The Future Of Banking: Is It All Bitcoin And Blockchain? - Forbes

- Get link

- X

- Other Apps

The Future Of Banking: Is It All Bitcoin And Blockchain? - Forbes |

- The Future Of Banking: Is It All Bitcoin And Blockchain? - Forbes

- Elk, a blockchain dev board for decentralized IoT, launches on Kickstarter - TechCrunch

- The FBI wants more information about Long Blockchain - Quartz

- Making blockchain transactions secure and private - Tech Xplore

| The Future Of Banking: Is It All Bitcoin And Blockchain? - Forbes Posted: 25 Jul 2019 02:42 AM PDT  Tailors Alex Riley, left, and Ian Fielding-Calcutt carry suit bags outside the Deutsche Bank building in the City of London. Photo: Reuters ReutersAt the beginning of July, news broke of Deutsche Bank staff being sent home as 18,000 job cuts began unraveling before our very eyes. This news was brought to life with an iconic image of two suited men carrying their possessions past the doors of a Deutsche Bank branch in London along with a bag branded "Bitcoins." Unfortunately, that image turned out only to be an incredible piece of timing and coincidence as the men were not now out-of-work bankers hoofing it from their formal institutional workplace brandishing the 'future of money,' on their bags, instead they were tailors walking past at the right time. Still, that near-perfect latent image of the finance's future did spark a few questions in my mind, and the minds of others. Just how far are we from a future predicated on Bitcoin and blockchain in banking? The beginning of the end for banks To answer this question, I had to look at what is happening in the world of banking that has led to job cuts and the concerns for the traditional way of doing things in finance. Living in the United Kingdom, London is a historical hotspot for banking and the seat of power for some of the world's biggest banks. However, beyond the high-rise glass structures in the city center, there are signs - usually in the tube stations and bus stops - of a new way of managing and controlling your money on a day to day basis. No, it is not Bitcoin - yet - it is the challenger banks. Challenger banks, as defined, are: "Small, recently-created retail banks in the United Kingdom that compete directly with the longer-established banks in the country, sometimes by specializing in areas underserved by the "big four" banks." These banks, also called App-banks, are usually highly customer focused and made to be as user-friendly and as easy to operate on a day to day basis as they can. In comparison with traditional banks, challenger banks try and play to general user frustrations from your big institutional banks. Sound familiar? Challenging the legacy I spoke with Anne Boden, a banking doyen with 30 years experience in some of the most important financial institutions in the world, and now the founder and CEO of Starling Bank - one such challenger bank in the UK. Talking to her about the future of banking was fascinating for although Boden is aware of Bitcoin, blockchain, and its potential it has in the banking sector, she believes its time is still far on the horizon. In her recently released book, "The Money Revolution" Boden states: "[Blockchain] is easily the most revolutionary money change on the horizon and may make a huge difference across the fintech sector."  BERLIN, GERMANY - NOVEMBER 30: CEO of Starling Bank Anne Boden speaks on stage during TechCrunch Disrupt Berlin 2018 at Treptow Arena on November 30, 2018 in Berlin, Germany. (Photo by Noam Galai/Getty Images for TechCrunch) Getty Images for TechCrunchHer thoughts on how traditional banks will need to change and evolve because of several different factors could easily be viewed in the same way, but with blockchain and cryptocurrency-tinted glasses "I spent 30-odd years in traditional banking, I worked for all the big banks, I worked for Lloyds Bank, Standard Chartered, UBS, Zurich, and RBS. Then I went into AIG, post-financial crisis, to do the turn-around and I came to the conclusion that it was easier to start a new bank than to fix the old," Boden told me. Indeed, the banking legacy and way of doing things has become so stagnant that the wants of the banks and the needs of the customers almost do not line up anymore - especially on a day to day basis. Challenger banks are this fresh start customers have been baying for, but in comparison, cryptocurrencies and blockchain could be an entirely fresh system. "In this era, it is people like Atom, Monzo, and Starling that have come to market, and the ones that have been successful are the ones that have built their own technology," Boden added. "All these organizations have been called challenger banks, but you can only really disrupt when you have a current account - because people are using that every day - and when you have your own technology." Again, Boden is not necessarily referring to that technology as being blockchain; however, one can see how blockchain is a prime example of disruptive technology for the banking sector. The world is changing, and the way people do everything is different, and this is also down to technology. "Customers have changed. Customers are buying music differently; they are shopping on Amazon; they are doing things very differently," said Boden. "Technology has changed. Everyone is wandering around with their smartphones, these phones have better penetration than the laptop, and then all the time the regulations are changing as well, and that is a perfect storm to bring something like Starling to the market." Starling is one of several challenger banks that are succeeding at disrupting the banking hegemony with their customer focus, their everyday usability, and their own technologies. Their success is indeed a challenge to institutional financial systems, but because this is a fast-moving space, there are already challengers to the challenger banks. A new weapon in the arsenal Challenger banks, App-banks, mobile payment companies, merchant services aggregator, peer-to-peer payments companies, are all financial services that are looking to take a piece of the pie that traditional banks have held for so long - and it is not just a UK phenomenon. Circle, Square, and even Revolut, which is coming to the USA are also disruptive forces in the financial space, but what they all have in common is a cryptocurrency offering. Cryptocurrency may be a long way off from being as popular as the Pound or the Dollar in regards to payments, but some of these companies are still offering the chance to use this alternative payment method, should you be so inclined. This took me to the offices of two other App-banks in the UK, Wirex, and Zeux. Both companies operate as an alternative banking solution, allowing for payments and money transfers, but they also each have cryptocurrency offerings as well. These offerings are of course not going to be nearly as popular as the general fiat services of Starling, for example, but they are not supposed to be - as yet. "App-banks, or digital banks, are making things more convenient for everyday customers to manage their banking, "Frank Zhou, CEO of Zeux, told me. "There are a lot of needs in the early adopter space who are interested in cryptocurrency, from trading, investing, using it for payments. Those types of customers are easier to reach as they follow the newest developments and are willing to give it a try," Pavel Matveev, one of the founders at Wirex, explained that the use of cryptocurrencies need not only be for experimenting though. There are tangible use-cases within the payment sphere already. "While App-based and digital banks offer a more convenient means of managing money, they are still largely based on conventional payment infrastructure. This means that cross-border payments still take 3-5 days to settle and command relatively high fees," said Matveev "Decentralised digital currencies have the potential to revolutionize many aspects of the payments industry due to their transparency, mobility, and ease-of-use," added Dmitry Lazarichev, also of Wirex. "One of the most significant areas is international remittance. Cross-border crypto transactions are significantly faster than conventional methods of transferring money abroad and require very little in the way of fees and charges." Different offerings What Matveev and Lazarichev, as well as Zhou, had to say about including cryptocurrencies into the new era of banking, reminded me of Boden's view for the future of the industry. The hopes of the two crypto-offering App-banks is that they can fill small niches for people with this new technology, and for Boden, the view is that traditional banks will face stiff competition in these small niches of finance services. "What is going to happen is other things happening in the environment will catch up with the banking industry, they will surprise the banking industry," said Boden "The combination of 5G internet of things, self-driving cars, AI and machine learning will change the profile of how payments are made." "So I think that the nature of payments will change and you will get new entrants providing some of those new payment mechanisms, and I think in that environment the incumbent banks will find it harder to compete. Some will survive and mutate to something relevant, and many of them will die." If cryptocurrency is to become one of those new payment mechanisms, getting an early foot in the door is vital, but even more important is offering a service that is usable. Zeux may see this as using cryptocurrency for general payments, while Wirex could believe remittances are key for the digital currencies; neither is more right than the other and perhaps that is the point - there will be a bevy of offerings in the future. "Like previous studies of mass adoption, it happens when the majority can use it as easily as they would use it normally. For example, from cash to PIN card, Pin card to contactless cards, contactless to mobile payment. An easy-to-use experience is key to bringing adoption," said Zhou. "I think the market is ready for crypto mass adoption. But, there needs to be a solution before the mass demand surfaces. Once all the customers know they can spend their cryptos easily everywhere in any shops, it increases their willingness to accept cryptos as payment in the first place. Mass adoption only happens after the solution appears, not before." A changing future The banking world has, for almost the last century, continued in pretty much the same way with little to no threat from alternatives. That is all changing. People would like to believe that the power of blockchain in the financial system, and the option of cryptocurrencies, are about to shake up the entire banking space, but they would be wrong. There is little doubt that banking will start to incorporate blockchain, as Boden explains: "I think that blockchain is likely to be used in certain aspects of the banking business, so probably for trade finance where you have lots of parties collaborating on a transaction, but I think you will see blockchain implementation in niche areas of the business, you won't see it as a wholesale change for the banking platform." However, for an entire, legacy-based industry of such a traditional magnitude to overhaul its entire system for a nascent technology is foolhardy. In saying that, cryptocurrencies will start to gain more mass appeal. This does not mean these two sides of the same industry will be what changes the face of banking. Still, the face of banking is changing, and that is why traditional banks that are oblivious to this are starting to show cracks. Everyday usage of money and payments is already on the march, and because of the needs of customers, there is an emerging market of challenger banks, app-banks, financial institutions and payment facilitators in the wings. Some are already offering blockchain and crypto services, some may do so down the line, but to say that the only way to the future of banking is with blockchain and crypto is short-sighted - there are much bigger demands and many more niches to be filled. |

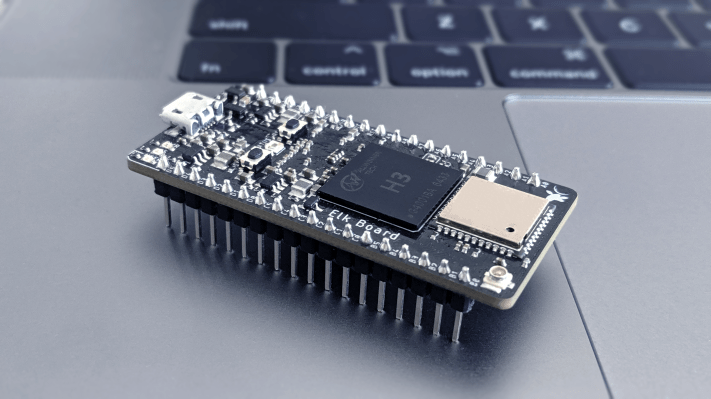

| Elk, a blockchain dev board for decentralized IoT, launches on Kickstarter - TechCrunch Posted: 25 Jul 2019 07:56 AM PDT  Hardware developers toying with the idea of building physical stuff that can plug into the decentralized world of blockchain should point their eyes at Elk: A dev board in the making that's been designed to support all sorts of IoT projects with a blockchain flavor. Such as, for example, a connected door-lock that doesn't demand that your ability to access your own property be dependent on the uptime (and accord) of servers of a remote corporate giant, nor your comings and goings be logged by a commercial third party. Or, in another of their suggested examples, an alarm clock that charges you in bitcoin if you hit the snooze button too much, rather than getting up. Ouch. The team behind Elk have just launched a crowdfunding campaign on Kickstarter to bring their prototype to market — with the aim of shipping the board to developers from next Spring. They're looking to raise a modest ~$20k. While the gizmo is being priced at $59 for early bird backers, or ten dollars extra for those who failed to, uh, un-snooze their clocks in time. We covered Elk last year — when it was in an earlier stage of development and being called Elkrem. At that point the team hoped to get the device to market before the end of the year. As it turns out it's taken them a little longer to feel ready to fire up a crowdfunder — hitting various challenges along the way. It's worth flagging it's not the team's first product for hardware devs. They grabbed attention at TechCrunch Disrupt Europe back in 2013, when they got plucked out of startup alley as an audience choice to participate in our startup battlefield competition — where they pitched their idea to tap into sensors on smartphones as an alternative to Ardunio shields. They went on to crowdfund and ship the 1Sheeld — and are still selling it to this day. So there are fewer caveats than can usually apply to a crowdfunded hardware (though, as ever with anything being pitched for sale when still a prototype, it's always prudent to expect delays). Here's a quick Q&A with Elk CEO and co-founder Amr Saleh on the team's aim and ambition for the device: TC: What is Elk and what is it for? Elk empowers developers to build what we call "Decent IoT". Decent IoT is decentralized, gives users true control and true privacy, and allows entirely new use-cases like payments, oracles, selling your data, and much more. With Elk you can build a smart door lock that you can control remotely without relying on a cloud provider that tracks and controls your device usage, or build a charging station that you can rent with Ethereum, or lock money into a treadmill that you can only get back when you work out. The possibilities are truly endless. TC: Why is dedicated hardware necessary for developing blockchain IoT devices? What advantages does the hardware offer over rival dev boards, for eg, using microprocessors like Raspberry Pi? Unlike using a Raspberry Pi, with Elk you won't have to deal with wallet and keys management, fuss over setting up nodes, tune their parameters to run well on an embedded device, handle crashes, etc. We are delivering the 10x easier Arduino-like experience to blockchain IoT development, with all the libraries that Arduino already supports. Developers can now focus on their applications and not the overheads. TC: Who is the Elk for? How large is the blockchain hardware development community right now & how do you see that evolving over the next few years? We believe the potential for blockchain and decentralization extends far beyond that. Elk is not just for blockchain enthusiasts, but for privacy-conscious makers as well. Decentralization allows us to build IoT that is far more private, far more secure, and far more capable. We call it "Decent IoT", and that's what we are set out to introduce with Elk. Current IoT architecture relies on centralized cloud providers for communication and data storage. This, by necessity, means that cloud providers (and whomever hacks them) can control your devices, deny you access, or tap into your private life. The new decentralized web enables a completely new paradigm for IoT. A paradigm where your communication flows privately through a decentralized network with no central authority responsible for relaying your communication, no third party that can track your device usage, and no third party that can control your device. It additionally opens the door for other possibilities like payments, oracles, selling your data, and more. Elk provides the tools and the UX to make building Decent IoT as easy as writing a few lines of code, and we're hoping that over time this would further drive adoption of decentralization within the hardware community. TC: Why the delay in launching the KS? What challenges have you encountered as you've prototyped Elk & how confident are you of meeting your estimated shipping deadlines? Another significant challenge we faced was finding the right balance of features to offer in Elk. For example, we initially felt it was paramount for Elk to have a secure hardware enclave and spent months building out a prototype. We decided to later drop hardware security in favor of a stable and superior development experience. The development experience in building Decent IoT, we think, is far more of a bottleneck than pushing the extra mile in security. At this point, we've been through four different iterations of our hardware and have done our diligence to be confident that we can deliver the product we're offering with no surprises in production. We've already been through the process of manufacturing hardware. In our previous Kickstarter we shipped on time to our backers and sold tens of thousands of units in the years that followed. TC: What's the business model? Are you intending to make money via distributing/supporting the SDK as well as selling dev hardware? |

| The FBI wants more information about Long Blockchain - Quartz Posted: 25 Jul 2019 04:00 AM PDT Even during the heady days of the epic bitcoin bubble in 2017, Long Island Iced Tea Corp.'s pivot to blockchain was a particularly brash ploy to latch onto the crypto hype. More than a year later, court records show that authorities are still digging into what they believe was a sophisticated insider trading operation designed to supercharge the stock's rise. The beverage company's stock skyrocketed nearly 300% when it said it was changing its name to Long Blockchain on Dec. 21, 2017, and indicated that it was "shifting its primary corporate focus" from tea to distributed-ledger technology. Since then, the Farmingdale, New York-based company has been delisted from the Nasdaq stock market and investigated by two US financial regulators, with authorities poring over evidence from recorded phone calls and a hacked iPhone. According to a search warrant request, the FBI is looking for evidence of insider trading and securities fraud connected to Long Island Iced Tea stock, and has focused on conversations about the company that took place between two men, Oliver Lindsay and Gannon Giguiere, who were arrested for securities fraud in relation to a separate company. Those phone messages about Long Island Iced Tea may also include conversations with a wealthy New Zealander named Eric Watson, who hasn't been charged with wrongdoing.  The FBI also thinks Long Island Iced Tea stock was the target of a so-called "pump-and-dump" scheme, according to the search warrant document. The way these scams typically work is that promoters buy a cheap stock, start hyping it to investors with eye-catching claims, then sell their own holdings during the resulting mania, hopefully securing a profit before the stock comes crashing down. The FBI says in its warrant that proceeds from these scams can be distributed to accomplices through offshore back channels. "Anytime there's a new technology like blockchain, and there's any kind of mania around it, this is what the fraudsters take advantage of," said Joshua White, assistant professor of finance at Vanderbilt University. A similar pattern took place amid computer software hype in the 1980s, the internet at the turn of this century, and marijuana stocks more recently. "It's a winning formula," said White, who authored a penny-stock analysis for the Securities and Exchange Commission.  Long Island Iced Tea's flirtation with bitcoin mania was perhaps too successful. When its stock blasted off amid the crypto bubble's media frenzy, it caught the attention of journalists, traders, as well as the chairman of the SEC. While scams involving smaller companies are far from uncommon in the US, Long Island Iced Tea was a bigger fish than usual, had had a star-studded executive board, and was trading on the Nasdaq exchange. The FBI's search warrant shows a deepening investigation that is uncovering a new layer, and providing more insight into the mechanics of stock manipulation. iPhone messagesThe FBI started out investigating Lindsay and Giguiere for securities fraud in a company called Kelvin Medical, according to the search warrant, which led authorities to arrest them. After seizing their cell phones and extracting evidence, the FBI requested a search warrant related to Long Island Iced Tea. The SEC has a case against Kelvin Medical that appears to be ongoing. "Very few scammers will be content to have one thing going," said Dennis Franks, a security consultant who oversaw complex investigations during a 22-year career with the FBI. "They'll have a lot of other things going, too." One of the men arrested, Lindsay, is a Canadian citizen who mainly lived in Georgetown, Cayman Islands, and also ran an offshore brokerage, according to the search warrant. The other, Giguiere, operated TheMoneyStreet.com, a now-defunct website that promoted stocks of small, risky companies, commonly called "penny stocks." The FBI thinks both of them were engaged in insider trading of Long Island Iced Tea, according to the search warrant. After Lindsay and Giguiere's arrests in July 2018, FBI agents were able to hack into Lindsay's iPhone and extract months of text message conversations, according to the search warrant. (Investigators haven't been able to get into Giguiere's device.) The US government is also receiving information about the pair's alleged market manipulation from an informant, described as "CHS," who had allegedly earlier conspired to commit securities fraud. This person spoke with Lindsay and Giguiere about a separate alleged fraud involving Kelvin Medical:  The FBI thinks a person named "Eric W" in a series of WhatsApp messages is Eric Watson, who owned around 15% of the shares in Long Island Iced Tea at about the time of the infamous blockchain pivot, according to the search warrant. Watson is a wealthy New Zealander whose liaisons with models, and a bathroom fight with actor Russell Crowe, have been occasional tabloid fodder. He acquired American Apparel along with Jon Ledecky, a wealthy investor and sports team owner, in 2006.  Greg Bowker/New Zealand Herald Watson has lived in London since about 2002, according to separate court documents in the UK. He came into Long Island Iced Tea in 2015, two years before its blockchain pivot, when it was acquired by Cullen Agriculture Holding, a company he controlled. Lawyers for Watson, Lindsay, and Giguiere didn't respond to calls and email requests for comment. Long Blockchain also didn't respond to calls and an email request for comment. "Let's get going"Non-alcoholic iced tea wasn't especially popular in September 2017, but bitcoin was. The original crypto asset had tripled in value since the beginning of the year. News stories were bouncing around the internet about people who had made millions betting on bitcoin, which would climb to its zenith that December. By the time Long Island Iced Tea's stock blasted off in December 2017, Watson had been having conversations about the company with Lindsay for at least three months, according to the search warrant:  Another name that comes up in the search warrant is Julian Davidson. The document doesn't definitively link the conversations to Long Island Iced Tea's executive chairman, but it stretches the imagination to think it was anyone else. The FBI notes in its search warrant that Lindsay sent a text file with the contact information for a person named Julian Davidson, described as Executive Chairman of LTEA, the ticker for Long Island Iced Tea. Lindsay also sent a number of WhatsApp messages to a person identified on his phone as Julian Davidson. Davidson became Long Island Iced Tea's executive chairman in 2016, and had been with the company since the year before as a consultant. He had industry experience, having been an executive in New Zealand for the Lion Nathan beverage company. Davidson hasn't been charged with wrongdoing by authorities, and, potentially notably, he resigned from the board a few days before the blockchain pivot was announced on Dec. 21, 2017, according to filings. He didn't respond to attempts to reach him by email and phone through his attorney.   Steven McNicholl/New Zealand Herald Photograph The US suspects that the "IR program," short for investor relations program, was really a stock promotion campaign. The FBI search warrant also contains other details that it says are consistent with a so-called "pump-and-dump" scheme. In addition, in October 2017, government authorities allege that Lindsay sent documentation of a $681,625 wire transfer between an asset management company and Long Island Brand Beverages to a person named Julian Davidson, according to the warrant. The FBI document says this and other evidence provides context for an insider-trading conspiracy, and identifies other possible conspirators. A chunk of Long Island Iced Tea stock changed hands the following the month as well. The FBI search warrant says an insider trading investigation by the Financial Industry Regulatory Authority found that 332,500 shares of Long Island Iced Tea were acquired by CMGT Inc. on Nov. 20, 2017. The shares weren't purchased in the open market market, but came directly from the beverage company in connection to an offering, according to the search warrant. SEC court documents (pdf) have linked Lindsay to a broker in the Cayman Islands called CMGT Capital Management. The following message involving "Eric W," according to the search warrant, detailing advertising spending on Yahoo and Facebook, as well as payments to a blogger, trader, call center, and so on, are common elements of a pump-and-dump scheme. To be exact, the FBI thinks it refers to the "pump" part of the campaign, the search warrant shows:  The penny stock problem childThe US market for stocks with small- and micro-size capitalizations has been a problem area for regulators for decades. It attracts sensational misbehavior: Jordan Belfort, whose boiler room exploits in pumping up dodgy stocks became the basis of the movie Wolf of Wall Street, is the best known, but there are many others each year. The victims are mostly small-time retail investors who get duped. This puts the SEC in a difficult spot. Authorities want small American companies to be able to raise money from ordinary investors. There may be bad apples, but it's understandable why watchdogs are reluctant to throw out the entire bunch. Policing thousands of penny stocks, however, is beyond their reach. It gets more complicated, because small-time traders themselves play a vital role in perpetuating scams. For many of them, the penny stock market is like a lottery. They know some stocks are rigged, and in fact research shows that they seek them out. The idea is to find the stocks with buzz, ride the wave, and then jump out before the whole thing collapses. It usually doesn't work, but they keep looking for that gambling-fueled dopamine hit. Postings on InvestorsHub, a website for retail investors, show that small-time traders sensed there was something fishy about Long Island Iced Tea's pivot: "This such a fraud…. stay away," a person wrote the day the press release went out. Based on the reaction of shares, investors gambled on it anyway. Stock scams, like the pump-and-dump scheme detailed in the FBI search warrant, wouldn't work without these supporters. Kiwi rich listWatson, 60, took a winding path to Long Island Iced Tea, and he has been involved in a range of industries over the years. He became executive chairman of Cullen Investment, a private investment company, in 1995, according to SEC filings. Its portfolio included Bendon, a marketer of women's lingerie that included licenses to brands like Elle MacPherson Intimates and Stella McCartney, with representation from model Heidi Klum. Its investments also included the New Zealand Warriors rugby team. "I think of myself as an entrepreneur that is focused on creating value, joining the dots, bringing one and one and one together and hopefully equalling more than three," Watson told the Otago Daily Times in 2012. In 2007, Watson and Ledecky formed a blank check company—meaning it raised funds for acquisitions and investments without having identified a target—called Triplecrown. Triplecrown had a star-studded board of directors that included a NetJet executive, a founder of the Carlyle Group private equity firm, and Kerry Kennedy, a human rights activist and daughter of congressman Robert Kennedy. In September 2009, Triplecrown merged with Cullen Agriculture Holdings (CAH), a dairy company that Watson controlled. In January 2015, CAH said it was merging with Long Island Brand Beverages, whose non-alcoholic teas and other drinks were sold around the Northeast US, and the combined company became known as Long Island Iced Tea Corp. Kennedy resigned from Long Island Iced Tea's board on September 21, 2017. She didn't respond to a request for comment through her foundation. Some of Watson's previous business ventures didn't end well. He and several associates settled in 2015 with New Zealand's financial regulator (pdf), which investigated Watson and others over misleading disclosures regarding a property investment vehicle during the subprime crisis. The watchdog said in its settlement document that while it believed disclosure breaches had occurred, none of the defendants had admitted any liability as part of the settlement. Watson settled in 2001 with the US SEC, which alleged that he withheld trading information during acquisition discussions. He neither admitted nor denied the findings in the SEC's settlement document. Courts in recent months have said that he owes millions of dollars in taxes and also owes millions in legal obligations as part of a dispute brought against him by a business associate. A judge reviewing the case said Watson "resorted to deliberate deception," according to a court document. "This release drops today, correct?"The FBI alleges that Lindsey and Giguiere were conspiring to manipulate at least two stocks in late 2017, including Long Island Iced Tea, with the aim of cashing in on the blockchain mania, according to the search warrant document. One possibility was a deal or merger with a company called Stater Blockchain, according to the document, a company that said it was developing blockchain technology for financial markets. There are no allegations of wrongdoing by Stater.  Lindsay told "CHS" that "Eric" was having discussions with shareholders that month, according to the search warrant. He said some of those details, even though they contained inside information, were expected to leak out ahead of a letter of intent (LOI), the document shows:  In December 2017, the search warrant shows that Lindsay and Giguiere were exchanging emails related to LTEA—Long Island Iced Tea's stock ticker at the time—and its "Crypto transaction." On Dec. 19 and 20, the days before the company's bombshell press release, Watson was exchanging encrypted document attachments with Lindsay with the words "LIIT Press Release_Block Chain" in the title, the document shows. Several versions of what appeared to be a press release about blockchain changed hands between Lindsay and Watson. The FBI search warrant says Giguiere and Lindsay exchanged this encrypted text message sometime before the press release hit the wire:  In the meantime, the FBI says account statements show that Long Island Iced Tea shares were bought using brokerage accounts in the names of Giguiere and his wife, Lindsay Giguiere, according to the search warrant. On Dec. 20, 2017, Giguiere's Robinhood account showed purchases of 17,500 shares, worth about $42,350, at $2.42 per share. His wife's Scottrade brokerage account showed purchases of the same amount of shares, the document shows. The beverage-company-cum-blockchain-startup issued its press release the next day:

The stock briefly surpassed $14 when the news hit. The FBI says Watson and Lindsay exchanged this message a little after the press release went public, according to the search warrant:  Giguiere and his wife unloaded all the stock they had bought the day before at an average price of around $7 per share, producing gross profits of more than $162,000, according to the FBI's warrant.  Watson also appears to have sold shares a few days later, according to an SEC filing. Blockchain-R-UsLong Island Iced Tea's blockchain-based success didn't last very long. In late January 2018, alluding to companies that change their name to something like "Blockchain-R-Us," SEC chairman Jay Clayton said in a speech that the agency was "looking closely at the disclosures of public companies that shift their business models to capitalize on the perceived promise of distributed ledger technology." Long Blockchain was given notice from Nasdaq shortly after that it would be delisted, which finally took place in April 2018, according to filings. Davidson, the board's former executive chairman, also filed an action against the company in March of that year. The SEC subpoenaed Long Blockchain in July 2018, and Lindsay and Giguiere were arrested that month, according to court documents. Long Blockchain's market capitalization crested at more than $60 million during its crypto flirtation, but it has dropped since and is valued at around $9 million. The company has since started a subsidiary for gift cards and loyalty programs. Financial filings show that Long Blockchain has continued posting losses. The FBI, meanwhile, is still digging. Court records show that FBI special agent Stephanie Schuld filed a follow-on search warrant in May to go through Lindsay's iPhone again, seeking communications during a broader range of dates, which she thinks will uncover more evidence of securities fraud. |

| Making blockchain transactions secure and private - Tech Xplore Posted: 25 Jul 2019 09:25 AM PDT  Blockchains have become an important part of internet technology. They are used for cryptocurrencies such as Bitcoin, but also for other security-sensitive tasks, such as managing supply chains for high-tech factories. Although blockchains were initially thought to be the holy grail of security and privacy in public information exchange, it turned out that that they actually fall short of keeping that promise. Given this state of affairs, the Security and Privacy Group at TU Wien (Vienna) launched a blockchain research lab in September 2018. In the past few months, the lab has already been extremely successful: Pedro Moreno-Sanchez, the lab leader, who joined TU Wien in 2018 after receiving his Ph.D. from Purdue University, has raised 820,000 Euros from some of the world's leading blockchain companies; he has won the prestigious FWF Lise Meitner Fellowship; and, perhaps most importantly, he came up with fundamental scientific breakthoughs: Two major security and privacy problems in blockchain technologies have been solved through new cryptographic techniques developed at TU Wien. These solutions have already been implemented by the leading providers of Bitcoin software and are being used to perform thousands of transactions every day. Coinshuffle and Lightning Networks Every Bitcoin transaction is published on the blockchain, which can be read by everybody. This is important to make sure that all transactions are verified and, ultimately, all participants agree on which amount of money belongs to whom. But this is at odds with privacy. "In principle, the Bitcoin blockchain is anonymous, as it does not contain any names, just user IDs," says Moreno-Sanchez. "But if I find out which Bitcoin ID belongs to you, I can easily see what you did in the past, and I can monitor your transactions in the future." A retailer who delivers goods to his customers' home addresses and is paid with Bitcoin can easily match names, addresses and Bitcoin-IDs. "There are even companies that offer this kind of tracking as a paid service," says Moreno-Sanchez. But this is about to change: Moreno-Sanchez and his team have developed "Coinshuffle," a software tool that can easily be added to existing blockchain technologies, such as Bitcoin. Coinshuffle collects several transactions from different users and merges them, creating one single Bitcoin transaction, while making sure that all participants receive the correct amount of money. After the transaction, the complete list of IDs that took part in this transaction shows up in the published blockchain, but nobody can tell, who sent money to whom. "We were able to provide a formal proof that this technology is secure," says Pedro Moreno-Sanchez. "Not even the people sharing the single Bitcoin transaction have a chance to break anonymity—this is a mathematically proven fact." Another problem that Bitcoin faces is scalability: The sheer number of transactions can hardly be handled any more. Therefore, the Lightning network has been developed: It is a technology that enables business partners who frequently exchange Bitcoins to handle these transactions privately among themselves, without creating a Bitcoin transaction that has to be published all around the world. Only when the two partners agree to end their series of transactions, the remaining balance is settled using a standard Bitcoin transaction. "Everyone used to think that this improves privacy," says Pedro Moreno-Sanchez. "But we found out that this is not true. The system could even be exploited to steal money from others." But the team at TU Wien was quick to identify and solve this problem, proposing an innovative cryptographic protocol that has been already integrated in the Lightning network. Turning Basic Research into Working Solutions Both Coinshuffle and the new cryptographic protocol for Lightning networks have quickly raised the attention of leading blockchain companies. "Just like there are several big companies developing internet browsers, there are several big providers of blockchain software. We talked to them and they have already implemented our solutions," says Moreno-Sanchez. "So thousands of Bitcoin transactions are performed every day all around the world, using the security and privacy-enhancing technologies designed and developed here at TU Wien." "We are very happy to have our own blockchain research lab here at TU Wien, and it is astonishing how quickly it took off and produced quite amazing results," says Professor Matteo Maffei, leader of the Security and Privacy group at the Institute for Logic and Computation at TU Wien. "Pedro Moreno-Sanchez and his team have not only been incredibly successful raising money from tech companies and delivering useful solutions, they have also earned international acclaim in academia. Their results have been presented at the most prestigious scientific conferences in security and privacy." Explore further Provided by Vienna University of Technology Citation: Making blockchain transactions secure and private (2019, July 25) retrieved 25 July 2019 from https://techxplore.com/news/2019-07-blockchain-transactions-private.html This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no part may be reproduced without the written permission. The content is provided for information purposes only. |

| You are subscribed to email updates from "blockchain" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

- Get link

- X

- Other Apps

Comments

Post a Comment