bitcoin price

- Get link

- X

- Other Apps

bitcoin price |

- Bitcoin Price Watch: BTC Could Retest $3,600 Before Buyers Reappear - newsBTC

- Bitcoin [BTC] Price Analysis: Price Broke Down From The Symmetrical Triangle, Where to Next? - Coingape

- Bitcoin (BTC) Price Analysis: Breakout Levels to Watch - Ethereum World News

- Bitcoin Price Falls Toward $3700 amid Market-Wide Correction - Hacked

- Bitcoin Price Sinks Below $3,800, Ethereum and EOS Plunge 5%: is Crypto on the Decline? - CCN

| Bitcoin Price Watch: BTC Could Retest $3,600 Before Buyers Reappear - newsBTC Posted: 03 Mar 2019 10:30 PM PST   Looking at the chart, bitcoin price is slowly declining towards the $3,680 and $3,650 support levels. If sellers remain in action, there are even chances of more losses below the $3,640 level. The key support is at $3,600, where buyers are likely to take a stand. On the other hand, to start a decent uptrend, the price must clear the $3,800 and $3,860 resistance levels.Technical indicatorsHourly MACD – The MACD is gaining momentum in the bearish zone.Hourly RSI (Relative Strength Index) – The RSI for BTC/USD declined heavily and it seems to be heading towards the 15 level.Major Support Level – $3,650 followed by $3,600.Major Resistance Level – $3,760, $3,775 and 3,800. Looking at the chart, bitcoin price is slowly declining towards the $3,680 and $3,650 support levels. If sellers remain in action, there are even chances of more losses below the $3,640 level. The key support is at $3,600, where buyers are likely to take a stand. On the other hand, to start a decent uptrend, the price must clear the $3,800 and $3,860 resistance levels.Technical indicatorsHourly MACD – The MACD is gaining momentum in the bearish zone.Hourly RSI (Relative Strength Index) – The RSI for BTC/USD declined heavily and it seems to be heading towards the 15 level.Major Support Level – $3,650 followed by $3,600.Major Resistance Level – $3,760, $3,775 and 3,800. |

| Posted: 04 Mar 2019 02:31 AM PST The price of BTC/USD touched $4225 on February 24th, before generating bearish divergence in the medium-term and breaking down. After a slight bounce on the ascending support line, price broke down again and fell to the minor support area near $3800. In the short-term, the price has struggled to retrace past the 0.382 fib line of the entire drop and recently broke down from a short-term symmetrical triangle. Key Highlights:

Bitcoin Price Analysis – BTC/USD – 4 Hours Chart A look at the 4-hour chart shows us that after touching $4250, the price dropped sharply through a massive bearish engulfing candle. The drop occurred with significant volume and was preceded by bearish divergence in both the RSI and the MACD. Price enjoyed a slight bounce on the long-standing support line, but it ultimately proved unsuccessful and price broke down again shortly after. It is currently trading at $3815, inside the minor support area at $3800-$3850 where it has effectively made a triple bottom pattern. The support area coincides with the 0.5 fib line of the entire upward move. If the support area fails, the next one will be found near $3650. Conversely, the closest resistance area is found near $4000. As for the indicators, the price is trading below the 21 and 50-period moving averages which have made a bearish cross and are offering close resistance to the price. The MACD has made a bearish cross and is falling sharply. The RSI is at 28, indicating oversold conditions. BTC/USD – Price Analysis – 15 Minutes Chart A look at the 15-minutes chart shows that after the drop, price bottomed at $3820 and has been struggling since to break above the 0.382 fib line which is at $3980. There is also a very significant resistance area near $4000, formed by previous support levels and the 0.5 fib line of the entire drop. After making a double bottom, the price started following an ascending support line. After 3 days and 17 hours, the price broke down from the triangle and made a triple bottom at $3815. The breakdown occurred at a very small volume. Price has formed a support area at $3800-$3830. As for the indicators, the RSI is at 29, indicating oversold conditions. Price is trading below the 21 and 50-period moving averages which have made a bearish cross and are offering resistance to the price. ![Bitcoin [BTC] Price Analysis: Price Broke Down From The Symmetrical Triangle, Where to Next?](https://cdn.coingape.com/wp-content/uploads/2019/03/04151538/BTC-4h.png) Article Name Bitcoin [BTC] Price Analysis: Price Broke Down From The Symmetrical Triangle, Where to Next? Description The price of BTC/USD touched $4225 on February 24th, before generating bearish divergence in the medium-term and breaking down. After a slight bounce on the ascending support line, price broke down again and fell to the minor support area near $3800. In the short-term, the price has struggled to retrace past the 0.382 fib line of the entire drop, and recently broke down from a short-term symmetrical triangle. Valdrin Tahiri Publisher Name Publisher Logo  |

| Bitcoin (BTC) Price Analysis: Breakout Levels to Watch - Ethereum World News Posted: 03 Mar 2019 07:25 PM PST Bitcoin is still stuck in tight consolidation, bouncing off support around $3,835 and resistance at $3,950. Price is at the middle of its range and could be due for a breakout anytime soon. The 100 SMA is below the longer-term 200 SMA to hint that the path of least resistance is to the downside or that a move lower is more likely to happen. This could either mean a test of support or a break lower and a drop that's the same height as the chart formation. Price is moving below both moving averages to indicate that bearish pressure is in play. Then again, the gap between the moving averages is narrowing to reflect slightly weakening selling pressure. A move above both could spur a test of the range top or a break higher, leading to a rally of the same size. RSI is pointing down, also indicating that selling pressure is present, even though overbought conditions have not been met. Stochastic is on the move up to signal that buyers might still have some energy left but a downward crossover or early bearish signal seems to be brewing. Traders are still holding out for actual developments in the space before piling on long positions, possibly waiting to see if Fidelity is able to push through with its institutional platform launch. More so, market watchers are eager to find out how banks and funds will position themselves. Also, the increase in volume might be weighing on volatility as more and bigger players enter the field. Meanwhile, the dollar would likely take cues from overall sentiment, as well as economic data like the NFP release. It's no secret that the Fed is looking to slow down its pace of tightening but an upside jobs data surprise could still keep bulls hopeful that another hike is in the works soon. |

| Bitcoin Price Falls Toward $3700 amid Market-Wide Correction - Hacked Posted: 04 Mar 2019 04:36 AM PST Following several days of relative calm in the cryptocurrency segment, the week started out with an active and bearish day. The majors are all trading in the red after the US opening bell, and even the recently strong Litecoin got dragged lower by the broader market. On another negative note, most of the coins violated the short-term support levels that we have been monitoring, and without a quick rebound, a new downswing might already be underway in the ongoing bear market. Our trend model remained on sell signals on both time-frames throughout the short-term consolidation phase, and with the negative short-term outlook now confirmed, traders and investors should still not enter new positions here. The long-term downtrends are clearly intact in the segment, and even the relatively stronger coins will likely follow the market-wide trend, do downside risks remain high for all of the top coins. ETH/USD, 4-Hour Chart Analysis We have been paying special attention to Ethereum during the consolidation phase, as it has been showing the way for the market in recent weeks, and today, the second largest coin has been leading the way lower again as expected. ETH broke below last week's low and the key $130 support in early trading, and although the bearish momentum is not damaging, selling pressure is still apparent in the coin's market. That's a negative sign for the whole segment, and while short-term support levels are found near $125 and $120, the more important $112 level is now likely to be tested in the coming day. ETH remains on sell signals on both time-frames in our trend model, and from a broader perspective, at least the re-test of the prior bear market low near $80 seems likely, with another strong support zone found between $95 and $100. BTC/USD, 4-Hour Chart Analysis Bitcoin also violated last week's swing low today in early trading, and although it's slightly stronger than ETH from a short-term standpoint, it still looks poised to test the $3600 level in the coming days. Below that, all eyes will be on the support/resistance zone just above the $3450 level, while from a broader perspective, a move towards $3000 could already be underway. Bulls would need a quick recovery above the $3850 level to change the short-term outlook, but given the long-term setup in BTC and the whole segment, odds favor the continuation of the bear market here. Above $3850, strong resistance is also ahead in the $4000-$4050 zone and near $4450, while further support is found near $3250. Altcoins Under Pressure Again but Litecoin Still StableLTC/USD, 4-Hour Chart Analysis While Litecoin continues to be relatively strong compared to its closest peers, it failed to make meaningful technical progress, and today it edged closer to the key $44 support amid the broad sell-off. The coin is still within its recent consolidation range, while being clearly above last week's lows, but the market-wide trends make a sustained bullish move unlikely in LTC. With that in mind, traders and investors still shouldn't enter new positions here, with strong resistance zones now ahead near $48 and $51, and with further support found at $38 and $34.50. XRP/USDT, 4-Hour Chart Analysis While Ripple enjoyed a brief period of relative strength last week, today, it sold off together with the broader market, although it remained within its short-term trading range. The $0.30 support stopped the bleeding, for now, but XRP is still the weakest top coin from a technical perspective, and a move towards $0.28 and $0.26 still seems very likely. Ripple is on clear sell signals on both time-frames in our trend model, and it is now close to the lower boundary of the broader bearish triangle pattern that has been providing support over the past couple of months. A move below that could accelerate the, so traders should stay away from entering even short-term positions here, with key resistance zones now ahead near $0.32, $0.3550, and $0.3750. EOS/USD, 4-Hour Chart Analysis After showing short-term weakness, EOS plunged below last week's low while also clearly leaving behind the previously dominant short-term trendline. With that, the counter-trend move now has an even smaller chance of resuming, since the bullish leadership is getting weaker and weaker. EOS is now likely headed to the $3 support level, with strong resistance zones ahead near $3.50 and $3.80, and with further support found near $2.80 and between $2.50 and $2.55. Featured image from Shutterstock Disclaimer: The analyst owns cryptocurrencies. He holds investment positions in the coins, but doesn't engage in short-term or day-trading, nor does he hold short positions on any of the coins. |

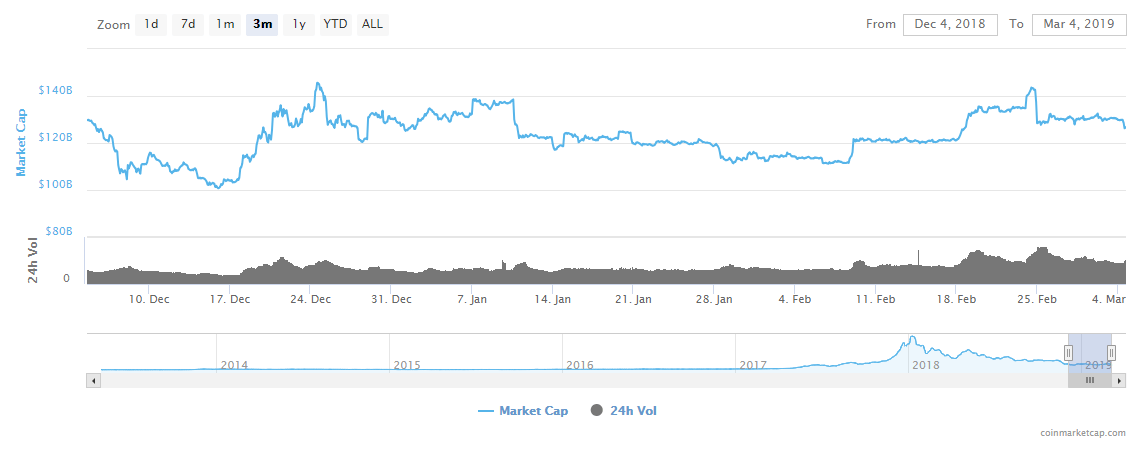

| Bitcoin Price Sinks Below $3,800, Ethereum and EOS Plunge 5%: is Crypto on the Decline? - CCN Posted: 04 Mar 2019 12:50 AM PST In the last 24 hours, the Bitcoin price dropped from $3,874 to $3,764 by 2.8 percent, leading major crypto assets such as Ethereum and EOS to lose well over 5 percent of their value against the U.S. dollar. The valuation of the crypto market fell by $4 billion from $130 billion to $126 billion, dropping to the $120 billion region for the first time since mid-February. Traders Not Optimistic About Short-Term Movement of BitcoinEarlier this month, one cryptocurrency analyst suggested that the longer Bitcoin remains in its tight range from $3,300 to $4,000, the higher the probability of the asset declining below key support levels gets. Since the start of the 15-month bear market in January 2018, Bitcoin has tended to record a large drop in value following an extended period of stability.

For well over three months, BTC has barely moved out of its tight range in the $3,000 region, struggling to test crucial resistance levels above $4,200. As such, an increasing number of traders have started to wait out and observe the short-term price movement of the crypto market before engaging in any trade.

On March 2, a cryptocurrency trader with an online alias "Hsaka" said that the weaker follow through of Ethereum has presented a better opportunity for traders at $125. Since then, the price of Ethereum has dropped by 5 percent to $127 and is en2 route to testing a support level at $125. "Every subsequent reaction (bounce of range low) has a weaker follow through. I'd rather long the next level down at $125 than a beaten up support," the trader said. Similarly, other major crypto assets such as EOS have dropped to their respective support levels, which could be crucial levels to defend in the days to come.

Although analysts remain optimistic in the mid-term price trend of crypto assets with potential catalysts like Bakkt and Fidelity on the horizon, in the near-term, analysts remain cautious on the price movements of the cryptocurrency market. Previously, a technical analyst said that if BTC fails to remain above the mid-$3,000 region, there exists a strong possibility that the asset drops to a new yearly low in the $2,000 region.

With the cryptocurrency market demonstrating indecisive movements in a tight range, traders are not ruling out any near-term possibilities. Currently, Bitcoin is in a position wherein it could break out of $4,200 and establish newly found momentum for a short-term rally or potentially retest previous lows. How About the Institutions?Since the release of Grayscale's 2018 report, investors in the cryptocurrency space have questioned the lack of movement in crypto markets given the growing involvement of institutional investors. To date, less than $500 million are said to have been invested by institutions over the last 12 months. That is less than 5 percent of the daily trading volume of the cryptocurrency exchange market. Eventually, some investors like billionaire Mike Novogratz foresee institutions having an impact on the price trend of crypto assets but in the upcoming months, it will likely have a minimal effect on the market. View the live bitcoin price chart here. |

| You are subscribed to email updates from "bitcoin price" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

- Get link

- X

- Other Apps

Comments

Post a Comment