Coinbase Will Now Reward Users for Holding This Cryptocurrency - CoinDesk

- Get link

- X

- Other Apps

Coinbase Will Now Reward Users for Holding This Cryptocurrency - CoinDesk |

- Coinbase Will Now Reward Users for Holding This Cryptocurrency - CoinDesk

- Riot Games’ Millionaire Founder Defrauded In $5 Million Amazon Cloud Cryptocurrency Mining Scam, DOJ Says - Forbes

- Senator Romney Considers ‘Action As A Nation’ On Cryptocurrency Threat To Homeland Security - Forbes

- This New Bitcoin And Cryptocurrency Exchange Can’t Be Hacked - Forbes

- How to launch a cryptocurrency career - TechRepublic

| Coinbase Will Now Reward Users for Holding This Cryptocurrency - CoinDesk Posted: 07 Nov 2019 03:50 AM PST  Coinbase is for the first time allowing general users to earn rewards by simply holding cryptocurrency, starting with the Tezos (XTZ) token. In a company blog Wednesday, Coinbase said U.S. customers (barring residents of Hawaii and New York) can now stake the smart-contract platform's crypto with an estimated 5 percent annual return. Tezos uses an alternative consensus mechanism to proof-of-work mining – the system built into the largest cryptocurrency by market cap, bitcoin. Called proof-of-stake, the alternative mechanism rewards network users for holding onto its coins and thereby helping protect the network. Coinbase's 5 percent estimate is based on Tezos' last 90 days of staking returns. The firm also notes that there's an initial holding period of 35–40 days, after which stakers will start to see rewards appear in their accounts every three days. The exchange has also added Tezos to Coinbase Earn, a program aimed at educating the public about crypto, and will give out XTZ to participants completing educational videos. Coinbase soft-launched staking for both Tezos and decentralized finance token Maker (MKR) this March on Coinbase Custody. As Coinbase wrote at the time, Coinbase Custody primarily serves institutional clients holding large amounts of crypto. This latest initiative brings staking to even the smallest of Tezos holdings, however. Coinbase also recently rolled out 1.25 percent interest on users' holdings of the dollar-pegged stablecoin USDC. Coinbase CEO Brian Armstrong image via CoinDesk archives |

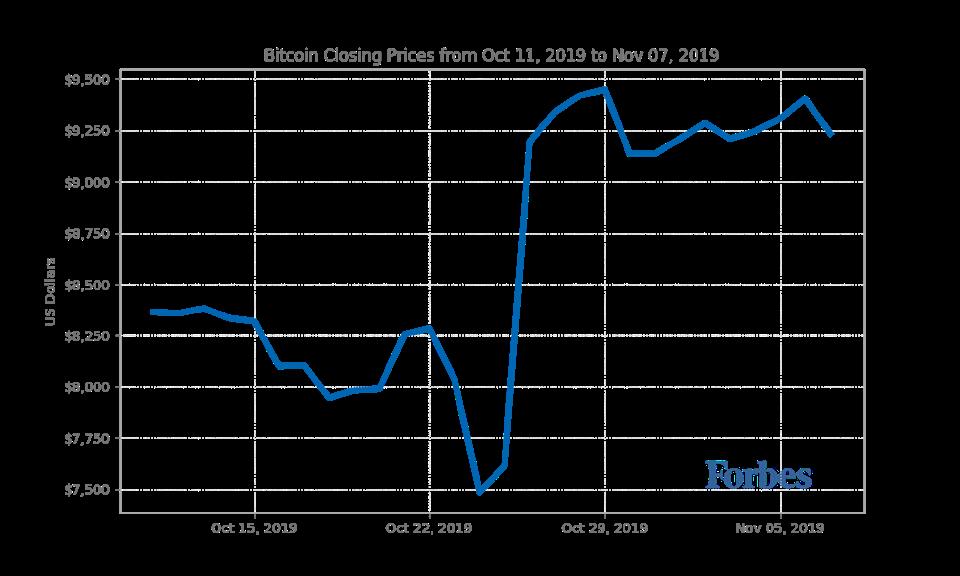

| Posted: 07 Nov 2019 08:55 AM PST  Cofounder and co-CEO of Riot Games Marc Merrill was the target of a $5 million fraud, DOJ ... [+] investigators claim. Vivien Killilea/Getty Images for BAFTA Los AngelesMarc Merrill, the cofounder of Riot Games, was the victim of a massive fraud that started in November 2014, when his American Express credit card information was used to buy up cloud computing power from Amazon, Google and others, according to a just-unsealed court filing discovered by Forbes. The man accused of stealing Merrill's identity, Singaporian national Matthew Ho, was said by investigators to have used Amazon and Google servers to mine various cryptocurrencies, including Bitcoin and Ether. Before it was eventually noticed in January 2018, Ho had racked up bills totalling $5 million with Jeff Bezos' tech giant, according to the government's allegations. At least one payment of that bill, for $135,000, was made on Merrill's Amex card in December 2017. (Court documents didn't clarify whether the full $5 million bill had been paid, though the DOJ did say "some" were). The same card had been used to pay for Riot Games' actual Amazon Web Services cloud computing products. Thought the charges against Ho were revealed by the Department of Justice in October, the victim (Merrill) had not previously been revealed. Neither Merrill nor Riot Games had responded to requests for comment at the time of publication. It's unclear how his personal information and credit card data were pilfered.  Bitcoin closing prices, October 11, 2019 to November 7, 2019 Forbes Media / CoinMarketCap.comHo tricked Amazon into believing he was Merrill, the co-creator of the massively popular, $20 billion-making League of Legends title, in various ways, as per a search warrant for the accused's Facebook account. He'd created a fake Californian driving license that carried Merrill's name and used an email address that appeared to be a legitimate Gmail for the Riot Games co-chairman, according to the court filing. For further "proof" of identity, he presented Amazon with one of Merrill's real home addresses, the feds said. Because Merrill was an established Amazon customer, Ho was given "access to substantially elevated levels of cloud computer services," investigators wrote, though they didn't disclose exactly what those priveleges were. Ho used the same Gmail address to contact Google and sign up to its cloud services, which he would again use for mining cryptocurrency, according to the search warrant. A total of 16 separate payments were made by the fraudster to Google on Merrill's Amex card, which he shared with his wife, authorities said, charging a total of $240,000. But "nearly all" of that was returned to the account or declined by the issuing bank. Neither Amazon nor Google had responded to a request for comment at the time of publication. Once he'd mined cryptocurrency, Ho sold it on localbitcoins.net. But eventually, thanks to data like IP addresses and login information provided by Amazon, Google, Facebook and others, police were able to pin down Ho as the chief suspect. He was arrested by Singapore Police Force on September 26 and is being investigated for various alleged offenses committed under Singapore law. A 14-count indictment was unsealed in the U.S. last month, which detailed other victims, including an unnamed Texas resident and an Indian tech company founder. But the defendant does not yet have counsel in the U.S. It's possible he could be forced to face charges in the U.S., as America has an extradition treaty with Singapore. He remains innocent until proven guilty. |

| Senator Romney Considers ‘Action As A Nation’ On Cryptocurrency Threat To Homeland Security - Forbes Posted: 05 Nov 2019 06:37 PM PST As Senator Romney has recently been in the news on his criticism of the President as impeachment proceedings, it seems the former Presidential Candidate and Republican Senator from Utah might want to 'impeach' cryptocurrency from the United States based on the threat level it may pose to national security. During a hearing in the U.S. Senate Committee On Homeland Security And Governmental Affairs, Senators asked leaders from the FBI, Homeland Security, and the National Counterterrorism Center questions on "Threats To The Homeland", Senator Mitt Romney (R-UT) raised the prospect of whether the U.S. needed to take action on cryptocurrencies or not worry about them. The FBI took no time in responding how cryptocurrencies are a 'significant problem that will get bigger and bigger'.  WASHINGTON, DC - September 23: Senator Mitt Romney (R-UT) speaks to journalists before votes on the ... [+] Senate floor on Capitol Hill in Washington, DC on Monday September 23, 2019. (Photo by Melina Mara/The Washington Post via Getty Images) The Washington Post via Getty Images

While the Senator invited all three of the witnesses to respond to his question, FBI Director Wray jumped in to note how big of a problem cryptocurrency already is. The FBI Director stated, 'Well certainly for us cryptocurrency is already a significant issue and we can project out pretty easily that it's going to become a bigger and bigger one. Whether or not that is the subject of some kind of regulation as the response is harder for me to speak too.' FBI Director Wray, while being careful not to provide any policy or regulatory recommendation, noted the issues of cryptocurrencies and how they are used by terrorists is part of a larger issue involved with our enemies' increased capabilities in using tech and the ability to process anonymous transactions.

WASHINGTON, DC, UNITED STATES - 2018/06/28: Christopher A. Wray, Director of the Federal Bureau of ... [+] Investigation, at the House Judiciary Committee in the Rayburn Building at the US Capitol. (Photo by Michael Brochstein/SOPA Images/LightRocket via Getty Images) LightRocket via Getty ImagesThe FBI Director did note that 'We're looking at [cryptocurrencies] from an investigative perspective including tools that we have to try to follow the money'. He also noted that it is not just cryptocurrency but various types of technologies that, if the U.S. doesn't get its act together, could result in the FBI being walled off by technology from doing their jobs in the future. |

| This New Bitcoin And Cryptocurrency Exchange Can’t Be Hacked - Forbes Posted: 14 Oct 2019 12:00 AM PDT  Getty Bitcoin exchange hacks have plagued the cryptocurrency ecosystem since the first platforms for trading were launched in the early 2010s, and these events have caused major public relations issues for the entire crypto asset market. While exchange hacks don't have anything to do with potential technical problems related to the underlying Bitcoin network, it's never a good look when millions or even billions of dollars worth of Bitcoin is stolen from thousands of exchange customers in a matter of minutes. Although the Bitcoin exchange industry has improved its ability to deal with crypto asset security over the years, the threat of another large hack is always looming over the ecosystem. But that could soon change. One of the main features of Bitcoin is that it's programmable money, and developers have figured out new ways to build exchanges in ways that do not require users to turn over control of their funds until the exact moment they want to make a trade. One of the new exchanges that is taking advantage of this technology is Nash. How Does Nash Secure Customer Funds? In the past, exchange customers have always deposited their coins onto trading platforms with the exchange taking custody of the funds. That exchange platform then becomes a central point of focus for hackers because there's a big payday in it for them if they're able to get into the exchange's internal wallet. With platforms like Nash, users do not need to hand over custody of their crypto assets to a third party before they trade. Many Bitcoin enthusiasts are excited about the Lightning Network's potential to cut transaction costs, speed up transactions, and potentially improve user privacy. And this same sort of technology can be used to vastly improve the level of security offered by exchanges. Nash uses a system of state channel smart contracts to handle trades, and the system is currently live on the Ethereum and Neo blockchains. Notably, the Ethereum blockchain briefly surpassed Bitcoin in a key measurement of overall adoption last month. However, Ethereum's ETH token is also down heavily against Bitcoin over the past couple of years. According to Nash co-founder Fabio Canesin, Bitcoin support is expected to be added to their platform soon. "We initially demonstrated that our proposed architecture could deliver cross-chain markets that compete with the performance of centralized exchanges – an extremely important parameter for liquidity," said Canesin when reached for comment. "For this reason, we focused on the NEO-ETH market. Now that this is live and functioning well, we can move onto other networks. Bitcoin is the obvious next candidate owing to its importance in our industry." State channels effectively allow multiple parties to transact with each other in Bitcoin or other cryptocurrencies without having to touch the blockchain. This works via a technical trick that involves two parties placing funds into a 2-of-2 multisig address and then creating valid transactions from that multisig address to each of their personal addresses as a way to update how much of the funds in the multisig address belong to each party. None of these generated transactions are actually broadcast to the blockchain. The only transactions that hit the blockchain are the ones at the end when each party is ready to leave the payment channel with the appropriate amount of funds (if this was too confusing try reading this longer explanation of the Lightning Network). While decentralized exchanges have existed in the past, a key advantage of using state channels is they allow transfers to happen instantly, meaning users don't have to wait seconds or minutes for blockchain confirmations to execute their trades. It should also be noted that, while customer funds cannot be stolen by hacking an exchange's internal wallet, hackers could still cause plenty of damage if they were able to push out a malicious software update to Nash customers. That said, this is still a huge security gain. "Updates require a signed payload using offline keys," said Canesin when asked about this potential issue. "However, if a hacker did somehow manage to push a malicious update, users would also have to log in and sign a transaction before encountering an issue. The data in our software is not enough, since user-provided entropy is also required. We try to mitigate these risks by building several layers of protection." The high level of security offered by Nash also relies on the integrity of the smart contracts backing the exchange, and vulnerabilities in advanced smart contracts have continued to pop up in 2019. Other projects that are working on this type of non-custodial trading technology include SparkSwap, which is built on the Lightning Network, and Arwen, which has built its own plugin model for existing exchanges. In addition to their trading platform, Nash is also working on a mobile wallet, browser extension, and payment processing service for merchants that will all be integrated with each other. While even the developers behind Bitcoin admit the cryptocurrency is an experiment that could still fail, exchanges like Nash are another step in the right direction when it comes to improving both usability and security of this technology at the same time. This is also the sort of technology that makes it clear that it would be difficult for governments to implement a Bitcoin ban, as two members of the U.S. Congress recently admitted. Note: This article was updated to point out the potential issues associated with complex smart contracts that are used as the basis for Nash's exchange and other similar platforms, as pointed out by Kraken CEO Jesse Powell on Twitter. |

| How to launch a cryptocurrency career - TechRepublic Posted: 07 Nov 2019 06:00 AM PST A Seen by Indeed report reveals the top roles related to cryptocurrency, most in-demand skills, and companies looking for talent in the field. More about InnovationCryptocurrency is booming, according to data released Thursday from Seen by Indeed. The data reveals the most in-demand roles related to cryptocurrency, the skills most often listed in cryptocurrency job postings, and companies hiring the most cryptocurrency-related positions. Cryptocurrency is a type of digital currency that uses cryptography to validate itself and protect financial transactions. The most well-known cryptocurrency on the market is Bitcoin, the original decentralized cryptocurrency, according to TechRepublic's Bitcoin: A cheat sheet for professionals. SEE: Cryptocurrency: An insider's guide (free PDF) (TechRepublic) The cryptocurrency market has exploded in recent years and will continue growing, a Transparency Market Research report found. This growth is reflected in the heightened demand of cryptocurrency professionals, Indeed found, as experts are needed to navigate the evolving cryptocurrency landscape. After analyzing the percentage change in the share of job postings and share of job searches per million for roles related to bitcoin, cryptocurrency and blockchain, Indeed revealed that between September 2015 and September 2019, the share of jobs per millions of roles grew by 1,457%. In the past year, from September 2018 to September 2019, the share of cryptocurrency job postings per million increased by 26%. This growth isn't surprising. The appeal of cryptocurrencies for businesses is that it "doesn't need to be issued by banks, and exchange rates don't need to be controlled by a central bank. A company can create its own contracts. As long as counterparties will agree to uphold the contract, a whole system of transactions can be set in motion without having to be ruled by the processes of normal monetary and banking authorities," reported ZDNet's Tiernan Ray in Cryptocurrency 101: What every business needs to know. Indeed determined the top five most in-demand roles related to cryptocurrency in 2019. Most in-demand cryptocurrency jobs1. Software engineer General software engineers are responsible for developing, launching, building, and maintaining software products and systems. These systems include business applications, operating systems, networking systems, connected hardware, and mobile and web applications, according to TechRepublic's How to become a software engineer: A cheat sheet. One of the most popular software engineer jobs is a blockchain engineer, which has grown by 517% year over year. As more businesses adopt blockchain and handle cryptocurrencies, these roles will continue to be in demand, a Hired report found. 2. Senior software engineer A senior software engineer holds all the skills of a regular software engineer, but the main difference is that a senior software engineer typically leads other team members and spearheads major projects, according to a PayScale post. Companies wanting to dive into cryptocurrency will most likely turn to senior software engineers to lead their blockchain engineering initiatives. 3. Software architect A software architect is a high-level software developer who helps select the best architecture for various business systems. Additionally, the architect helps successfully execute solutions alongside software engineers, according to Indeed's Software Architect Career Guide, catering to blockchain initiatives if the organization is moving in that direction. 4. Full stack developer A full stack developer is responsible for building the backend and frontend components of business interaction projects, requiring coordination with engineering and design teams. A common task for full stack developers includes website development for an organization, but for organizations using cryptocurrency, full stack developers are often asked to help with cryptocurrency and blockchain integration, according to TechRepublic Premium's Hiring Kit: Full Stack Developer. 5. Front-end developer A front-end developer is a specialized web developer who focuses on the user experience part of the web experience, holding strong design capabilities that forge visually appealing elements on a site, according to TechRepublic Premium's Job description: Front-end developer. For companies focused on blockchain and cryptocurrency, front-end developers could help gear a website toward that focus. Competitive skillsTo become a more competitive applicant in the cryptocurrency field, Indeed recommended candidates familiarize themselves with basic cryptography, P2P networks, and programming languages including C++, Java, Python, or JavaScript. C++, Java, Python, and JavaScript are all considered to be the most popular programming languages in the enterprise, a RedMonk report found. However, engineers rank Python higher than the rest, mainly because of its user-friendliness in the rapidly growing machine learning field, according to an IEEE Spectrum report. Developers working on cloud-native applications typically opt for Java and JavaScript, as they best support cloud-native functionality, a Cloud Foundry Foundation report found. C++ rose in popularity this past year because of compiler support for its latest version, which makes the language safer and more expressive, according to a TIOBE report. For resources that can help brush up your programming language knowledge, check out TechRepublic's How to get a developer job: The best programming languages to learn in 2019. Companies hiring cryptocurrency prosAfter studying the highest share of job postings related to bitcoin, cryptocurrency, and blockchain between October 2018 and September 2019, Indeed identified the top 15 companies hiring the most roles in cryptocurrency.

The companies listed spanned across industries to include IT consulting firms, crypto companies, banks, and non-financial companies, indicating the widespread usability of cryptocurrency in the enterprise, Indeed found. For more, check out Cryptocurrency market to explode due to fast transaction speeds, enterprise investment on TechRepublic.  Tech News You Can Use NewsletterWe deliver the top business tech news stories about the companies, the people, and the products revolutionizing the planet. Delivered Daily Sign up today Sign up todayAlso see NicoElNino, Getty Images/iStockphoto |

| You are subscribed to email updates from "cryptocurrency" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

- Get link

- X

- Other Apps

Comments

Post a Comment