Bitcoin And Blockchain Job Hunts Drop 53% Over Past Year - Forbes

- Get link

- X

- Other Apps

Bitcoin And Blockchain Job Hunts Drop 53% Over Past Year - Forbes |

- Bitcoin And Blockchain Job Hunts Drop 53% Over Past Year - Forbes

- China Gives Digital Currencies a Reprieve as Beijing Warms to Blockchain - The New York Times

- Bitcoin Spikes As China Embraces Blockchain - Forbes

- Blockchain Makes Inroads Into the Stock Market’s $1 Trillion Plumbing System - The Wall Street Journal

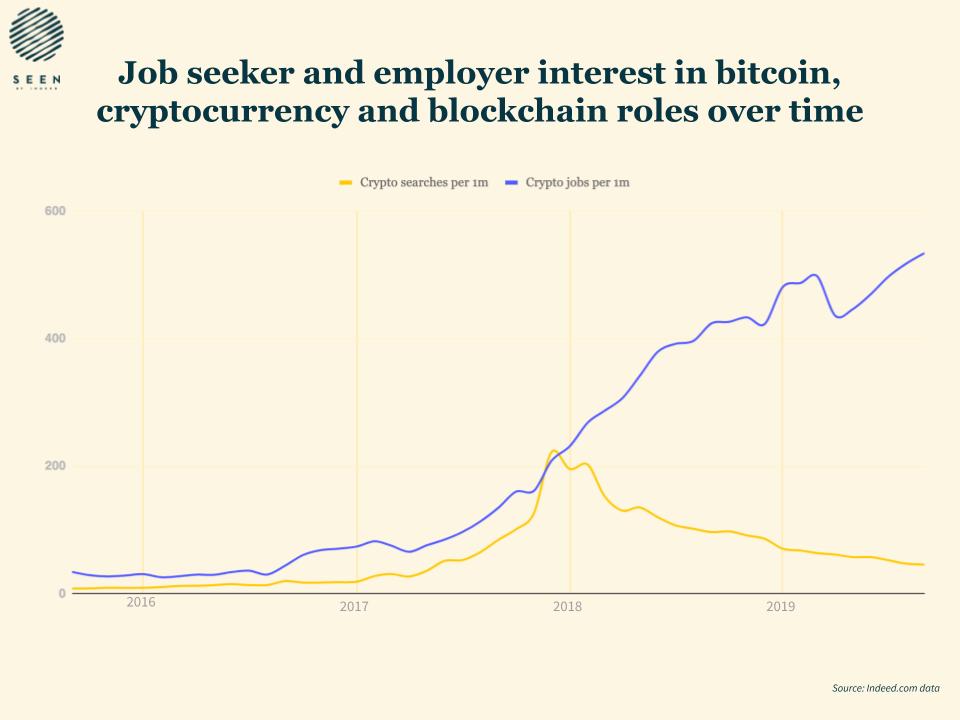

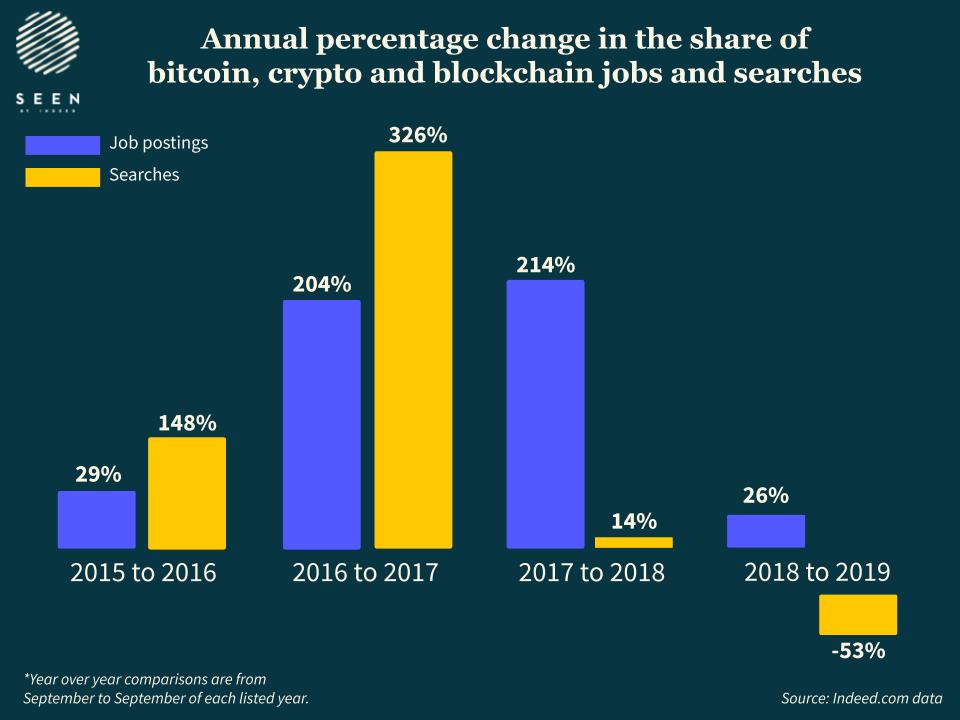

| Bitcoin And Blockchain Job Hunts Drop 53% Over Past Year - Forbes Posted: 07 Nov 2019 06:00 AM PST  Between September 2018 and September 2019, job opportunities in the crypto and blockchain space ... [+] became more available, but job seeker interest waned, according to recent data gathered by Indeed. IndeedOver the past several years, the cryptocurrency and blockchain space has seen immense growth, not only regarding digital asset prices, but also in the many startups and existing businesses that are now involved in the industry and its underlying technology. Numbers from the past year, however, show decreased interest from job seekers even though the number of jobs in the crypto and blockchain industry has grown, according to recent data gathered by popular employment site Indeed. From September 2018 to September 2019, "the share of cryptocurrency job postings per million on Indeed have increased by 26%, while the share of job searches per million have decreased by 53%," Indeed detailed in a report provided to me. These numbers are also down from the figures posted one year prior. September 2017 to September 2018 tallied a 214% growth in crypto and blockchain jobs on Indeed with a 14% growth in related job seeker searches, according to an email from an Indeed representative.  This past year is the first down year for crypto/blockchain job searches on Indeed since 2015. IndeedSince the birth of the industry's flagship asset bitcoin in 2009, entities have created numerous other digital assets, as well as various use cases for blockchain, the technology underpinning bitcoin. As these assets and their underlying technologies gained exposure, an increasing number of people entered the arena with ideas on how to harness such opportunities, leading to an increased number of available jobs in the industry. "[B]etween September 2015 and September 2019, the share of these jobs per million for roles related to cryptocurrency grew by 1,457%. In that same time period, the share of searches for these jobs per million increased by 'only' 469%," Indeed said in the report. The initial coin offering (ICO) boom of 2017 brought significant attention to the cryptocurrency and blockchain industry as startups capitalized on the new way to raise significant amounts of funds. With these ICOs came new job opportunities. The ICO bubble burst in 2018, however, causing the total cryptocurrency market cap to plummet 85%, HackerNoon detailed in an article. More than 1,000 cryptocurrency projects died in 2018, as reported by TechCrunch last year. Regulation also flooded to the space as authorities investigated numerous projects and companies. Amid the ashes of many, a number of companies continued to grow, such as Coinbase and Binance. Additionally, many mainstream giants such as Amazon, Walmart and JPMorgan Chase have taken steps to incorporate blockchain technology in various capacities. Such growth requires people with specific skills to implement this new technology, hence the increased number of job postings. According to Indeed's report data provided to me, software engineers, software architects, full stack developers and front-end developers were top priority hires in the crypto and blockchain industry between October 2018 and September 2019. The companies with the most job postings on Indeed over the past year primarily were mainstream powerhouses such as Deloitte, IBM, Accenture and Cisco, among many others, the Indeed data included. This list lines up with the current trend of mainstream blockchain technology adoption. Based on the numbers listed above from the past year, however, job seekers have been less interested in searching for cryptocurrency and blockchain related employment opportunities. |

| China Gives Digital Currencies a Reprieve as Beijing Warms to Blockchain - The New York Times Posted: 06 Nov 2019 04:18 AM PST  HONG KONG — Blockchain is back in Beijing's good graces. Chinese officials have quietly removed the business of making Bitcoin and other cryptocurrencies from a list of hundreds of industries that Beijing plans to outlaw. In April, the practice appeared on a list of industries that would be denied benefits and subsidies from local governments, leading to worries in China that a popular and lucrative business would dry up. But making digital currency — a practice known as mining — was not on a final list released on Wednesday. It was not clear why the National Development and Reform Commission, China's top economic planning agency, had removed cryptocurrency mining from the list, and officials there could not be reached for comment on Wednesday. There appears to have been a significant shift in how China regards the unproven world of digital currencies. Even President Xi Jinping appears to have warmed to the technology, though Beijing may accept cryptocurrencies only in ways that it can tightly control. Last month, Mr. Xi endorsed studies in blockchain, the underlying technology that allows a cryptocurrency like Bitcoin be tracked across a wide network of computers. Electronic payments are typically tracked by a centralized system like those run by PayPal or similar companies, giving those firms great control over the digital flow of money around the world. According to state media, Mr. Xi told top Communist Party leaders that the technology was at the heart of China's innovation and "key to increasing China's influence and rule-making power in the global arena." Cryptocurrency makers and watchers said the comments were most likely meant to pave the way for China to create its own digital currency, both to tighten controls as well as to make China's currency more readily available outside the country. The comments led to a surge in interest in China. Investors sent shares of local digital currency-related companies soaring, while cryptocurrency stalwarts rejoiced. "I will open more mines," said Yu Wei, who owns four cryptocurrency mines in China. China has not always held the technology in high regard. Two years ago, fearful of investment bubbles, it ordered local exchanges that trade cryptocurrencies to close. It has also banned initial coin offerings, a method by which start-ups or online projects can raise funds by issuing cryptocurrency. Some Chinese officials had also begun to express concerns about electricity use. Mining cryptocurrencies requires a host of computers crunching numbers, a power-hungry process. The industry fell under a further cloud when it appeared on the April list of industries officially frowned upon by the government. Some miners began to hide or move to places with friendlier laws or abundant electricity, including the United States. Many officials have since come to believe that cryptocurrency mining brings jobs and revenue at a time of slowing growth, said Ziwen Xu, head of research at Dotscommunity, a consulting firm. Slackening activity at factories means cheaper and more abundant electricity. Still, China's vision of cryptocurrencies may not match that of the rest of the world. Blockchain technology appeals to many people in part because its decentralized nature makes it difficult for governments to control. The Chinese government, by contrast, is exploring issuing an e-currency fully controlled by Beijing. Officials are discussing creating a cryptocurrency that would be tied to China's real currency, the renminbi, and would be easier to track. That could allow China to loosen the limits on how its currency is used outside its borders while firmly maintaining ultimate control. China uses its currency controls to take a stronger hand in running its financial system, but it has long envied the power and influence the United States enjoys from the dollar's wide use around the world. China also wants to track money flowing across its borders, both to tamp down on corruption and to protect the economy from violent swings in currency value. |

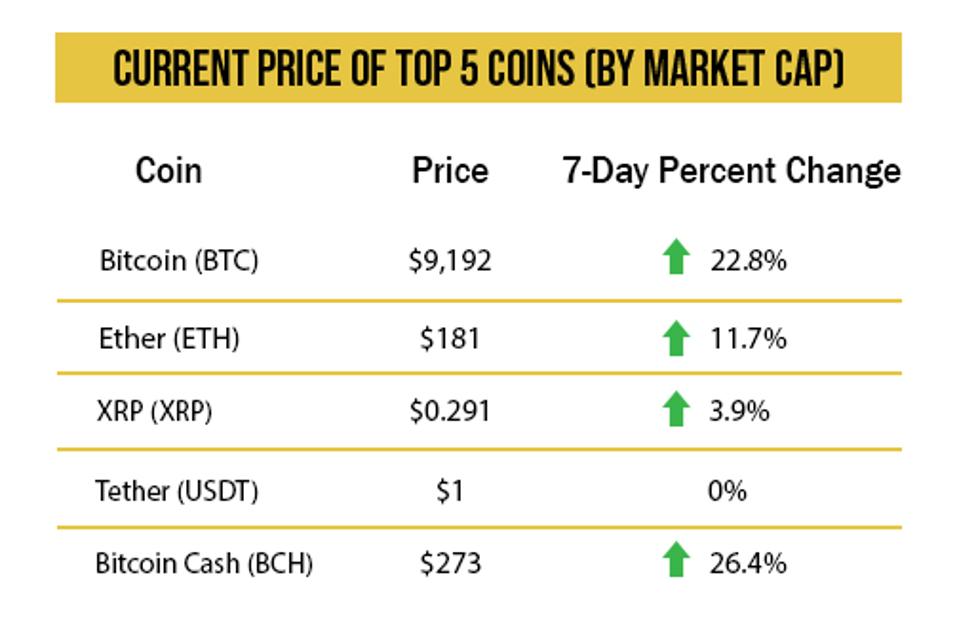

| Bitcoin Spikes As China Embraces Blockchain - Forbes Posted: 03 Nov 2019 05:30 AM PST  Getty DETROIT REVS ITS BLOCKCHAIN ENGINESAt the Forbes 30 Under 30 Summit in Detroit last weekend, executives from Ford, BMWand the Mobility Open Blockchain Initiative (MOBI) took the stage to talk about blockchain's potential to transform the auto industry. While the technology is being explored by manufacturers around the world, perhaps no auto center has more to gain than Detroit, Michigan, whose auto industry was knocked to its knees in the early 2000s as production of U.S. vehicles gradually shifted abroad. For example: a vehicle identity proof-of-concept that tracks the entire life of a car is being built by Detroit giants Ford and GM in a rare partnership with fellow international competitors BMW, Groupe Renault, Honda and other members of MOBI. CRYPTO MARKETSBitcoin saw a major jolt last week after Chinese president Xi Jinping expressed his support for blockchain, saying the country needs to take advantage of the opportunities the technology provides. Bitcoin soared from $7,500 to $10,500 in just a few hours following Xi's remarks. Plus: Genesis Capital, a subsidiary of crypto investment firm Digital Currency Group(DCG), has reported a 38% increase in stablecoin loans in the third quarter of 2019. Strong demand to acquire stablecoins that are equivalent in value to the U.S. dollar indicates positive business sentiment in the crypto sector following a two-fold increase in the price of bitcoin year-to-date.  Source: Messari. Prices as of 4:00 p.m. on November 1, 2019. CRYPTO'S REGULATORY 'RACE TO THE BOTTOM'Last month, two major blockchain platforms met U.S. regulators head on: blockchain-builder Block.one paid a $24 million fine for an unregistered securities offering as part of an SEC settlement, and the CFTC's new chairman, Heath Talbert, announced that Ethereum is a commodity. As U.S. regulators come to terms with cryptocurrency and blockchain innovations, could they be gearing up for a so-called 'race to the bottom'? ENTERPRISESamsung Galaxy S10 users can now access Tron tokens and applications on their phones, Justin Sun revealed on Twitter this week. The move gives Tron access to a space that was previously reserved for bitcoin and Ethereum assets. Tron's integration with the Samsung Blockchain Keystore is the latest example of how cryptocurrencies are using enterprise partnerships to expand beyond early crypto adopters to capture more mainstream users. Plus: What does the Ethereum 2.0 upgrade mean for enterprises? ELSEWHEREEscaping fate of demolition, a century-old powerhouse in U.S. will become crypto mining center [The Block] Amber Baldet on what blockchain technology can do for us beyond cryptocurrency [The Verge] What's Blockchain Actually Good for, Anyway? For Now, Not Much [Wired] Bitcoin Just Hit $1 Billion in All-Time Transaction Fees [CoinDesk] |

| Posted: 07 Nov 2019 05:00 AM PST  By Alexander Osipovich Technology from the bitcoin world is coming to the trillion-dollar plumbing that underpins the U.S. stock market. Last week, the Securities and Exchange Commission gave the green light to a pilot project in which blockchain—the technology behind cryptocurrencies—will be used to settle trades in stocks like General Electric Co. and AT&T Inc. Paxos, the blockchain startup leading the project, hopes to construct a faster and cheaper way to process stock trades, ultimately reducing costs for Wall Street banks and investors alike. SHARE YOUR THOUGHTSWhat benefits or drawbacks do you see to using blockchain to settle stock trades? Join the conversation below. The project will be limited to a tiny slice of the U.S. stock market and there is no guarantee that it will succeed. Still, it could eventually bring change to the world of clearing and settlement, which has evolved slowly since the current system was created in the 1970s. Settlement is the delivery of securities from sellers to buyers, while clearing is the process of handling trades from when they are initially agreed upon to when they are settled. Today, the standard time it takes to settle a stock trade is two business days—which is why investors must typically wait several days to get cash from their brokers when they sell shares. Paxos's initiative is aimed at settling trades at the end of the day in which they are agreed upon, or even sooner. Settling UpRegulators authorized a two-year experiment in which Paxos, a blockchain startup, will settle trades in a limited number of stocks between up to seven participating banks. Participating banks deposit cash and eligible securities into Paxos's accounts... ...Paxos creates digital representations of the cash and securities... The participating banks can now access the proceeds of their trade. ...and ownership is recorded on the Paxos Ledger, a database of which every participant has a copy. On the settlement date chosen by the participants, Paxos settles the trade by simultaneously moving the digitized cash and securities to the appropriate accounts on the ledger. When two participants agree to do a trade, its details are submitted to the ledger.  Participating banks deposit cash and eligible securities into Paxos's accounts... ...Paxos creates digital representations of the cash and securities... ...and ownership is recorded on the Paxos Ledger, a database of which every participant has a copy. When two participants agree to do a trade, its details are submitted to the ledger. On the settlement date chosen by the participants, Paxos settles the trade by simultaneously moving the digitized cash and securities to the appropriate accounts on the ledger. The participating banks can now access the proceeds of their trade.  Participating banks deposit cash and eligible securities into Paxos's accounts... ...Paxos creates digital representations of the cash and securities... ...and ownership is recorded on the Paxos Ledger, a database of which every participant has a copy. When two participants agree to do a trade, its details are submitted to the ledger. On the settlement date chosen by the participants, Paxos settles the trade by simultaneously moving the digitized cash and securities to the appropriate accounts on the ledger. The participating banks can now access the proceeds of their trade.  Participating banks deposit cash and eligible securities into Paxos's accounts... ...Paxos creates digital representations of the cash and securities... ...and ownership is recorded on the Paxos Ledger, a database of which every participant has a copy. When two participants agree to do a trade, its details are submitted to the ledger. On the settlement date, Paxos settles the trade by simultaneously moving the digitized cash and securities to the appropriate accounts on the ledger. The participating banks can now access the proceeds of their trade. For decades, an organization called the Depository Trust & Clearing Corp. has had a monopoly on the clearing and settling of equities trades in the U.S. Owned by a financial-industry consortium, DTCC traces its roots to a 1970s effort to eliminate paper stock certificates and replace them with electronic records. Last year, it cleared an average of $1.3 trillion in stock trades each day. Now, DTCC is about to face something new: competition. On Oct. 28, the SEC issued a letter that lets Paxos set up an experimental settlement service for stock trades. Paxos, whose other businesses include a cryptocurrency exchange, expects to launch the service by the end of the year. Credit Suisse Group AG and Société Générale SA have said they would use it and Paxos hopes to bring more banks on board. The appeal to banks is that a faster, more efficient settlement service could reduce costs in their stock-trading businesses, an area where profit margins have shrunk in recent years due to competition and declining fees. Newsletter Sign-up"There has been so much innovation in the way trading happens over the past 20 years, with people trading in microseconds, but there hasn't really been innovation in clearing or settlement," Paxos Chief Executive Charles Cascarilla said in an interview. DTCC says it welcomes the competition. "That kind of innovation is helpful for the industry," said Michael McClain, the head of its equities clearing and settlement business. DTCC says it has modernized its processes, studied blockchain technology and shifted the U.S. stock market from three-day to two-day settlement in 2017. That two-day delay comes with various costs. Banks collectively set aside tens of billions of dollars in capital to cover the risk that firms elsewhere in DTCC's network will fail before the trades settle. There are also separate systems at each big bank, as well as at DTCC itself, that track what different market participants are expected to pay or deliver at settlement time. Bankers say this is inefficient and results in errors when systems disagree with each other. "We are constantly reconciling that data," said Jeffrey Rosen, a New York-based managing director at Société Générale. "That is hugely expensive. While we've built tools to do it efficiently, it would be better not to do it." Paxos's goal is to eliminate these redundant systems by creating a unified record of trading obligations using blockchain technology. A blockchain is essentially a database with many copies distributed across the internet that constantly communicate with each other to ensure the data doesn't get garbled or hacked.  With cryptocurrencies, the blockchain records who holds how many coins at any time and it supports the transfer of coins from one person to another. Similarly, Paxos's planned blockchain would let banks exchange digital representations of cash and securities to settle trades with each other. It would also allow settlement in less than two days. Paxos plans to give participating banks the option of next-day or same-day settlement, or perhaps even to settle trades multiple times a day, Mr. Cascarilla said. The SEC has put significant limits on Paxos's experiment. Only about 140 of the most actively traded, least volatile stocks, like Exxon Mobil Corp. and Bank of America Corp. , are eligible for the project. The number of trades Paxos can settle will also be capped at 1% of average daily trading volume of those stocks, according to the SEC's letter. Moreover, the electronic records that officially record stock ownership won't leave DTCC but will instead be housed in Paxos's account at DTCC. So while Paxos's blockchain is recording transfers of stocks between the participating banks, the stocks will stay within the existing system—a measure that will limit disruptions to the market's plumbing. Still, proponents say the project offers a blueprint for a next-generation approach to clearing and settlement. "There's an enormous amount of capital trapped in the system to make sure clearing can take place," said Eric Noll, the former CEO of brokerage Convergex and an adviser to Paxos. "The day you can clear a trade instantaneously, or near instantaneously, the need for that capital to be tied up goes away. That should ultimately lead to lower costs for investors." Write to Alexander Osipovich at alexander.osipovich@dowjones.com Copyright ©2019 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8 |

| You are subscribed to email updates from "blockchain" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

- Get link

- X

- Other Apps

Comments

Post a Comment