Blockchain blockchain Malkovich blockchain - TechCrunch

- Get link

- X

- Other Apps

Blockchain blockchain Malkovich blockchain - TechCrunch |

- Blockchain blockchain Malkovich blockchain - TechCrunch

- Entrepreneurs And Investors, It's Not About Bitcoin: Build Or Invest In Blockchain Solutions - Forbes

- Bitcoin, Not Blockchain: People Feverishly Search for World’s First Crypto - CCN

- Seiza: Cardano (ADA) Blockchain Explorer is Now Live - Ethereum World News

| Blockchain blockchain Malkovich blockchain - TechCrunch Posted: 20 May 2019 02:09 PM PDT  I spent much of last week at blockchain conferences, and I'm about ready to never hear the word again. This despite the fact I've been supporting decentralized software, as a counterweight or at least alternative to the growing power of governments and megacorps, for years now. Do you think blockchains are no answer? Great, let's discuss! I wholeheartedly support you skeptics with whom I cautiously disagree. What I can't stand, it turns out, is an endless sea of true believers nominally on my side. The believers are twofold, and the two groups grate differently. One group is there almost purely because there is money in the space: Wall Street types hoping to rule a new asset-tokenized world which may come to be; financial startups offering blockchain versions of existing financial tools; new marketplaces just like old marketplaces, except On The Blockchain, and therefore better. It's all too easy to envision a future in which the collective vampire squid that is the financial industry — which has gone from taking 14% of all US profits in 1985 to consistently raking in more like 25% over the last couple of decades — ironically turns blockchains into a tool for "financializing" the economy even more, routing every global transaction through even more middlepeople, each of them shaving off a basis point or two. I doubt this will ever happen — but it's the clear goal of much of group one. (And before you even think about blaming regulators for this continued attempt at creeping financialization, consider that the cryptocurrency casino is full of so much shadiness it serves as a superb object example of why regulators exist, even if a few of their rules are a bit hidebound and baffling in today's world.) Needless to say this was not the original vision. The original vision of Bitcoin was, quote, "A Peer-To-Peer Electronic Cash System." How has that worked out? Well, as Tom Howard puts it, "It's 2019. Where the fuck is our Global Peer-To-Peer Electronic Cash System?"1 His conclusion: still not here. He has a point — but in many ways the Bitcoin community is among the most admirable in the space. Their vision may have pivoted, from "medium of exchange" to "decentralized store of value," but it is clear, and it is succeeding, they are making both sacrifices and technical leaps to advance it. (And maybe one day Lightning will provide us all scalable peer-to-peer payments atop Bitcoin. Maybe. One day.) Furthermore, people actually use Bitcoin in sizable numbers … albeit mostly for speculation. The other group of true believers is the technical group, for whom I should have more love, as an engineer myself. But so much blockchain engineering is built on the unexamined presumption that blockchains are inevitably going to become wildly important, rather than an attempt to actually make them important in any way … again, other than the decentralized global casino of unregulated speculation. There are still projects I like. Ethereum offered us the breakthrough concept of decentralized applications, although it turns out their usage rate is flat. Cosmos is an important and scalable alternative to Ethereum's approach, although it's only just launched. Blockstack's approach is even more interesting, although the most successful Blockstack app — by far — has only 8,000 installs, still basically a rounding error, albeit one with an impressive growth rate. And yet most of the non-financial people I met or read about last week were building new blockchains, or new tools for blockchains, new governance or voting systems to run atop blockchains, new blockchain analytics platforms, new ways to scale blockchains to handle the inevitable immense demand for their capacity … which is not at all apparent. The industry has so much potential, everyone agrees. It's so revolutionary. It's going to change everything. It's going to be so important for the unbanked, everyone agreed, while standing in rooms full of bankers. Meanwhile the decentralized Internet, "Web 3.0," is beginning to feel like nuclear fusion or superpower Brazil: perpetually 10 years away. The belief is that scaling must be solved first — but premature scaling is exactly the mistake which has killed many a startup. Almost everyone in the space, financial or technical, seems primarily focused on tooling, infrastructure, platforms, and scaling, and writes off the lack of any non-believer users as merely "a UX problem" to vaguely be solved somehow in the future. Maybe. Or maybe, a decade on from the Bitcoin whitepaper, it's past time to instead be building applications that unbelievers who don't care one whit about blockchains actually want to use, in the course of their everyday existence, at home and/or at work. If there are any fundamental issues other than scaling which prevent that from happening, then maybe it's past time to focus on them instead. 1 I feel compelled to note that Mr. Howard actually wrote "f*ck" to preserver his readers' delicate sensibilities; TechCrunch, of course, has a long and proud history of not worrying about those. |

| Posted: 20 May 2019 07:46 AM PDT  Group of programmers developing new software on desktop PC's in the office. GettyThe recent rise and fall of Bitcoin (slight uptick recently), should give you pause for thought and help you understand where the real potential might be. While the future potential of secure digital payments through crypto currency remains to be seen, the focus should be on building blockchain based platforms and marketplaces. The rapid rise and fall in Bitcoin should remind us of the early Internet days when a new technology arrives but no one really knows how to use it. Early websites were nothing more than brochure ware while companies like Amazon saw the real potential to conduct enterprise-based ecommerce in entirely new ways. Sometimes, it's not about the product but about the technology. And in this case, that is blockchain. Here is a simple definition of blockchain. A blockchain is a digital record of transactions. The name comes from its structure, in which individual records, called blocks, are linked together in single list, called a chain. Blockchain can be used for recording transactions made with crypto currencies, such as Bitcoin, but have many other powerful applications. Each transaction added to a blockchain is validated by multiple computers on the Internet. These systems, which are configured to monitor specific types of blockchain transactions, form a peer-to-peer network. They work together to ensure each transaction is valid before it is added to the blockchain. This decentralized network of computers ensures a single system cannot add invalid blocks to the chain. So why should you as an entrepreneur or investor care more about blockchain than Bitcoin? Bitcoin is still a speculation on a future crypto currency that the world may not yet adopt. Maybe in the future, maybe not. But blockchain is a serious technology that can provide a variety of solutions. Imagine you are an automotive manufacturer and you have a product quality problem. Rather than recall thousands or millions of cars, you can simply recall the cars whose part is potentially defective based on blockchain identification and tracking. Or perhaps you need to track a product or good all the way through the supply chain to verify its source or heritage. Think heirloom tomatoes or cannabis where absolute tracking is critical. Entrepreneurs working on blockchain solution. GettyThe real potential for blockchain will come from existing companies or startups that actually build the new platforms and marketplaces of the future. Using tokens (values of an asset), here are four potential solutions that companies can build using blockchain. Digital Rights Management: As assets continue to get deployed across the Internet, whether that is images, music or code, blockchain solutions to track them would be a powerful way to control and mange the rights to that asset in an extremely secure manner. That could lead to future royalty payments for the owners of that asset. Unlocking Real Assets: It's almost impossible to raise funds to support the building of real assets without tons of paperwork and lawyers. But imagine if you were a developer building 200 homes in a new neighborhood and you wanted to generate some more free cash flow without taking on debt. You could convert the value of the land and the new homes being built into tokens, assign a real value to a token and allow multiple investors to buy into a real estate asset class that would appreciate in value and provide a return as the homes were sold. Investing in Assets: Again, using blockchain technology and tokens, you would have the ability to take real assets around the world and allow people (investors) to invest in the asset without contracts or lawyers by simply purchasing tokens of value for that secured asset. Want to invest in a large plot of land in Montana as a partial investor? You could. Want to invest in a Palladium mine in a foreign country? It would be possible. Customer Reward Marketplaces: Today, we get gift cards, coupons and special promotions that are used to incent us to buy something. Imagine if these offers were based on tokens of value and available to trade in a digital marketplace. That would allow for not only secure tracking but for people to sell or exchange these tokens based on need or want. You don't want the 40% off of the product but someone else does. Great, exchange or sell it in a marketplace using blockchain and tokens. The manufacturer or brand stills wins as they gain a new customer. In the 1800's it was not always the gold miners who thrived. But the people who sold picks and shovels did. In the early days of the internet, it was not the multitude of startups that were rewarded. Most failed. But the builders of web infrastructure and internet technology thrived. Don't confuse the adoption of Bitcoin as a digital currency with the enormous potential for blockchain technology. |

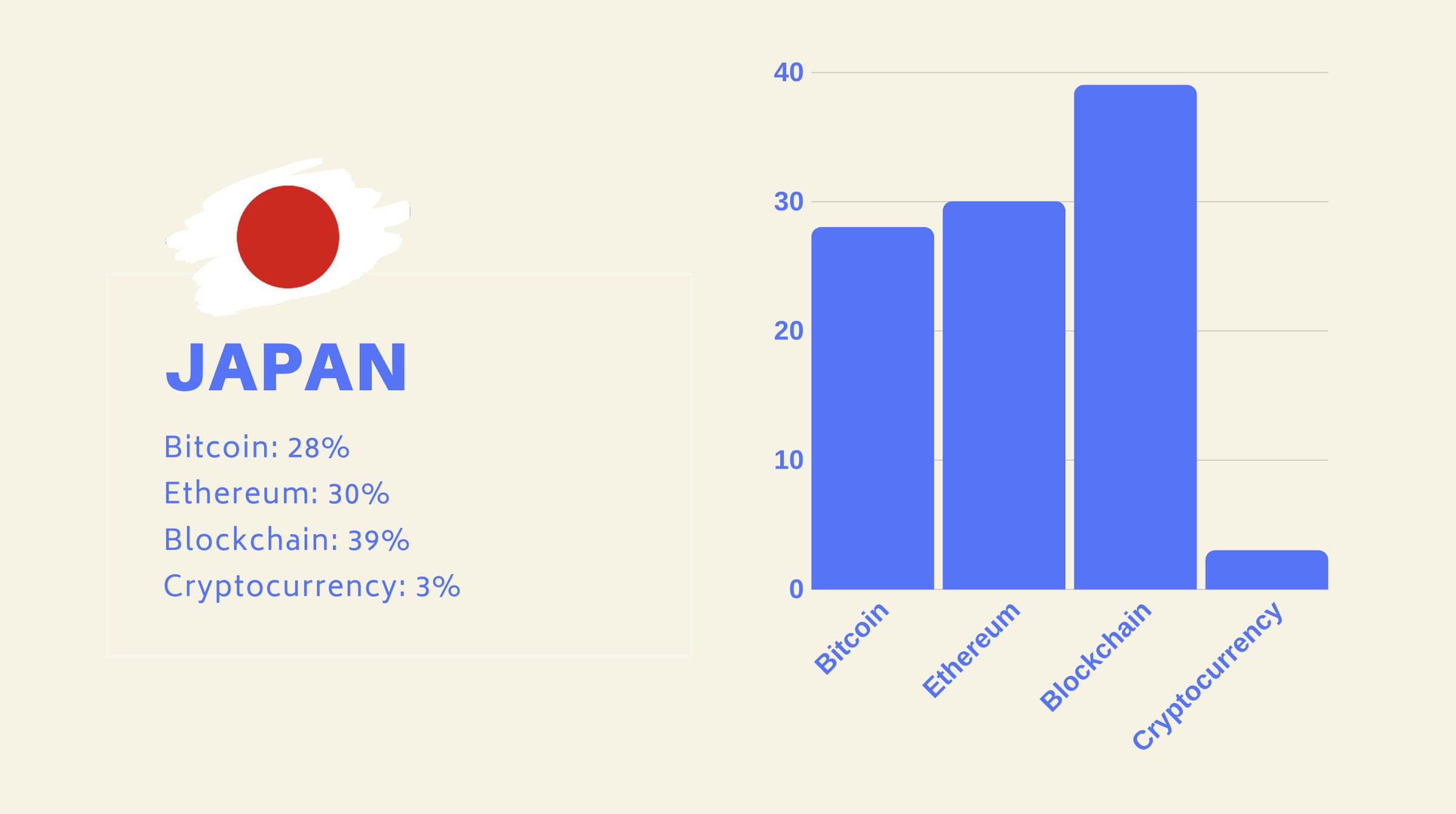

| Bitcoin, Not Blockchain: People Feverishly Search for World’s First Crypto - CCN Posted: 20 May 2019 12:00 PM PDT By CCN: Around the world, the majority of searches related to cryptocurrency involve the word "Bitcoin," a new report by ConsenSys concludes. Excepting a few Asian countries, most of the world wants to find information about Bitcoin. In the U.S., UK, Nigeria, Brazil, France, and elsewhere, roughly 70% or more of all crypto-related searches are for Bitcoin. Comparatively, Taiwan and Japan have an abiding interest in Ethereum, blockchain, and related cryptocurrency more broadly.  Japanese web surfers are more interested in Ethereum and Blockchain than most of the world. Source: ConsenSys Key Markets for dApp DevelopmentConsenSys, which was among the first companies to develop for Ethereum, needs the data to understand where key markets might be. While their report largely summarizes the data, the company goes out of its way to note the places with the most interest in its flagship blockchain:

Bitcoin and blockchain are synonymous to many initially seeking information about cryptocurrency. While the two terms have essential differences, search spikes for any terms related to crypto generally coincide with gaining market trends. As well documented, one of the first efforts to dismiss the crypto movement was for various central bankers and pundits to preach "blockchain, not Bitcoin." This was an attempt to display financial wokeness without embracing an exceedingly disruptive movement. A blockchain is not secure unless its base token has value enough to incentivize its security. "Blockchain, Not Bitcoin"? Nah.No blockchain model is based on the idea that people will secure the network "for the public good." Instead, in Bitcoin and Ethereum both, those providing that security are rewarded with transaction fees and base rewards. There are, however, legitimate arguments that lend more credence to the blockchain technology as a whole, including but far from limited to Bitcoin.

One question that arises from these statistics is whether they're a sign that the market as a whole is quite nascent. If the majority of people are searching strictly for "Bitcoin," things are either only beginning or the maximalist vision of the future, in which there is Bitcoin and little else, is much more likely than one might think. In the case of Venezuela, it's interesting that Ethereum represented around 9% of all searches when people were definitively looking for alternative ways to secure their net worth. Bitcoin saw a 75% share of Venezuelan searches related to crypto, while "cryptocurrency" more generally accounted for only 2%. "Blockchain" did even worse than that, at 1%. |

| Seiza: Cardano (ADA) Blockchain Explorer is Now Live - Ethereum World News Posted: 21 May 2019 06:33 AM PDT  Cardano has released a blockchain explorer, Seiza, to make it easy to track transactions on the platform. The development was announced by EMURGO, a section of Cardano's team that develops, supports, and incubates commercial ventures. In a tweet, EMURGO said:

The Dawn of Shelley PhaseThe release of the blockchain explorer comes at a time when Cardano is gearing up to go through an upgrade nicknamed Shelly and which number two on Cardano's road map. The Shelly upgrade is in honor of Percy Bysshe Shelley, an English poet of the 18th century. With Shelly, Cardano aims at improving its network's decentralization together with providing more stability with its Proof of Stake consensus mechanism Cardano is taking a rather untrodden path in the consensus world. Their aim is to simplify reentry of nodes after being offline. Apart from nodes, ADA holders will be able to delegate their stake to participate in the production of new blocks through a stake pool. In return, Cardano "will provide incentives to those who delegate their stake and become active participants in the PoS consensus protocol." A Delegation Certificate Bind Everything and Everyone TogetherSince everything is being handled on-chain, a delegation certificate will be created on the Cardano blockchain to act as a binding digital document between ADA holders that have delegated their coins and the stake pool operator. Unfortunately, ADA holders who delegate their coins will also need to pay the stake pool operator "to perform these services on their behalf." A quote from Shelley's works that best echoes with Cardano's goals of full decentralization reads:

Those that should despair at the mighty works of Cardano are centralized blockchain platforms and those that have a poor implementation of the Proof of Stake consensus mechanism. Goguen, Basho, and VoltaireApart from Shelly, Cardano has three other notable upgrades on the way; Goguen, Basho, and Voltaire. Each of these upgrades brings in something new to the platform. For example, the Goguen upgrade targets to build a next-generation virtual machine plus a universal language framework targeting future blockchain technologies. As such, the upgrade aims to enhance security and dependability. After minimizing the risk of vulnerabilities, Cardano will concentrate on improving performance, scalability, and an additional dose of security through the Basho upgrade. Voltaire will be the last leg of Cardano's existing roadmap. With Voltaire, Cardano will introduce a governance model together with a treasury system.

|

| You are subscribed to email updates from "blockchain" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

- Get link

- X

- Other Apps

Comments

Post a Comment