Bexplus Exchange - Earn BTC with Leveraged Bitcoin Futures Trading - Smartereum

- Get link

- Other Apps

Bexplus Exchange - Earn BTC with Leveraged Bitcoin Futures Trading - Smartereum |

- Bexplus Exchange - Earn BTC with Leveraged Bitcoin Futures Trading - Smartereum

- Infamous Crypto Whale Moves Millions in Bitcoin (BTC) – Plus Ripple and XRP, Ethereum, Litecoin, Stellar, Tron - The Daily Hodl

- FairPlay blockchain casino motivates to buy cryptocurrency: 200% bonuses for Bitcoin and air - The Cryptocurrency Post

- Term Sheet April 25, Uber's IPO, Bitcoin Tether Woes, and Other Letters - Fortune

| Bexplus Exchange - Earn BTC with Leveraged Bitcoin Futures Trading - Smartereum Posted: 26 Apr 2019 09:00 AM PDT  Cryptocurrency derivatives – BTC CFD (Contract-for-Difference) product are gaining popularity because they can help protect traders against volatility in the crypto markeplace. Traders may also benefit from being able to long (buy/up) or short (sell/down) at a preagreed price, and profit from the unpredictable market. Is BTC Futures Trading Profitable? In BTC spot trades, the only way that you can make money is to wait for BTC's price rising. However, it has been almost 2 years, BTC has not yet skyrocketed to $20,000 again. With Try BTC Futures Trading with $1 Billion+ Liquidity in Bexplus Bexplus is a popular cryptocurrency futures exchange that allows traders to invest in BTC, ETH and LTC futures trading with up to 100x leverage. In 2017, Bexplus founded its headquarter in Hong Kong and established offices in U.S, Australia, Russia, Brazil and India in 2018. Bexplus app for Android and iOS are available to users from 36 countries worldwide and support 21 languages. Bexplus's other advantages: Easy registration with email address. No KYC is required, keep your personal information private. How to Trade BTC Futures Contracts with 100x Leverage Sign in after registration and deposit BTC in your account. Click into Exchange and choose the trading pair BTC/USDT, ETH/USDT or LTC/USDT on the top of the interface. The minimum trading volume is 0.1 BTC, 1 ETH and 10 BTC added 100x leverage. Set trading volume and click Buy/Up or Sell/Down to long or short BTC, ETH or LTC. You can set stop-profit and stop-loss points to lower the risks in the Hold order column. Note: Switch to the trading simulator, you will get 10 free BTC to try futures trading. Join Bexplus Latest Activities to Earn Free BTC Get 100% Free BTC Bonus Up to 50% Invitation Referral Reward Invite friends to register and trade in Bexplus, you can earn 10%-50% of your invitees' each deposit instantly. It will be counted with BTC and directly credited in your account. More: https://www.bexplus.com/en/account/activity_show With features like 100x leverage and the function to long-buy or short-sell BTC before the bull market in Bexplus, it's no surprise that you may profit from the market fluctuation. BTC futures trading is also used to hedge risks in the spot trades. Follow Bexplus on: |

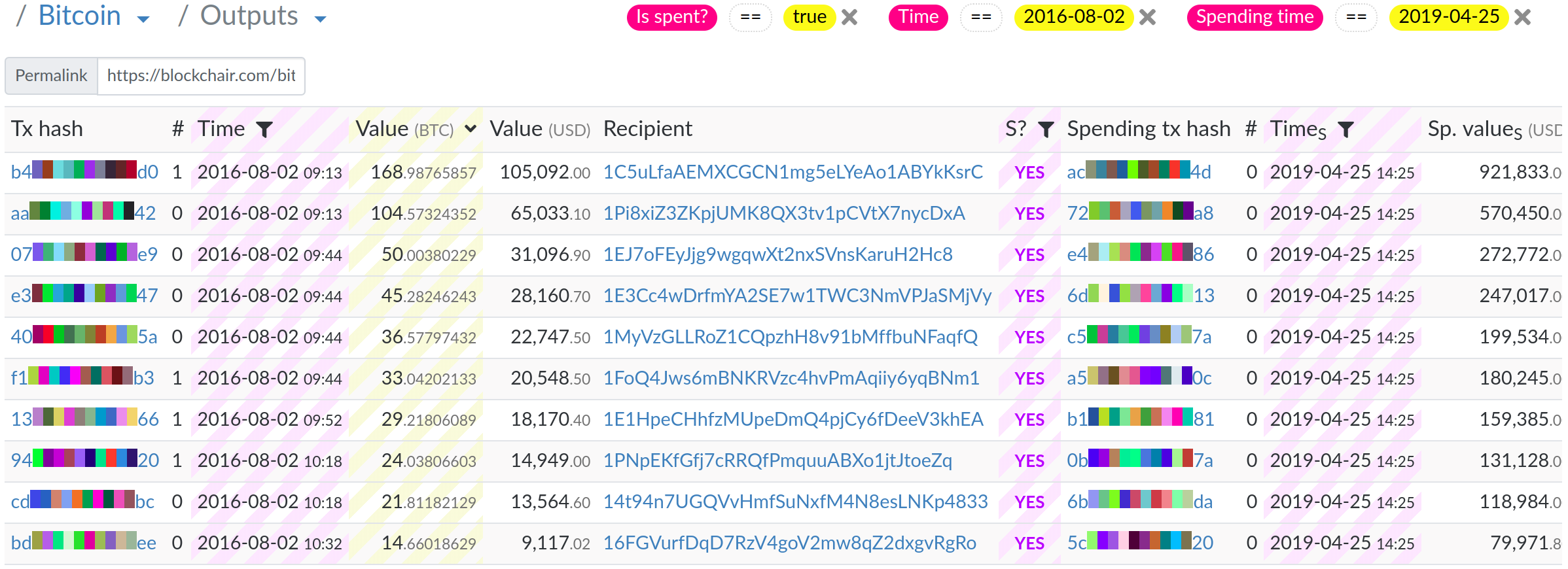

| Posted: 26 Apr 2019 12:06 AM PDT  From a notorious crypto hacker on the move to new partnerships at Stellar and Tron, here's a look at some of the stories breaking in the world of crypto. Bitcoin A hacker who became an infamous crypto whale after stealing more than 100,000 Bitcoin from the crypto exchange Bitfinex in 2016 has apparently started transferring 550 of the BTC that was never recovered. Reddit user Jankeldidi spotted the stolen crypto worth nearly $3 million in motion. The BTC has been transferred to 15 separate, new addresses, as shown by the data aggregator Blockchair.  With so many eyes on the stolen crypto, it would be hard to sell on an exchange without it getting flagged and locked. However, the hacker could use a number of methods to try to turn the crypto into cash, including an attempt to mask the origin of the BTC through a mixing service. Ethereum Ethereum scaling solution developer Prysmatic Labs just released a new update on Ethereum 2.0. Prysmatic says development on its Ethereum 2.0 Phase 0 testnet is moving forward at a rapid pace. "The past two weeks have had our best development velocity ever, merging in dozens of critical bug fixes and efficiency improvements. We improved the efficiency of our state transition function by 400x from the naive implementation, leading to massive improvements in our runtime and our cloud testnet." Ripple and XRP Ripple says the CEO of Japanese financial giant SBI Holdings, Yoshitaka Kitao, will be joining Ripple's Board of Directors. SBI first invested in Ripple back in 2016, and Kitao has been a steadfast Ripple and XRP enthusiast ever since. "Mr. Kitao is also a pivotal player in the joint venture between SBI Holdings and Ripple, SBI Ripple Asia. The joint venture established a next-generation payments platform on RippleNet, Ripple's robust network of 200+ financial institutions worldwide, along with Japanese banks. In particular, the company provides the revolutionary MoneyTap mobile app that allows banks' customers to settle transactions instantly, 24 hours a day, seven days a week."

Litecoin Bonus content from Litecoin creator Charlie Lee's recent interview on the Unchained podcast is now online. Some of the questions initially left on the cutting room floor cover Litecoin's market cap, the amount of daily transactions on the network, and how much technical knowledge tomorrow's crypto users will really need to have. "Cryptocurrency is both a store of value and a means of exchange. I think people will know which assets they store their money in. But when they use it, they will not need to know what happens to that asset to get it to the recipient. Could be Lightning. Could be atomic swapped for other assets like Litecoin. Or it it could be something totally new." You can check out the extended interview here. Stellar The crypto payment startup Wirex is launching 26 stablecoins on the Stellar network. The crypto assets will be pegged to a variety of fiat currencies, including the euro, US dollar, British pound, Hong Kong dollar, Singapore dollar and more. "Currently, most stablecoins on the market are USD-backed tokens. Providing stablecoins in an array of local currencies allows for swift, international remittance without the need for local liquidity providers – and converting back into local currency is quick and cheap."

Tron The crypto startup Swarm, which offers an open, full-stack solution for the life-

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing. |

| Posted: 26 Apr 2019 12:23 PM PDT The blockchain-casino team FairPlay , which operates on Ethereum smart contracts, completed the beta testing of the site and enters the market with bonus offers to expand the active audience. We recently wrote about how blockchain is being introduced into the gambling industry and why the future of the market is behind the distributed registry technology using the example of the FairPlay blockchain casino already in operation. Now the team is entering the world market, and on the site, new users can receive either free tokens for games or free spins (the ability to "spin the drum" without making a monetary rate). For already active users there is a proposal for making deposits: from 75% to 200% for the first four deposits. In addition, FairPlay periodically distributes promotional codes, for which these same bonuses can be doubled with a minimum deposit (from 1 TPLAY). FairPlay representatives report that the recent Bitcoin growth had no effect on the overall game statistics, since gambling does not depend on changes in the cryptocurrency rate, but on the popularity of digital money in general. It is worth recalling that the difference between FairPlay and similar projects is that they publish all the game data in a smart contract, which can be checked in the blockchain explorer. Based on the amount of bets and the amount of winnings, you can calculate the overall rating of the game, which for the players is indisputable proof of fair play. For accountability of gaming transactions, FairPlay uses its partner's blockchain platform, TruePlay. Thanks to this integration, users have the opportunity to check the rating of the game in the blockchain, and all transactions within the games are carried out in TPLAY game tokens, which eliminates the possibility of fraud. Now bitcoin and ethereum are available at FairPlay, but soon it is planned to expand the list of currencies, including Fiat. Recall that last year FairPlay hit the short list of the best startups in the field of online gambling at the annual SiGMA Pitch 2018 event. |

| Term Sheet April 25, Uber's IPO, Bitcoin Tether Woes, and Other Letters - Fortune Posted: 26 Apr 2019 07:14 AM PDT  Happy Friday! Lucinda here filling in for the final (consecutive) time until Polina's return Monday. So please do begin sending deals back her way at Polina.marinova@fortune.com, and rejoice that you'll be safe from my clutches in a mere three days. UBER Uber CEO Dara Khosrowshahi's valuation bonus is off to a nonstarter. The commander-in-chief is eligible for 1.75 million in options at a price of $33.65 apiece should Uber reach an average fully-diluted valuation of $120 billion or more for 90 contiguous days. But at the high end of Uber's IPO pricing range, the valuation falls short of that. Uber says it plans to raise roughly $8.5 million in an IPO of 180 million shares priced between $44 to $50 apiece—valuing the firm at about $91 billion at the high end of the range. Of course, IPOs often price above range and then proceed to pop on the first day. So for now, the jury is still out. Other fun facts: The high-end of Uber's range doesn't leave later investors much breathing room. It last sold shares for roughly $48.77 apiece during its 2018 Series G round. In that layer of financing, Softbank spent $1 billion to add to its stake while TPG spent $47 million. Saudi Arabia's pension fund and DiDi also bought stakes worth $3.5 billion and $1 billion at that price—though their deal was (slightly) sweeter with options. Several stockholders are selling a segment of their own shares in the IPO: Softbank is selling 2% of its stake worth as much as $272.5 million. Benchmark is offering 4% of its pool worth as much as $287.4 million. Founder Travis Kalanick himself is offering 3% ($186.8 million) of his current stake. Others making some cash in the IPO include Lowercase Ventures, First Round Capital, and TPG. PayPal meanwhile has agreed to purchase $500 million of Uber's stock. PayPal and Uber also plan "to explore future commercial payment collaborations, including the development of our digital wallet." BITFINEX MASKS $850 MILLION IN LOST FUNDS At least, that's what the New York attorney general is alleging. Thursday night, the AG dropped a 23 page legal filing saying that Bitfinex, one of the world's largest crypto exchanges, had claimed to have taken $700 million in loans from Tether—a company Bitfinex owns—to help cover up $850 million in lost funds. The filing allege that those funds had gone to (what is believed to be) a Panamanian payment processor known as Crypto Capital. Those funds included both customer and corporate dollars. Bitfinex later repeatedly asked for those funds back, according to the filings, but Crypto Capital said the the money had been seized by government authorities in Portugal, Poland, and the United States. Based on a back-and-forth in the filing, a senior Bitfinex did not believe the seizures. Though in a public letter following on the filing, Bitfinex argued the filing misconstrued reality."On the contrary, we have been informed that these Crypto Capital amounts are not lost but have been, in fact, seized and safeguarded," it wrote in a blog post. For the uninitiated: Flies have been buzzing around Bitfinex for a while now, with several critics questioning whether or not Tether is truly backed by the U.S. dollar. Tether for its part hasn't posted audits to prove that it indeed has the reserves it claims to have. Either way, it's a blow to the crypto trading world. Tether is said to account for 80% of Bitcoin trading, per CryptoCompare. Read the story here. Letters: The Kleiner Perkins Empire Is Alive and Well In response to Polina's investigation into "How the Kleiner Perkins Empire Fell" from earlier this week, KP partners including John Doerr issued a defense on Fortune. According to the statement, the firm is "firing on all cylinders having just raised KP 18—a $600 million early stage fund that was 200% oversubscribed—and is investing in some of the most sought-after early stage companies." They add: "Also muddled in the article is the rationale for the separation of venture and growth and Mary Meeker's efforts to raise an independent fund. What we said last September remains true today: The two funds had grown apart with limited synergy between venture and growth and it was mutually agreed that it was in both parties best interests to pursue separate paths. There is nothing more complicated to the story than that." Read the letter here, and read the full feature here. TPG, BILL MCGLASHAN TPG Capital said Bill McGlashan, a former worker accused in the ongoing college bribery scandal, will forfeit 100% of his vested and unvested interest. "The thorough investigation conducted by Ropes & Gray LLP, with support from Ernst &Young LLP, found no evidence that any other TPG personnel were implicated in or aware of the conduct alleged in the charges against Mr. McGlashan," a TPG spokesperson said in a statement. In a separate TPG letter to employees and LPs obtained by Fortune, the investigation also found that McGlashan had introduced the man at the center at the scandal, Rick Singer, to co-workers at TPG—pointing to Singer's business ideas as potential investments. The team eventually decided early on there wasn't an opportunity there. LINKS • Ford Invests in Rivian (by Tamara Warren) • Central Banks Are the World's Newest Climate Change Activists (by Katherine Dunn) • Microsoft Joins the $1 Trillion Club (by Chris Morris) • Verizon Reveals 20 More Cities Getting 5G Mobile this Year. Here's What You Need to Know (by Aaron Pressman) Walmart unveils AI enabled store lab. Cantor Fitzgerald's mug of crap. Uhm who knew Ray Dalio had a career advice app? Kyle Bass aims at the Hong Kong dollar. Dying deals add to Europe's collapsing M&A landscape. OECD says 14% of jobs are at high risk of automation. Warren Buffett: 'I'm having more fun than any 88-year-old in the world' (Paywall). DOJ seeks guilty plea on Goldman's 1MDB settlement. Huawei and the U.K. Google allows for arbitration option in sexual harassment allegations. PepsiCo is suing farmers in India for growing the potatoes used in Lays chips. Larry Fink returns so Saudi Arabia post Khashoggi. |

| You are subscribed to email updates from "bonus bitcoin" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

- Get link

- Other Apps

Comments

Post a Comment