Is cryptocurrency payroll legal? - MultiBriefs Exclusive

- Get link

- X

- Other Apps

Is cryptocurrency payroll legal? - MultiBriefs Exclusive |

- Is cryptocurrency payroll legal? - MultiBriefs Exclusive

- Is cryptocurrency a security? - Yahoo Finance

- Don’t Forget About Cryptocurrency Like Bitcoin At Tax Time - Forbes

- What are the benefits of cryptocurrency? - Fox Business

| Is cryptocurrency payroll legal? - MultiBriefs Exclusive Posted: 06 Feb 2020 12:34 PM PST Paying employees in cryptocurrencies could be an emerging trend. But it's not without controversy or implications. What is cryptocurrency?According to Decryptionary.com, cryptocurrency is "an electronic money that uses technology to control how and when it is created and lets users directly exchange it between themselves, similar to cash." Cryptocurrency eliminates the need for banks, as transactions are processed on a shared database called a "blockchain" — which is operated by various individuals and companies. These transactions are safeguarded using "cryptography" or encryption techniques. Presently, there are thousands of cryptocurrencies in existence. However, it all started with Bitcoin, which was released in 2009 and remains the most popular cryptocurrency to date. Per industry experts, Bitcoin is secure (at least, so far) because it's almost impossible to alter transactions once they've been validated and made part of a block. Is it legal to pay employees in cryptocurrency?Short answer: maybe The practice of paying wages in cryptocurrency is becoming more common, but U.S. employers should tread carefully. A key area of consideration is the Fair Labor Standards Act (FLSA), which says that employers must pay employees "prescribed wages, including overtime compensation, in cash or negotiable instrument payable at par." "Negotiable instrument payable at par" is interpreted to mean either cash or something that can be immediately converted into cash, such as direct deposit or paper check. As noted in a report by Bloomberg Tax, the U.S. Department of Labor (DOL) permits employers to compensate employees via foreign currencies, provided the amounts — when converted into U.S. money — meet the respective FLSA standards. However, it's not clear whether the DOL regards digital money, such as cryptocurrencies, as a legal method for paying wages under the FLSA. Also, there may be state laws at play. For example, in Maryland, wages must be delivered "in United States currency; or by a check that, on demand, is convertible at face value into United States currency." Many other states have similar requirements. Moreover, some states require employers to make wages readily accessible to employees, without fees or hindrances. Employers in these states risk violating the law if their employees aren't able to convert their cryptocurrency wages (without fees or hindrances) into cash. Another concern is the Internal Revenue Service (IRS), which regards cryptocurrencies as property, not as money. Basically, employers that pay wages in cryptocurrency must convert the digital currency into U.S. dollars, withhold federal taxes from the dollar wages, and report the information on employees' Form W-2 — all of which could prove challenging for many employers. Other potential complicationsThe cryptocurrency market is currently not regulated by the U.S. Securities and Exchange Commission (SEC), though this could change in the future. If it does change, employers paying wages in cryptocurrency may need to adhere not just to wage-and-hour laws but also securities laws, on both federal and state levels. There's also the unstable nature of some cryptocurrencies. If the cryptocurrency suffers a loss in value — such as the Bitcoin crash in 2018 — it could trigger issues with minimum wage and overtime compliance. It could also put the employee at a financial disadvantage. To minimize risks, the employee would have to cash out the cryptocurrency payment immediately upon receipt — while it's still trending up. Can cryptocurrency payroll work?Experts note that the majority of employers that pay wages in cryptocurrency are "creating the cryptocurrency themselves; therefore, it costs them very little to make the payments." These employers are essentially producing their own coin, typically at a very cheap price. When they use their own cryptocurrency to pay wages, the transaction is akin to paying employees via company shares, thereby yielding significant savings in payroll costs. To prevent noncompliance with the FLSA, some payroll professionals suggest satisfying federal minimum wage and overtime thresholds in fiat currency and then paying any remaining amounts in cryptocurrency. Alternatively, employers can give employees the option of receiving only discretionary bonuses in cryptocurrency, as these types of bonuses don't have to be included in FLSA overtime calculations. While some employees might reject the idea of receiving wages in cryptocurrency, others, especially millennials, may welcome it. ConclusionThe payment of wages in cryptocurrency is still in the beginning stages. It may one day become commonplace, or it could end up dying an early death. Ultimately, its fate depends on the future of cryptocurrency. Meanwhile, there are a host of variables to consider before adopting this practice, including whether your employees want to be paid in cryptocurrency, whether such compensation is legally acceptable, and whether it makes sense to offer this payment model. |

| Is cryptocurrency a security? - Yahoo Finance Posted: 12 Jan 2020 12:00 AM PST   The growing popularity of cryptocurrencies has led to a lot of heated debates about how they should be defined and regulated. The argument centres on whether cryptocurrencies should be classified as securities – and the answer could have major ramifications for the way the world of digital assets operates going forward. This is because anything classed as a security is regulated – in the US by the Securities and Exchange Commission (SEC) and in the UK by the Financial Conduct Authority (FCA). Many people argue this goes against the very nature of cryptocurrencies, which are anonymous by design, are not governed by any single authority, and aim to be free of centralised regulation. What is a security? To understand whether cryptocurrency is a security, it's important to understand what a security actually is. A security is a tradable financial asset that has monetary value. It represents an ownership position in a publicly-traded corporation (via owning shares), a creditor relationship with a government body or a corporation (via owning bonds), or rights to ownership as represented by an option. The legal definition of a security varies by jurisdiction. In the US, a security is a tradable financial asset of any kind. In the UK, the FCA's definition of a security applies only to equities, debentures, alternative debentures, government and public securities, warrants, certificates representing certain securities, units, stakeholder pension schemes, personal pension schemes, and rights to or interests in investments. The crypto security debate The SEC has been fairly open in its ponderings about whether cryptocurrency is a security. Under US law, a security includes an "investment contract" – which is defined as an investment of money in a common enterprise with a reasonable expectation of profits to be derived from the entrepreneurial or managerial efforts of others. This is known as the Howey Test, and it essentially asks whether the value of a transaction for one of its participants is dependent upon the other's work. SEC chairman Jay Clayton has clarified that Bitcoin is not a security. In an interview with CNBC in June, he stated: "Cryptocurrencies are replacements for sovereign currencies… [they] replace the yen, the dollar, the euro with Bitcoin. That type of currency is not a security." Former CFTC chairman Gary Gensler has also stated that Bitcoin cannot be classified as a security. He pointed out that Bitcoin came into existence as mining began as an incentive in validating a distributed platform, with no initial token offering, no pre-mined coins, and no kind of common enterprise. Bitcoin has never sought public funds to develop its technology and it does not pass the Howey Test. Ethereum and Ripple The position is less clear when it comes to other cryptocurrencies such as Ethereum (ETH) and Ripple (XRP). Jay Clayton has endorsed remarks made by his colleague William Hinman that Ethereum is not a security. However, Gensler has warned that more than 1,000 cryptocurrencies are probably operating outside of US law and will have to come into regulatory compliance. He said that although Bitcoin is not a security, Ripple "sure seems like a common enterprise". A council created by some of the major cryptocurrency exchanges – Crypto Ratings Council – seems to agree as it awarded XRP a four out of five in matching the criteria considered to be a security. It pointed out that Ripple sold XRP before the token had any utility and used a securities-like language when promoting XRP. Ripple CEO Brad Garlinghouse has since hit back at critics who have been "spreading fear, uncertainty, and doubt" about XRP, stating that the company's token "is not a security". Speaking at the MIT Business of Blockchain conference last year, Gensler highlighted the key distinctions that could determine whether tokens are securities. In a nutshell, if a coin offering is designed to give investors an ownership stake, the token should be treated like a security and subject to regulation. The FCA, on the other hand, recently suggested XRP is not a security because, like Ethereum, it can be used as a means of payment (exchange token) and to run applications (utility token). Conclusion Currently, the answer to the question "is cryptocurrency a security?" seems to be "it depends" or "sometimes". Certain crypto tokens do appear to pass the Howey Test. However, their fundamental goal of being autonomous and distributed networks that are designed to be decentralised is at odds with the regulated nature of securities. What the regulators eventually decide will have a huge impact on the crypto world and its investors. The post Is cryptocurrency a security? appeared first on Coin Rivet. |

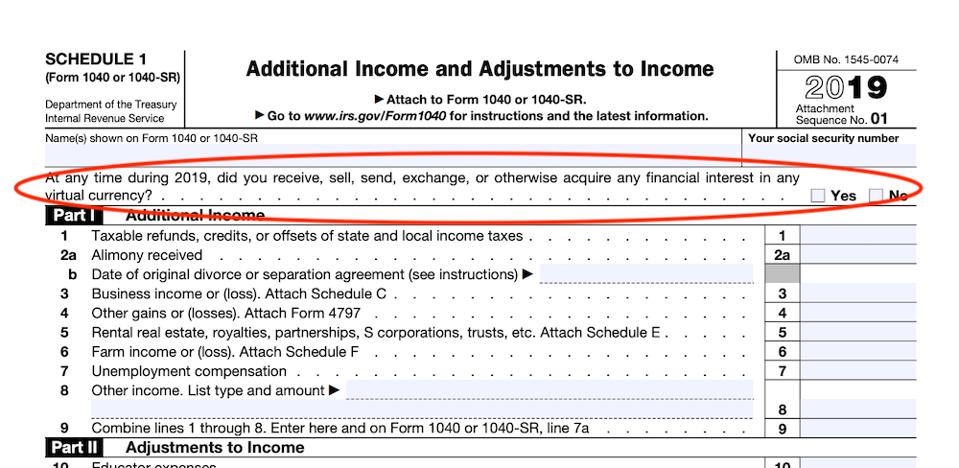

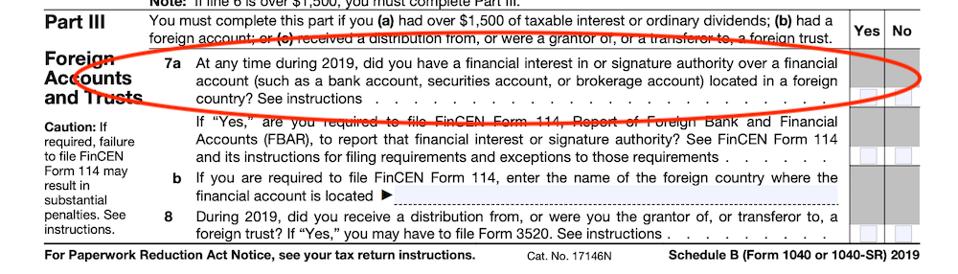

| Don’t Forget About Cryptocurrency Like Bitcoin At Tax Time - Forbes Posted: 06 Feb 2020 11:47 AM PST  PARIS, FRANCE - JUNE 25: In this photo illustration, a visual representation of the digital ... [+] Cryptocurrency, Bitcoin is displayed on June 25, 2019 in Paris, France. (Photo by Chesnot/Getty Images) Getty ImagesForm 1040 may look similar to last year's return, but there's one key difference that's attracting attention: a question about cryptocurrency. As I reported late last year, early drafts of Form 1040 reflected a new question on the top of Schedule 1, Additional Income and Adjustments to Income (downloads as a PDF). Schedule 1 is used to report income or adjustments to income that can't be entered directly on the front page of form 1040. The new question made it onto the final version of Schedule 1:  KPE The question asks: At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? The placement of the question is important. I believe the question is intended to be so conspicuous that it makes it difficult for any taxpayer to argue that they didn't know that it was necessary to report cryptocurrency transactions. The Internal Revenue Service (IRS) has made no secret of the fact that it believes that taxpayers are not properly reporting cryptocurrency transactions. An IRS dive into the data showed that for the 2013 through 2015 tax years, the IRS processed, on average, just under 150 million individual returns annually. Of those, approximately 84% were filed electronically. When IRS matched data collected from forms 8949, Sales and Other Dispositions of Capital Assets, which were filed electronically, they found that just 807 individuals reported a transaction using a property description likely related to bitcoin in 2013; in 2014, that number was only 893; and in 2015, the number fell to 802. But… so what? If you skip over the question or answer it wrong, you can still claim that you made a mistake, right? Here's the thing. Even though the question is new, this kind of question certainly isn't. Tax professionals have watched taxpayers struggle before when answering a similar question about offshore accounts and interests at the bottom of Schedule B. This one:  KPE The IRS can and has taken the position that willfully failing to check the box related to offshores accounts and interests on Schedule B can form the basis for criminal prosecution. Failing to check the box by accident can still result in expensive headaches and draconian penalties. I fully expect a similar result when it comes to cryptocurrency. So why all the fuss over this new question? The IRS has made cryptocurrency compliance a priority. Last year, the IRS mailed letters to more than 10,000 taxpayers who might have failed to report income and pay the resulting tax from virtual currency transactions or did not accurately report their transactions. This wasn't unexpected since the IRS campaigns announced in 2018 that they were making noncompliance related to the use of virtual currency one of their targeted compliance campaigns. In 2014, the Internal Revenue Service (IRS) issued guidance to taxpayers (downloads as a PDF), making it clear that virtual currency like Bitcoin and Ethereum will be treated as capital assets, provided they are convertible into cash. In simple terms, this means that capital gains rules apply to gains or losses. (You can read more on the taxation of cryptocurrencies here.) It's clear that the IRS is getting serious about cryptocurrency reporting. If you have questions about how and what to report, don't stay silent: ask your tax professional for more information. |

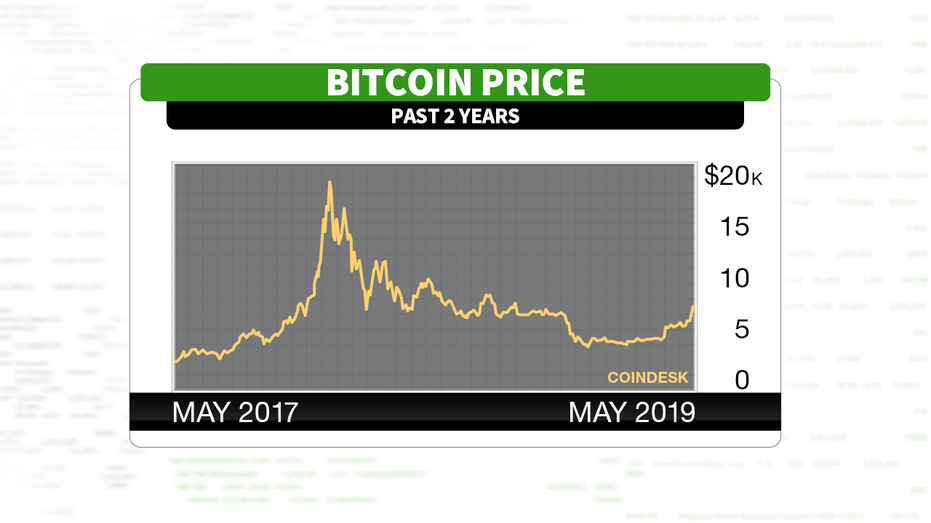

| What are the benefits of cryptocurrency? - Fox Business Posted: 06 Feb 2020 01:25 PM PST CoinList co-founder and president Andy Bromberg discusses the trajectory Libra and Bitcoin could take in 2020. Cryptocurrency is slowly but surely becoming an popular form of payment. Continue Reading Below Despite the growing curiosity in crypto, however, governments are cracking down on the digital currency because it is decentralized, meaning it has no central authority in the way the U.S. government holds authority over the dollar. Therefore, some experts believe crypto poses a threat to central banks and national security. So, why should someone risk investing in a currency unregulated by the government and that is subject to potential digital threats?  One man, sitting in his office next to the mining rig, using computer for mining bitcoin. / iStock "The benefits of cryptocurrency are many and profound," cryptocurrency education company Luno CEO Marcus Swanepoel told FOX Business in a statement. "We've heard how it's going to solve problems across the current financial system that nothing else could – everything from the truly significant, such as banking the unbanked, to the seemingly trivial, such as providing a more efficient way to buy a car." HACKERS STOLE $41B OF BITCOIN ON ONE OF THE WORLD'S LARGEST CRYPTO EXCHANGES "Cryptocurrency is not just a financial instrument. It's also a technology. Any benefits it offers are only possible because of the strength of the technology that underpins it because it works," Swanepoel added. No middle manCryptocurrencies don't use middlemen, so transactions are usually easier, faster and require less or no additional transaction fees. Some experts believe, however, that taking out the middle man goes beyond these simple benefits. WHY CRYPTO AND BLOCKCHAIN ARE PICKING UP SPEED IN TINY COUNTRIES Swanepoel said cryptocurrency has the ability to "give power back to the people. To eliminate current social structures and systems that disenfranchise individuals. To provide the foundations of a system that's transparent yet secure. Where corruption is exposed and rampant inflation ended." More confidentialEach cryptocurrency transaction is a unique exchange between two parties, which protects users from issues like identity theft. "Cryptocurrencies can do this because of the technology that underpins them – blockchain," Swanepoel said. "Blockchain technology is decentralized. This means that no one person, institution or government has central control. Rather, it is the network that is in control. Policies are hardcoded in, and it cannot be manipulated to suit agendas." US, CHINA AND THE RACE FOR DIGITAL CURRENCY This is another reason why governments feel threatened by digital currency. Crypto is more confidential and therefore a favored form of payment among criminals trading illegal goods and services. But there is also a general lack of trust in corporate and government operations, Swanepoel said.  Woman using a smartphone displaying a bitcoin wallet screen. / iStock "The financial system as it exists today is built on trust. But people no longer trust that it exists to help them – that it helps only people working in the industry," he said. "Cryptocurrency removes this need to trust people's motivations." Potential to help the "unbanked"On a global scale, more people have access to the internet than they have to banks or other currency exchange systems. This opens the opportunity for underprivileged people to establish credit. Swanepoel suggested that crypto could be the key to eradicating global poverty and corruption for this reason. "Cryptocurrency is uniquely positioned at the apex of technology and finance. It has been lauded as a potential game-changer for society, poised to eliminate corruption, bank the unbanked, and redistribute wealth in a way that's fairer and more equitable," Swanepoel said. CLICK HERE TO GET THE FOX BUSINESS APP During Luno's Pennydrop initiative, which shares the stories of ordinary people who use cryptocurrency, the company met "many people who first got into crypto because of its potential to help build a better society," he said. "Whether it was understanding something in the fundamental design of cryptocurrency ... or seeing first-hand its impact on a more personal level, there was a real belief that it could be used for good." Easier international exchangesCryptocurrency offers an opportunity for international business people or parties to make one-on-one exchanges online without the complications and added fees that traditionally come with international currency exchanges that involve third parties. Millennials should invest in bitcoin, billionaire investor says TimelyCryptocurrency is happening now. The currency became a topic of interest when the world witnessed the sudden drastic rise and subsequent fall and steady rise again with Bitcoin between 2017 and 2019. It sparked interest and education. Now, cryptocurrency is becoming more a part of the everyday norm than some people realize.  "Cryptocurrency is money for the digital age. It leverages technology in such a way that it's able to integrate seamlessly into the digital ecosystem. It is native to the internet, which allows it to work in conjunction with other technologies," Swanepoel said. "A square peg in a square hole. Not money as we know it today – a round peg in a square hole, developed and built for the analog age." Maglan Capital Co-founder and President David Tawil similarly said technology, in general, has "rendered massive upheaval and disruption to every business line" Now, that technology is moving into the way the world uses currency. "It is the natural and logical next step in financial services in the world," Tawil said. "Once upon a time, shares of stock were physical and transferred physically; those shares are now entirely digital. Similarly, currency needs to be digital and global." |

| You are subscribed to email updates from "what is cryptocurrency" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

- Get link

- X

- Other Apps

Comments

Post a Comment