Bitcoin Bulls Back in the Driving Seat as Price Crosses $10K - CoinDesk - CoinDesk

- Get link

- X

- Other Apps

Bitcoin Bulls Back in the Driving Seat as Price Crosses $10K - CoinDesk - CoinDesk |

- Bitcoin Bulls Back in the Driving Seat as Price Crosses $10K - CoinDesk - CoinDesk

- The U.S. Is Very Worried About Bitcoin—And It’s Finally Doing Something About It - Forbes

- Analyst Prices Bitcoin at $400k By Next Year Based on Miner Capitulation Pattern - newsBTC

- Bitcoin Price May Explode to $500,000, Says Fundstrat's Tom... - Coinspeaker

| Bitcoin Bulls Back in the Driving Seat as Price Crosses $10K - CoinDesk - CoinDesk Posted: 19 Feb 2020 03:00 AM PST

View

Bitcoin (BTC) returned into the five-figure zone on Wednesday, reviving the bullish case and putting recent highs near $10,500 back on the radar. At press time, bitcoin is trading at $10,139, representing a 4.48 percent gain on a 24-hour basis, as per CoinDesk's Bitcoin Price Index. However, the top cryptocurrency by market value was looking weak 24 hours ago, having breached the 2020 rising trendline support at $9,700. The subsequent sell-off, however, ran into bids near $9,600, following which prices charted a near 90-degree rise to $10,290 during the U.S. trading session. Tuesday's spike marked an end of the pullback from recent highs near $10,500 and validated the positive shift in the long-term sentiment highlighted by the golden crossover – the bull cross of the 50- and 200-day averages. As a result, bigger gains could be in the offing in the short term, more so as the price of gold, a classic safe haven asset, is again rising. The yellow metal jumped 1.32 percent on Tuesday – its biggest single-day gain since Jan. 3 – on haven demand amid losses in the U.S. stock markets. Investors shunned risk after Apple warned it does not expect to meet its March quarter revenue guidance due to the coronavirus outbreak's effect on suppliers in China. Bitcoin has increasingly moved in tandem with gold so far this year. Its one-month correlation with gold strengthened to 0.70 in January from December's -0.12, according to cryptocurrency exchange Kraken's January volatility report. Gold is currently trading above $1,600 per ounce and appears on track to test the six-year high of $1,611 reached on Jan. 8.

Daily chart Bitcoin jumped 5 percent on Tuesday, keeping the 2020 rising trendline support intact and confirming another bullish higher low at $9,467 (Feb. 17 low) – a sign of continuation of the rally from January lows near $6,850. Additionally, prices closed well above $10,050 – the high of Sunday's "doji" candle – confirming a bullish breakout from a period of indecisive price action. With the bulls back in the driver's seat, a re-test of the recent high of $10,500 looks likely.

4-hour chart Bitcoin is still trading in an expanding descending channel on the four-hour chart. A breakout looks likely as the relative strength index has already violated the descending trendline and is pointing north.

Bearish scenario If the cryptocurrency again finds acceptance under $10,000, prices may revisit the former hurdle-turned-support of $9,825 (marked by arrow) on the hourly chart (above left). A violation there would shift the focus to the neckline support of the potential head-and-shoulders pattern on the four-hour line chart. At press time, the key support is located at 9,584. A break lower could discourage buyers, leading to a deeper slide toward $9,000. Disclosure: The author holds no cryptocurrency at the time of writing Disclosure Read MoreThe leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. |

| The U.S. Is Very Worried About Bitcoin—And It’s Finally Doing Something About It - Forbes Posted: 18 Feb 2020 05:20 PM PST Bitcoin, cryptocurrencies, blockchain, decentralization, China's digital yuan, Facebook's libra—the U.S. is understandably worried about the dominance of the almighty dollar. Last year, U.S. president Donald Trump slammed bitcoin as based on "thin air," while his Treasury secretary Steven Mnuchin branded bitcoin a "national security threat." Now, the U.S. has admitted bitcoin and cryptocurrency could undermine the dollar's status as the world's reserve currency—and it wants to find out exactly how bad for the country, its economy, and security that could be.  The rise of bitcoin and cryptocurrencies has caused some to fear the dominance of the U.S. dollar ... [+] might be under threat. NurPhoto via Getty Images"Many cryptocurrency enthusiasts predict that either a global cryptocurrency or a national digital currency could undermine the U.S. dollar," the U.S. Office of the Director of National Intelligence wrote in a job listing earlier this month, calling for two researchers to evaluate the impact of the U.S. dollar losing its status as the world reserve currency. "If either of these scenarios or others come to pass, the U.S. would lose both its status in the world and its global authorities." The two roles, looking for a postdoc Ph.D. graduate and a U.S. university or government laboratory employee research assistant, are with the U.S. Intelligence Community Postdoctoral Research Fellowship Program through the Department of Energy's Oak Ridge Institute for Science and Technology. Back in 2018, the Department of Energy's Oak Ridge Institute for Science and Technology conducted research that found that the creation of new bitcoin, along with smaller cryptocurrencies ethereum, litecoin and monero, used more energy than mineral mining to produce the same market value. The Department of Energy's Oak Ridge Institute for Science and Technology did not respond to a request for comment. "There are many advantages for U.S. national security to have the U.S. dollar as the world reserve currency," the job post, which has a deadline of the February 28, read, pointing to the combat of financial crimes, the prevention of terrorism and the development of weapons of mass destruction, the ability of the U.S. to sanction other countries, cause financial instability in global markets. "The U.S. maintains international dominance in no small part due to its financial power and authorities." Christopher Giancarlo, former chairman of the Commodity Futures Trading Commission, recently set up the Digital Dollar Foundation to work on the design and potential framework of a digital dollar. The bitcoin price, which has failed to return to its all-time highs set in late 2017 despite it climbing around 50% since the beginning of the year, was given a substantial boost in the first half of last year by Facebook's plans for a bitcoin-like rival.  The bitcoin price has soared in recent years, making bitcoin easily the last decade's best ... [+] investment. CoinbaseMany have long expected governments to eventually try to undermine bitcoin's network to halt its adoption—though bitcoin's decentralized nature makes it remarkably resilient. "We can win a major battle [with governments] in the arms race and gain a new territory of freedom for several years," bitcoin's mysterious creator Satoshi Nakamoto wrote in 2008. "Governments are good at cutting off the heads of a centrally controlled networks like Napster, but pure [peer-to-peer] networks like Gnutella and Tor seem to be holding their own." Bitcoin now stands with these networks in resistance to government control. |

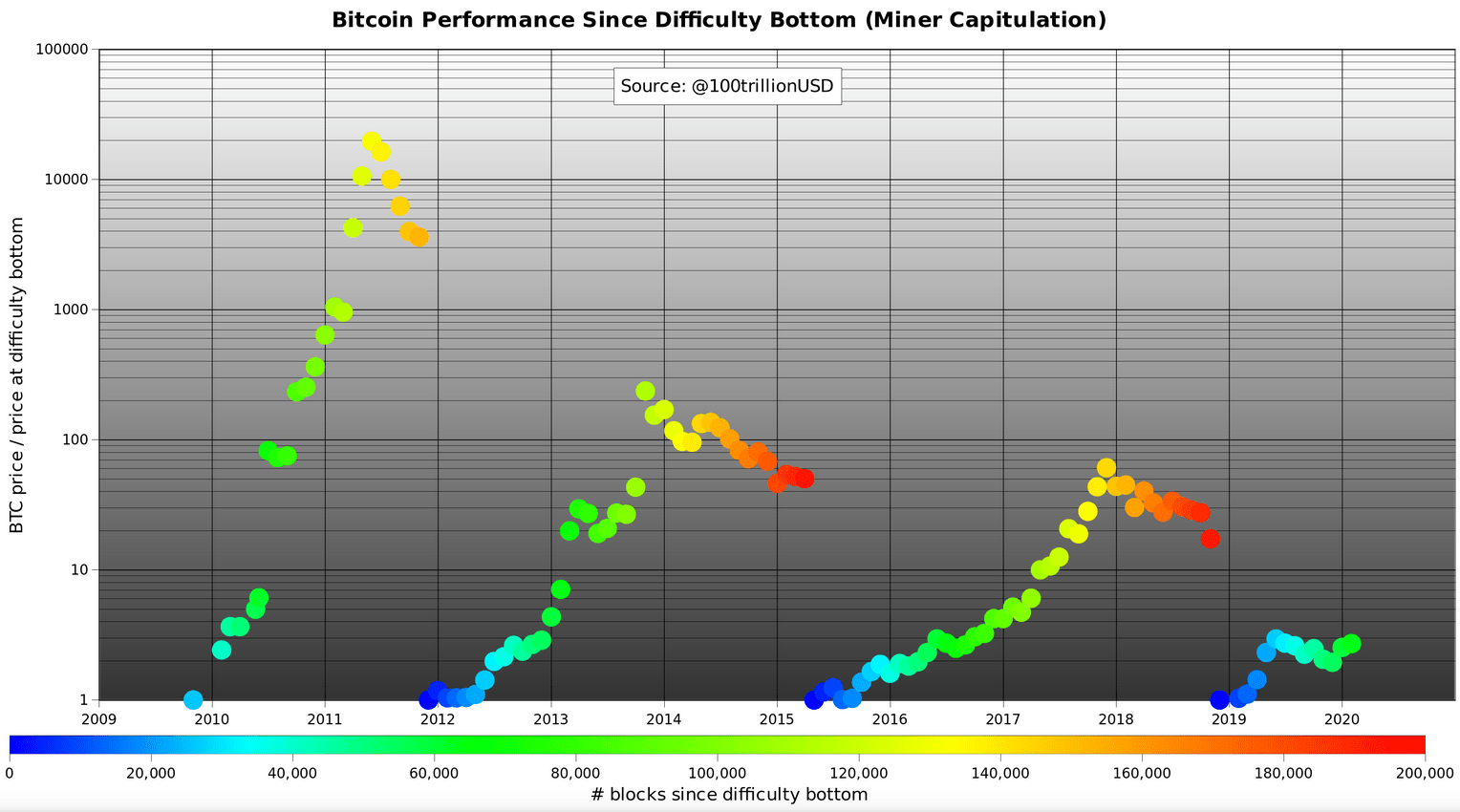

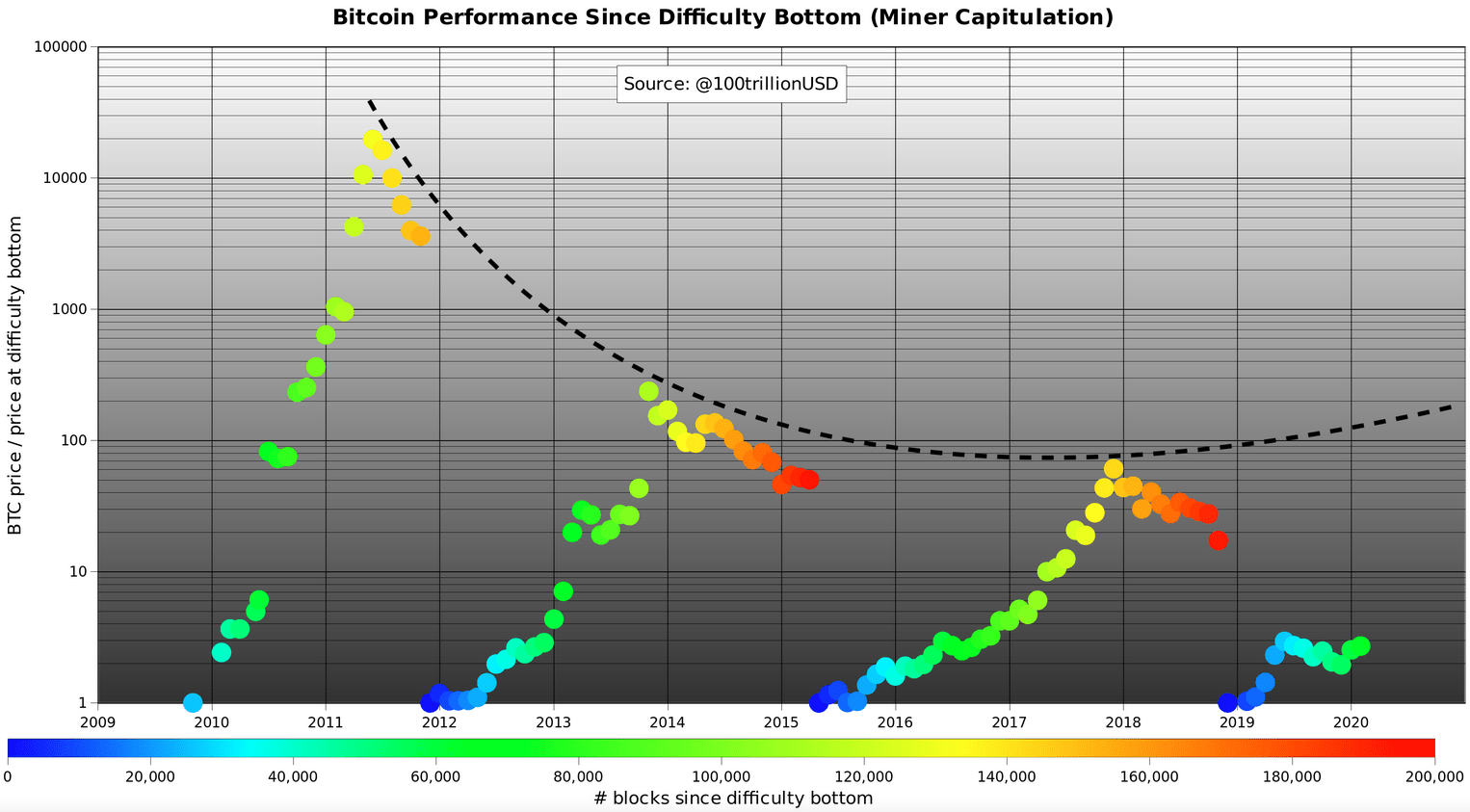

| Analyst Prices Bitcoin at $400k By Next Year Based on Miner Capitulation Pattern - newsBTC Posted: 19 Feb 2020 05:28 AM PST The Bitcoin Performance Since Difficulty Bottom chart shows the formation of a cup pattern peaking in spring 2021. This price prediction tool puts Bitcoin at an astonishing $400k by then.#bitcoin $10k … it's getting really interesting now pic.twitter.com/jocvo3sluD— PlanB (@100trillionUSD) February 18, 2020 Bitcoin Performance Since Difficulty Bottom ChartFollowing the weekend dip that spilled into Monday, business is resumed with Bitcoin back above $10k, and most of the alts posting green today.With that, bullish sentiment has once again returned. And hodlers continue to dare to dream of what might be for the Bitcoin price, and indeed, the wider market as well.Right on cue, analyst @100trillion USD, also known as Plan B, tweeted the chart below. It's based on a ratio of current price over bottom price ($3.7k – December 2018) against time and represented by mining difficulty.  Bitcoin performance since difficulty bottom. (Source: twitter.com)The chart shows four distinct cycles, each beginning with low mining difficulty that corresponds with a low ratio of current price/bottom price.In each case, the ratio increases in line with mining difficulty until it peaks at around 120,000 – 140,000 blocks. With this comes a dip in the ratio as mining difficulty gets increasingly hard.Current mining difficulty is at 80,000 blocks and based on the previous three cycles, there is room to grow up until the cup ceiling. Bitcoin performance since difficulty bottom. (Source: twitter.com)The chart shows four distinct cycles, each beginning with low mining difficulty that corresponds with a low ratio of current price/bottom price.In each case, the ratio increases in line with mining difficulty until it peaks at around 120,000 – 140,000 blocks. With this comes a dip in the ratio as mining difficulty gets increasingly hard.Current mining difficulty is at 80,000 blocks and based on the previous three cycles, there is room to grow up until the cup ceiling. Cup formation on Bitcoin performance since difficulty bottom. (Source: twitter.com)With that in mind, a ratio of 10, or 10 times the bottom ($3.7k), puts Bitcoin at around $37k come halving time. What's more, a climb towards the ceiling will see a ratio of around 100, or 100 times the bottom, putting Bitcoin at $370k by spring 2021.Caution Needs To Be ExercisedAs expected, crypto Twitter is buzzing with talk of these ambitious price predictions. With one reply pointing out that this cycle sees the convergence of multiple bullish factors not present in previous cycles. In short, expectations go beyond the already sky-high forecasts."The Bitcoin halving is bigger than you know. The daily global #Bitcoin demand will be higher than the daily release of #BTC; this was not the case in 2012 or 2016. When the daily supply can't fulfill the daily demand, we know what happens. We're in new territory #Crypto kids." Cup formation on Bitcoin performance since difficulty bottom. (Source: twitter.com)With that in mind, a ratio of 10, or 10 times the bottom ($3.7k), puts Bitcoin at around $37k come halving time. What's more, a climb towards the ceiling will see a ratio of around 100, or 100 times the bottom, putting Bitcoin at $370k by spring 2021.Caution Needs To Be ExercisedAs expected, crypto Twitter is buzzing with talk of these ambitious price predictions. With one reply pointing out that this cycle sees the convergence of multiple bullish factors not present in previous cycles. In short, expectations go beyond the already sky-high forecasts."The Bitcoin halving is bigger than you know. The daily global #Bitcoin demand will be higher than the daily release of #BTC; this was not the case in 2012 or 2016. When the daily supply can't fulfill the daily demand, we know what happens. We're in new territory #Crypto kids." |

| Bitcoin Price May Explode to $500,000, Says Fundstrat's Tom... - Coinspeaker Posted: 19 Feb 2020 04:36 AM PST Fundstrat's Tom Lee said that the price of Bitcoin could surge to $500,000 in the long term, but he failed to mention the exact timeline for such a pie-in-the-sky target to be achieved. Bitcoin and its value have been a topic of discussion for many in recent years. Tom Lee, the head of research at the Fundstrat Global Advisors, said that the Bitcoin price could surge to half a million dollars in the long term. Nonetheless, he did not mention the exact timeline for such a pie-in-the-sky target. $500,000 Is Not a Pipe DreamDuring a new interview with Nasdaq, Tom Lee says that he still supports his opinion that the Bitcoin price will hit $40,000 before the Dow Jones hits 40,000. When asked if Bitcoin will rise to $500,000, he said that he believes a 4,900% increase is highly likely based on the number of users that will join the network eventually. He added:

Although he is not sure of the timeline that Bitcoin needs to surge to these levels, he believes that the token has a strong use case in the current financial system. He commented:

Since Bitcoin works better than the traditional financial systems and the cost is significantly lower, more people will join the space in the long run. Currently, it is possible to transmit a million dollars of Bitcoin between countries for just $15. That same transaction using remittance counterparties would cost between 5% and 10% of that $50,000 to $100,000. Could There Be Pitfalls for Bitcoin Price?Bitcoin works better compared to the traditional systems since it is cheaper and more secure, as explained by Lee. To put everything into perspective, it takes one to pay $3.90 in fees to transfer almost $1 billion worth of BTC. In spite of being a raging bull, Lee also thinks that Bitcoin may ultimately get destroyed. He outlined various doom-laden scenarios like governments banning crypto off-ramps or a potential 51% attack on the network. Although the network has performed well for over ten years, Lee stated that there is potential for undiscovered security loopholes and harsh government regulations, which may harm the future of the crypto. He explained:

According to the analyst, the crypto market may succeed as a generational thing. For instance, Schwab's latest holding for stocks, a top-five holding, is the Grayscale Bitcoin Trust. Hence, just like the young people adopted the internet, the young are continually adopting cryptocurrencies. Bitcoin, Crypto, News Wanguba Muriuki is a content crafter passionate about putting everything into writing. He is passionate about Blockchain and Traveling. He is also an experienced creative and technical writer. Everything and everyone has a story to tell. What better way to capture the real story than in words. Share this articleThank you!You have successfully joined our subscriber list. |

| You are subscribed to email updates from "bitcoin price" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

- Get link

- X

- Other Apps

Comments

Post a Comment