the blockchain, rather than opening many channels. This effectively creates unregulated, centralized banks, and in my view goes against the core principles of blockchain technology. Even worse, because transactions are done off-chain and channel data can't be deterministically rebuilt, if a Lightning node crashes, both parties can easily lose funds. It may genuinely be one of the worst ideas in cryptocurrency. Notwithstanding, the blockchains of the future may not be so far off. New research in math shows promising results in the mathematical foundations of consensus that could produce blockchains with 50,000 transactions per second or more without compromising safety or decentralization. Every day, a new paper comes out or a crypto startup launches a new product. There are plenty of bright minds working on securing the crypto dream. I guess in twenty years if you're paying for your groceries with crypto you'll know that we succeeded. About the Author: Derek Sorensen, Pyrofex Research Mathematician, has an MSc in Mathematics and Computer Science from the University of Oxford and is set to start his PhD this fall at the University of Cambridge, where he will study logic and topology. His work at Pyrofex is in formal verification, which includes research on the theory of consensus and setting up mathematical frameworks to prove theorems about code. |

| E-Trade One-Ups Rival, Readies Launch of Bitcoin Trading for Millions - CCN Posted: 27 Apr 2019 10:06 AM PDT By CCN: E-Trade is about to offer bitcoin and ether trading, bolstering its securities platform for 5 million customers, a source familiar with the matter told Bloomberg Friday. The securities brokerage firm appears to be taking the approach that 'if you build it, they will come.' That plus their rivals are doing it. We know this guy's going to be happy about the news: Competition Among Crypto Trading Platforms Heats UpThe traditional Wall Street firm enters a crowded field of early movers in the crypto trading space, including leaders such as Coinbase and Square's Cash App. Nathaniel Popper, a tech journalist at The New York Times, was also tipped to the development. He points out that the move comes after TD Ameritrade began to quietly offer bitcoin trading for select customers:

E-Trade will also go head-to-head with commission-free stock trading app Robinhood. The finance "outlaw" app is a favorite among millennials for its ease of use and zero brokerage fees. Robinhood briefly overtook E-Trade based on the number of trading accounts in May 2018. E-Trade apparently hasn't forgotten. No doubt the appeal of cryptocurrency to the younger generation was a major draw for Robinhood's already millennial-friendly platform. Robinhood recently secured the coveted BitLicense to operate in New York, as did Bitstamp. E-Trade stands to capture a good chunk of the millennial trader market share by adding digital currencies. In fact, 43% of millennials say they trust cryptocurrencies more than the stock market. Meanwhile, 25% of millennials are already using or saving crypto assets. Unleashing E-Trade's 5 Million CustomersReports suggest that E*Trade is "unleashing" crypto onto its customers. Truth is, the company is really unleashing its 5 million trading accounts onto the bitcoin and Ethereum markets. Like Square's Cash App or Coinbase, E-Trade customers who purchase cryptocurrency will not be given the private keys to their own coins. E-Trade is reportedly finalizing talks with a third party for digital asset custodial services of customer accounts. This, no doubt, is not an optimal service for bitcoin "hodlers" or those looking to save large amounts of bitcoin and ether for the future. They will prefer to have the private keys in their own possession. An entire industry has grown around the need to secure private keys in cold storage hardware wallets. But an onslaught of E-Trade day traders will clearly infuse the market with massive amounts of liquidity and velocity. Day traders love markets with the precise characteristics of crypto, including volatility. |

| Posted: 27 Apr 2019 09:11 AM PDT

DAILY CRYPTO NEWS – APRIL 27, 2019 1) India's HDFC Bank 'threatens' crypto-customers: The Housing Development Finance Corporation Ltd [HDFC], the largest private lender in India has been ramping up its efforts in opposition of the country's cryptocurrency industry by disseminating "threatening" e-mails to those users who purchased cryptocurrencies. Read more at https://bit.ly/2GLELys 2) e-Trade could launch crypto-trading: The latest report from Nathaniel Popper, the technology reporter at New York Times, stated that eTrade, a popular financial management organization, was planning to provide Bitcoin [BTC] and Ethereum [ETH] trading options to a large batch of their customers. Read more at https://bit.ly/2LmhAzp 3) Peter McCormack on London Block Exchange: Peter McCormack, the host of What Bitcoin Did podcast, alleged that The London Block Exchange is insolvent and that it has been insolvent since Autumn of 2018. Read more at https://bit.ly/2DD768a 4) Roger Ver denies ownership of '@bitcoin': In a recent interview with Bruce Porter, Ver clarified on an ongoing rumor that he owns the Twitter handle '@bitcoin', saying that he has nothing to do with it and that his actual handle is @rogerkver. Read more at https://bit.ly/2GH83xf 5) Charles Hoskinson on Shelly update: In the latest AMA, Hoskinson said that "Shelley will happen this year a 100 percent. I will eat my own shoe, if it does not". Read more at https://bit.ly/2UHcTPL 6) Bitfinex-Tether fiasco: Kraken, the American cryptocurrency giant, saw a notable "dump" of Bitcoin, leading to the coin descending below $5,000 prior to the announcement by the New York Attorney General. No concrete evidence points to a correlation between the BTC price decline on Kraken and the imminent announcement, but many in the community are curious. Read more at https://bit.ly/2IY6EFe |

| You are subscribed to email updates from "bitcoin" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

- Get link

- X

- Other Apps

Comments

Post a Comment