Don’t Forget About Cryptocurrency Like Bitcoin At Tax Time - Forbes

- Get link

- X

- Other Apps

Don’t Forget About Cryptocurrency Like Bitcoin At Tax Time - Forbes |

- Don’t Forget About Cryptocurrency Like Bitcoin At Tax Time - Forbes

- What are the benefits of cryptocurrency? - Fox Business

- Cryptocurrency entrepreneur finally gets his $4.6 million meal with Buffett - CNBC

- Cryptocurrency Market Update: Bitcoin bulls aim at $10,000; Ethereum stages an impressive rally - FXStreet

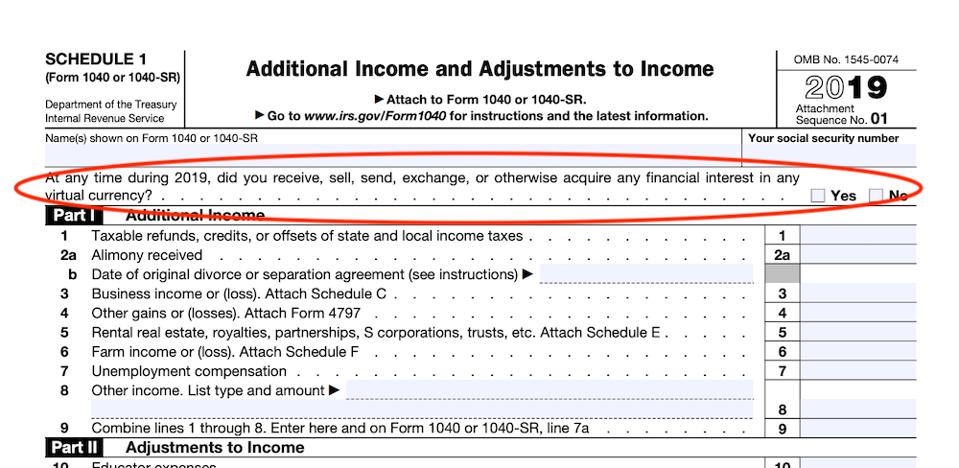

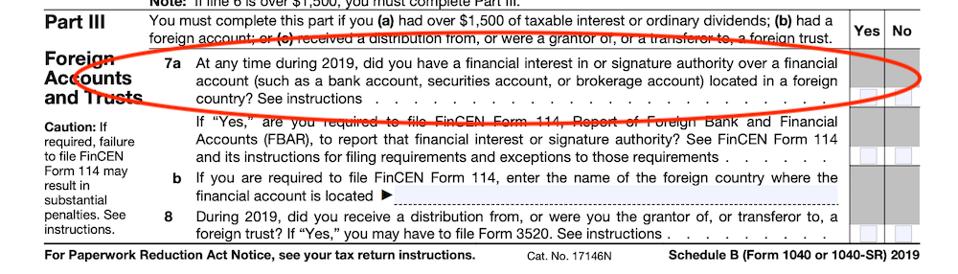

| Don’t Forget About Cryptocurrency Like Bitcoin At Tax Time - Forbes Posted: 06 Feb 2020 11:47 AM PST  PARIS, FRANCE - JUNE 25: In this photo illustration, a visual representation of the digital ... [+] Cryptocurrency, Bitcoin is displayed on June 25, 2019 in Paris, France. (Photo by Chesnot/Getty Images) Getty ImagesForm 1040 may look similar to last year's return, but there's one key difference that's attracting attention: a question about cryptocurrency. As I reported late last year, early drafts of Form 1040 reflected a new question on the top of Schedule 1, Additional Income and Adjustments to Income (downloads as a PDF). Schedule 1 is used to report income or adjustments to income that can't be entered directly on the front page of form 1040. The new question made it onto the final version of Schedule 1:  KPE The question asks: At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? The placement of the question is important. I believe the question is intended to be so conspicuous that it makes it difficult for any taxpayer to argue that they didn't know that it was necessary to report cryptocurrency transactions. The Internal Revenue Service (IRS) has made no secret of the fact that it believes that taxpayers are not properly reporting cryptocurrency transactions. An IRS dive into the data showed that for the 2013 through 2015 tax years, the IRS processed, on average, just under 150 million individual returns annually. Of those, approximately 84% were filed electronically. When IRS matched data collected from forms 8949, Sales and Other Dispositions of Capital Assets, which were filed electronically, they found that just 807 individuals reported a transaction using a property description likely related to bitcoin in 2013; in 2014, that number was only 893; and in 2015, the number fell to 802. But… so what? If you skip over the question or answer it wrong, you can still claim that you made a mistake, right? Here's the thing. Even though the question is new, this kind of question certainly isn't. Tax professionals have watched taxpayers struggle before when answering a similar question about offshore accounts and interests at the bottom of Schedule B. This one:  KPE The IRS can and has taken the position that willfully failing to check the box related to offshores accounts and interests on Schedule B can form the basis for criminal prosecution. Failing to check the box by accident can still result in expensive headaches and draconian penalties. I fully expect a similar result when it comes to cryptocurrency. So why all the fuss over this new question? The IRS has made cryptocurrency compliance a priority. Last year, the IRS mailed letters to more than 10,000 taxpayers who might have failed to report income and pay the resulting tax from virtual currency transactions or did not accurately report their transactions. This wasn't unexpected since the IRS campaigns announced in 2018 that they were making noncompliance related to the use of virtual currency one of their targeted compliance campaigns. In 2014, the Internal Revenue Service (IRS) issued guidance to taxpayers (downloads as a PDF), making it clear that virtual currency like Bitcoin and Ethereum will be treated as capital assets, provided they are convertible into cash. In simple terms, this means that capital gains rules apply to gains or losses. (You can read more on the taxation of cryptocurrencies here.) It's clear that the IRS is getting serious about cryptocurrency reporting. If you have questions about how and what to report, don't stay silent: ask your tax professional for more information. |

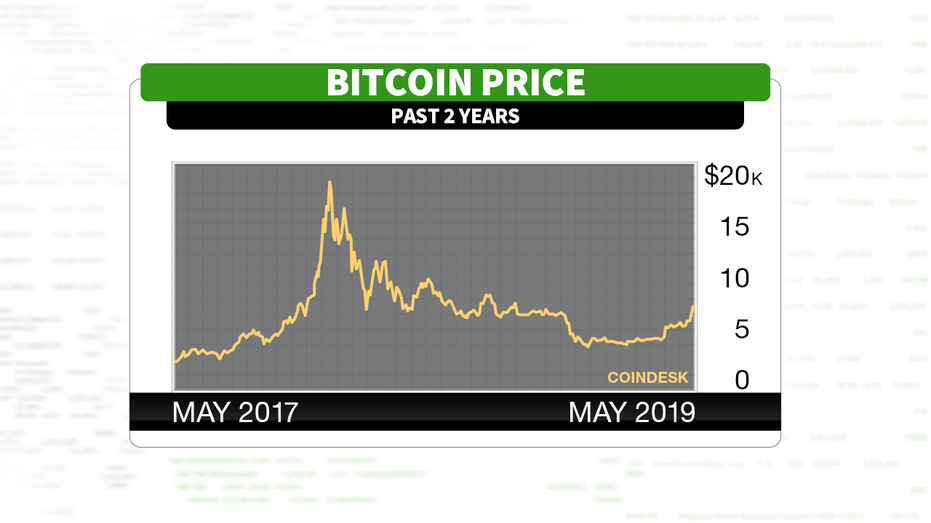

| What are the benefits of cryptocurrency? - Fox Business Posted: 06 Feb 2020 01:25 PM PST CoinList co-founder and president Andy Bromberg discusses the trajectory Libra and Bitcoin could take in 2020. Cryptocurrency is slowly but surely becoming an popular form of payment. Continue Reading Below Despite the growing curiosity in crypto, however, governments are cracking down on the digital currency because it is decentralized, meaning it has no central authority in the way the U.S. government holds authority over the dollar. Therefore, some experts believe crypto poses a threat to central banks and national security. So, why should someone risk investing in a currency unregulated by the government and that is subject to potential digital threats?  One man, sitting in his office next to the mining rig, using computer for mining bitcoin. / iStock "The benefits of cryptocurrency are many and profound," cryptocurrency education company Luno CEO Marcus Swanepoel told FOX Business in a statement. "We've heard how it's going to solve problems across the current financial system that nothing else could – everything from the truly significant, such as banking the unbanked, to the seemingly trivial, such as providing a more efficient way to buy a car." HACKERS STOLE $41B OF BITCOIN ON ONE OF THE WORLD'S LARGEST CRYPTO EXCHANGES "Cryptocurrency is not just a financial instrument. It's also a technology. Any benefits it offers are only possible because of the strength of the technology that underpins it because it works," Swanepoel added. No middle manCryptocurrencies don't use middlemen, so transactions are usually easier, faster and require less or no additional transaction fees. Some experts believe, however, that taking out the middle man goes beyond these simple benefits. WHY CRYPTO AND BLOCKCHAIN ARE PICKING UP SPEED IN TINY COUNTRIES Swanepoel said cryptocurrency has the ability to "give power back to the people. To eliminate current social structures and systems that disenfranchise individuals. To provide the foundations of a system that's transparent yet secure. Where corruption is exposed and rampant inflation ended." More confidentialEach cryptocurrency transaction is a unique exchange between two parties, which protects users from issues like identity theft. "Cryptocurrencies can do this because of the technology that underpins them – blockchain," Swanepoel said. "Blockchain technology is decentralized. This means that no one person, institution or government has central control. Rather, it is the network that is in control. Policies are hardcoded in, and it cannot be manipulated to suit agendas." US, CHINA AND THE RACE FOR DIGITAL CURRENCY This is another reason why governments feel threatened by digital currency. Crypto is more confidential and therefore a favored form of payment among criminals trading illegal goods and services. But there is also a general lack of trust in corporate and government operations, Swanepoel said.  Woman using a smartphone displaying a bitcoin wallet screen. / iStock "The financial system as it exists today is built on trust. But people no longer trust that it exists to help them – that it helps only people working in the industry," he said. "Cryptocurrency removes this need to trust people's motivations." Potential to help the "unbanked"On a global scale, more people have access to the internet than they have to banks or other currency exchange systems. This opens the opportunity for underprivileged people to establish credit. Swanepoel suggested that crypto could be the key to eradicating global poverty and corruption for this reason. "Cryptocurrency is uniquely positioned at the apex of technology and finance. It has been lauded as a potential game-changer for society, poised to eliminate corruption, bank the unbanked, and redistribute wealth in a way that's fairer and more equitable," Swanepoel said. CLICK HERE TO GET THE FOX BUSINESS APP During Luno's Pennydrop initiative, which shares the stories of ordinary people who use cryptocurrency, the company met "many people who first got into crypto because of its potential to help build a better society," he said. "Whether it was understanding something in the fundamental design of cryptocurrency ... or seeing first-hand its impact on a more personal level, there was a real belief that it could be used for good." Easier international exchangesCryptocurrency offers an opportunity for international business people or parties to make one-on-one exchanges online without the complications and added fees that traditionally come with international currency exchanges that involve third parties. Millennials should invest in bitcoin, billionaire investor says TimelyCryptocurrency is happening now. The currency became a topic of interest when the world witnessed the sudden drastic rise and subsequent fall and steady rise again with Bitcoin between 2017 and 2019. It sparked interest and education. Now, cryptocurrency is becoming more a part of the everyday norm than some people realize.  "Cryptocurrency is money for the digital age. It leverages technology in such a way that it's able to integrate seamlessly into the digital ecosystem. It is native to the internet, which allows it to work in conjunction with other technologies," Swanepoel said. "A square peg in a square hole. Not money as we know it today – a round peg in a square hole, developed and built for the analog age." Maglan Capital Co-founder and President David Tawil similarly said technology, in general, has "rendered massive upheaval and disruption to every business line" Now, that technology is moving into the way the world uses currency. "It is the natural and logical next step in financial services in the world," Tawil said. "Once upon a time, shares of stock were physical and transferred physically; those shares are now entirely digital. Similarly, currency needs to be digital and global." |

| Cryptocurrency entrepreneur finally gets his $4.6 million meal with Buffett - CNBC Posted: 06 Feb 2020 10:12 AM PST  Cryptocurrency entrepreneur Justin Sun finally got his $4.6 million charity auction dinner with Warren Buffett last month. In a Facebook post, Sun, founder of the Tron cryptocurrency platform, said he and several of his guests had an "Amazing dinner w/ Warren Buffett finally!" It included a photo of Buffett and Sun posing along with four other guests. Justin Sun had a charity dinner with Warren Buffett along with Sun's guests. Credit: Ryan E. Dennis/TRON Sun added, "Thx for your support & advice on how to take #TRON to the next level! Loved our talk on #Bitcoin , #Tesla & #TRON! Glad to support GLIDEsf as well! C U at # BRK2020 & our reunion meal in 2030!" Sun also posted photos of gifts he presented to Buffett including one bitcoin, "safely stored" in a Samsung Galaxy Fold. "Since I gifted him this #Bitcoin, $BTC has increased 16%! Hope it continues to moon!" Sun wrote. Sun gifted Buffett one bitcoin. Credit: Ryan E. Dennis/TRON Buffett has been very vocal with his opinion that bitcoin is benefiting from an investment bubble and is not suitable for long-term investors. He does, however, see value in the underlying blockchain technology. Along with the bitcoin, Sun also gave Buffett a bronze horse, "since we are both born in Year of the Horse, 1930/1990!" and a "traditional Chinese paper cutting of mouse in celebration of the Year of the Mouse 2020." Sun posted a photo of the meal's receipt, saying "Most delicious meal ever! Thks Warren Buffett for taking us to Happy Hollow Club! $4.56 MIL for a $515.05 dinner was money well spent! The insights I received are priceless." The receipt is signed by Buffett and dated January 23. CoinDesk reports Sun's guests included Litecoin creator Charlie Lee, eToro CEO Yoni Assia, Huobi CFO Chris Lee, and head of the Binance Charity Foundation, Helen Hai. Sun's $4.5 million bid was the winner in the 2019 auction of a meal with Buffett. A dinner had originally been scheduled for last July but was abruptly postponed when Sun said he was suffering from kidney stones. Around the same time there were stories in Chinese media that Sun was under investigation. Sun later apologized for "over-marketing" the event ahead of time. |

| Posted: 06 Feb 2020 06:00 AM PST

The cryptocurrency market is on fire with Bitcoin and all major altcoins growing sharply during earlu US hours. The first cryptocurrency refreshed the highest level of 2020 at $9,850 and the upside momentum is gaining traction. Meanwhile, altcoins also demonstrate bullish momentum. The total market capitalization jumped to $277 billion. The average daily trading volumes climbed to $138 billion, while Bitcoin dominance settled at 64.2%. Top-3 coins price overview:Bitcoin has gained nearly 4% in recent 24 hours with $10,000 now within reach. At the time of writing the first digital coin is changing hands at $9,850, however, the situation is fluid as the upside impulse is growing. Once $10,000 is taken out, BTC/USD buy orders will start snowballing. Read also: Bitcoin bulls are poised for mega trend; $10,000 within reach Ethereum staged an impressive recovery above $200.00. The second largest coin is trading at $214.88 with over 9% gains on a day-to-day basis. ETH/USD a multi-month high at $216.20 earlier on Thursday. Ripple's XRP settled above $0.2800 to trade at $0.2830 by press time. The third largest coin has been trading with bullish bias on Thursday and hit the recent high at $0.2849. Read aslo: Ripple Price Analysis: XRP/USD has outperformed Bitcoin reckons Mike Novogratz The biggest market-movers out of top-20:Binance Coin (BNB), and Bitcoin SV (BCV) gained over 6% in recent 24 hours; however, Ethereum remains the leader of altcoins with 9% rally. The market is driven mostly by speculative sentiments and positioning, while some positive fundamental developments fuel the movements. Many cryptocurrency experts note that Bitcoin is poised for further gains, which may become the beginning of a massive rally ahead of halving. |

| You are subscribed to email updates from "cryptocurrency" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

- Get link

- X

- Other Apps

Comments

Post a Comment