This Startup's Upgrade Code Can Be Used by Any Bitcoin-Based Blockchain - CoinDesk

- Get link

- X

- Other Apps

This Startup's Upgrade Code Can Be Used by Any Bitcoin-Based Blockchain - CoinDesk |

- This Startup's Upgrade Code Can Be Used by Any Bitcoin-Based Blockchain - CoinDesk

- IBM, Intel, J.P. Morgan and Microsoft join others on new blockchain token spec - Computerworld

- MY TAKE: How blockchain technology came to seed the next great techno-industrial revolution - Security Boulevard

| This Startup's Upgrade Code Can Be Used by Any Bitcoin-Based Blockchain - CoinDesk Posted: 04 Nov 2019 05:00 AM PST  A small blockchain company out of Arizona has built open-source software that it says any bitcoin-based blockchain could use to improve its functionality. Nexus announced Monday what it called its seventh "activation" – a protocol upgrade that brings smart-contract functionality to the Nexus blockchain, which launched as a fork of the original bitcoin protocol in 2014. Deployed today, the activation goes into full effect Nov. 11. If all goes well, other blockchains can feel free to follow suit by borrowing the code. "Part of the intention was to use the original bitcoin code from the 2014 era to upgrade that into our framework," Nexus founder Colin Cantrell told CoinDesk. "Any blockchain that uses the legacy UTXO can actually upgrade smart contracts over their live blockchain without having to do a chain reset or anything like that." UTXO stands for "unspent transaction output" but it's also become a shorthand for blockchains based on bitcoin. The basic idea is that such a blockchain verifies there is money to be spent before it spends it, which is part of preventing the double-spend problem. "All the bitcoin forks could essentially upgrade and potentially utilize it," Cantrell said of his company's latest release. Even if they didn't want to add smart-contract functionality, Cantrell argued that the Nexus codebase offers other improvements for UTXO chains – like much faster syncing for nodes and lower disk space usage, for example. What is Nexus?Nexus launched in 2014 and it has self-funded so far by directing a portion of the newly minted coins to the team building the network. With a market cap at $19.4 million as of this writing and a token price that has steadily sat at about $0.30 since last November, the project has had to generate enough value for its emitted tokens to support the team's work. (The price briefly rose as high as $13.00 in early 2018.) Nexus had no pre-mine, no venture capital and no initial coin offering. Cantrell said it started as a basic bitcoin fork, but Nexus has had several activations since it went live. Now it uses two different proof-of-work chains and a proof-of-stake system. And with the new Tritium upgrade, it also has smart-contract functionality with competitive transaction times. "One of the biggest things we've seen is that scalability is not a feature. It's kind of a requirement," Cantrell said. The startup claims it can manage anywhere from 2,000 to 25,000 transactions per second. (One of the highest-throughput blockchains, XRP, consistently hits 1,500 transactions per second.) Nexus uses a variety of strategies to achieve higher throughput, including sharding and proof-of-stake, but it also uses something familiar in basic computing but less discussed in the blockchain industry. "Our smart contracts run on a register-based virtual machine, and that's one way we've achieved extra efficiency," Cantrell said. That is, register-based as opposed to stack-based. Most existing blockchains are stack-based, which is an older style of computing. "The architecture is a lot more difficult to implement, but the efficiency is much higher if you implement it correctly," Cantrell said. Developers will find it much easier to work with since much of its functionality is accessible through an API, he said. And regular people can manage access through a more traditional login that gives them control over a public-private key pair held for them online. "We believe blockchain is still a bit complicated for people to use," Cantrell said. However, rather than simply storing them in the cloud, the company encrypts the keys in what he calls "mathematical hyperspace." "There's no central authority users are logging into," he said. Who will use it?Nexus has primarily focused on technology and hasn't done a lot of business development yet. However, at a tech event in Arizona, Apple co-founder Steve Wozniak announced a partnership with Nexus on a new education initiative that will be built on the Nexus blockchain. Cantrell said Nexus is ready to make a stronger case to potential business partners now because it understands what business customers need. A blockchain is not a good platform for full-on computing, he said, but it is a good way to verify things – such as identity, authenticity, ownership and logical soundness. These are the sorts of use cases that Nexus has been built around. "The internet can have a secure and immutable data layer," Cantrell said. Nexus founder Colin Cantrell (left) with advisor Dino Farinacci, image via Nexus |

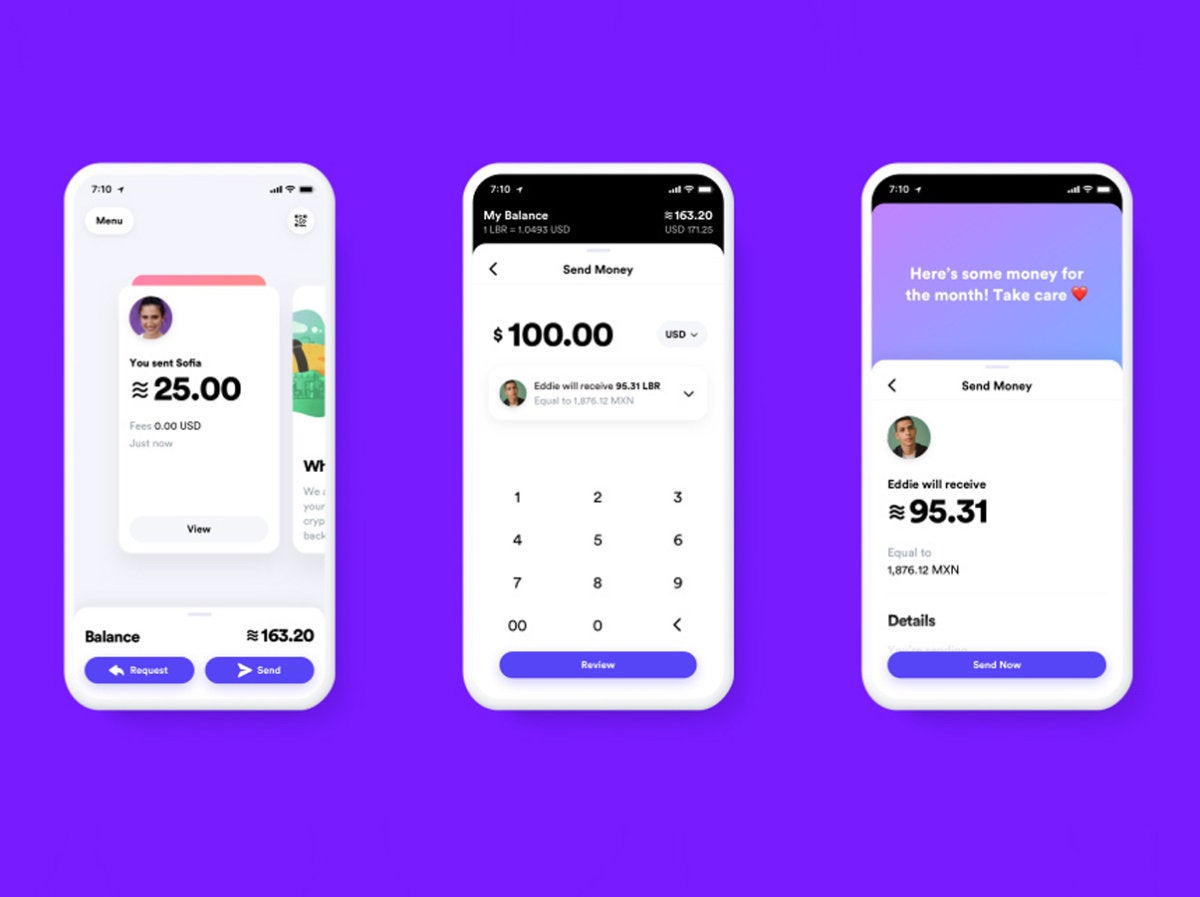

| IBM, Intel, J.P. Morgan and Microsoft join others on new blockchain token spec - Computerworld Posted: 04 Nov 2019 06:01 AM PST A new specification to allow businesses to create blockchain-based tokens for international trade and finance has been published – and businesses have already tested digital money based on it for cross border payments and settlement. The Token Taxonomy Framework v1.0 (TTF) was developed by more than two dozen businesses and overseen by the Enterprise Ethereum Alliance (EEA). Its goal: give businesses and developers access to a set of reusable, cross-industry components to create usable tokens. The Token Taxonomy Initiative (TTI) was first announced in April. The participants sought to create a non-technical, standard definition of what a token is, and to establish a common set of terms and definitions for cross-industry business use without employing industry jargon or coding. "In practical terms, a business user or consortium can select a base type of token and choose from contributed lists of behaviors and properties and assign them to the token, just as you might drag and drop icons on a screen," said Marley Gray, Microsoft's principal architect for Azure blockchain engineering and a member of the EEA's board of directors. "The framework enables a business person to create a token visually using a design tool without writing any code whatsoever and allows them to tell developers, 'I want one of these." Advertisement Creators of the specification said the digital currency is different from Facebook's Libra cryptocurrency, whose launch could be hampered by intense regulatory oversight in the U.S. and Europe. Seven of the founding members of the Libra Association, Facebook's non-profit governing council for its planned cryptocurrency, have jumped ship amid increasing regulatory scrutiny.  Facebook Facebook Images of the Facebook's Calibra digital wallet app that would store its Libra cryptocurrency. "Libra, at least as it was started, was not meant to be a regulated asset," said Julio Faura, TTI member and CEO of London-based tech services company Adhara. "When you're trying to use a non-regulated asset for regulated processes like banks and central banking, it's not easy. "The TTF framework can host all kinds of tokens, both regulated and non-regulated, both financial and non-financial," said Faura, who prior to 2018 was head of R&D and blockchain at Santander bank. Creating a single set of definitions and terms will help blockchain platform interoperability – regardless of the distributed ledger platform on which it resides, according to Gray. The framework's template approach and the tools to facilitate token workshops make exploration and innovation as easy as possible, the TTI group stated in a release. By using rich metadata, the framework facilitates automation like code generation, verification, and certification that business users don't need to understand but is extremely valuable to developers. Using the GitHub repository, teams can map business requirements to specific blockchain code or solution implementations allowing for discovery and use increasing "What we needed to do was put it [the TTF spec] through some exercises to make sure it worked right," Gray said. "What we're seeing now are their drafts that are also being used to learn. People can learn about tokens by looking at real-world examples..., concepts that are not grounded in cryptocurrency that are modeled after real-world B2B scenarios." A TTF-based token can represent any number of goods, commodities or fiat-currencies, all of which can be defined by the business creating its specific flavor of token. For example, tokens can represent rewards points at a retail store, real estate, precious gems, artwork or simply government-backed cash – basically whatever value the creator wants to give it. "Anyone can understand it; you don't have to be a programmer, but you can follow the links all the way down to the source code as a developer to see how they did it and reuse that code on the front- and back-end," Gray said. The Token Taxonomy Initiative has about 25 members, including Accenture, Adhara, Banco Santander, Blockchain Research Institute, Clearmatics, ConsenSys, Digital Asset, Envision Blockchain, EY, Hedera Hashgraph, IBM, Intel, ioBuilders, Itau, J.P. Morgan, Komgo, Microsoft, R3, and Web3 Labs. Separate from the TTI group, JP Morgan had already launched its own cash-backed token for international clearance purposes between clients. Several of the TTI members, including IBM, Microsoft, Intel and ConsenSys, have already created more than a dozen of test tokens based on the new spec and piloted them on a blockchain network for usability, after which they published their own draft specifications for their tokens.  Getty Images Getty ImagesFor example, Santander, one of the world's biggest banks, has tokenized a $20 million bond offering as a pilot to be used on an internal Ethereum-based blockchain network. The bond is made up by 20 million SUSD (Sandander U.S. Dollars) ERC-20 tokens, which are backed by $20 million Sandander received as payment from an unnamed investor through an off-chain, traditional channel. In September, John Whelan, head of digital investment banking at Santander, tweeted his bank issued 100 units of SUSD tokens with a value of $200,000 per unit. The SUSD tokens were redeemed for the real cash from the custody account. "SUSD is simply the tokenized cash leg that represents a claim against real cash on deposit in a custody account at our custodian (Santander Securities Services)," Whelan said via email. The bank was also able to use TTF smart contracts with embedded rules requiring only entities who'd passed the know-your-customer (KYC) regulatory process to be onboarded to the permissioned blockchain. Those who were whitelisted to be on the blockchain held tokens (bonds or cash) and were part of an exchange contract that acted as the escrow until the issuer accepted the transaction; that acceptance triggered the atomic DvP (delivery versus payment) ownership rights. (DvP is a securities settlement term that represents a guarantee that that securities will be transferred only after payment is received.) Whelan said he wasn't sure when a production version of Santander's SUSD token would launch, only that it will "take time." Adhara and ioBuilders created an E-Money token standard that is now a TTF token draft spec and an electronic money standard that enables the use of fiat money on blockchain. The token standard includes multiple extentions commonly used in finance, such as holds (EIP-1996), clearance (EIP-2018), detailed compliance (EIP-2009), funding orders (EIP-2019), and payout orders (EIP-2021). For example, one version of Adhara and ioBuilders' token was used for cross border remittances by Union Bank of the Philippines. The money transfers were performed in partnership with Singapore-based OCBC Bank using the Adhara liquidity management and international payments platform. Adhara's Faura said tokenized money eventually transform existing financial systems. "Tokenized money is essentially implementing regulated money in a bank or electronic money transfer industry or a central bank... but doing that on top of smart contracts on a blockchain construct," he said. "There's also the possibility to put that money on hold...while you do a financial process such as clearance of payments like paying for securities. "It's just a bank using another technology to issue money," Faura added. "And, we don't need a new regulatory framework to do that." |

| Posted: 04 Nov 2019 12:28 PM PST Some 20 years ago, the founders of Amazon and Google essentially set the course for how the internet would come to dominate the way we live. Jeff Bezos of Amazon, and Larry Page and Sergey Brin of Google did more than anyone else to actualize digital commerce as we're experiencing it today – including its dark underbelly of ever-rising threats to privacy and cybersecurity. Related: Securing identities in a blockchain Today we may be standing on the brink of the next great upheaval. Blockchain technology in 2019 may prove to be what the internet was in 1999. Blockchain, also referred to as distributed ledger technology, or DLT, is much more than just the mechanism behind Bitcoin and cryptocurrency speculation mania. DLT holds the potential to open new horizons of commerce and culture, based on a new paradigm of openness and sharing.

At least that's a Utopian scenario being widely championed by thought leaders like economist and social theorist Jeremy Rifkin, whose talk, "The Third Industrial Revolution: A Radical New Sharing Economy," has garnered 3.5 million views on YouTube. And much of the blockchain innovation taking place today is being directed by software prodigies, like Ethereum founder Vitalik Buterin, who value openness and independence above all else. Public blockchains and private DLTs are in a nascent stage, as stated above, approximately where the internet was in the 1990s. This time around, however, many more complexities are in play – and consensus is forming that blockchain will take us somewhere altogether different from where the internet took us. "With the Internet, a single company could take a strategic decision and then forge ahead, but that's not so with DLT," says Forrester analyst Martha Bennett, whose cautious view of blockchain we'll hear later. "Blockchains are a team sport. There needs to be major shifts in approach and corporate culture, towards collaboration among competitors, before blockchain-based networks can become the norm." That said, here are a few important things everyone should understand about the gelling blockchain revolution. How public blockchains work A blockchain is nothing more than a distributed database that functions as a shared ledger between multiple parties. The ledger can be shared among folks with a singular interest, such as Bitcoin holders. Or it can be a ledger for just about any type of information shared between companies or between people and organizations. A live copy of the ledger is distributed to the computers of the participants, and advanced cryptography prevents past ledger entries from being altered. There's a big difference between public blockchains like Bitcoin and Ethereum and private DLTs, like those leveraging the open-source Hyperledger framework backed by IBM, Intel, Cisco and dozens of other corporate giants. (More on private blockchains coming up.)

Bitcoin mining, for instance, is a contest to solve a difficult cryptographic puzzle in order to earn the right to add the next block of validated ledger entries to the historical chain of ledger blocks. The winning miner gets a token — one Bitcoin. All of the other miners, by competing against one another, serve to validate the ledger, thus eliminating the need for a trusted middleman. It's difficult to pinpoint the number of true public blockchains, but there are now a few dozen prominent ones that issue tokens. Thus, peripheral services have cropped up to support trading and speculation of blockchain tokens, aka cryptocurrencies, and the attendant speculation roller coaster gets a lot of attention. However, cryptocurrencies are only one small part of blockchain technology. Supplanting middlemen The disruptive component of public blockchains is not what many folks think. It's not just about issuing digital currency. The real power of blockchain lies in its potential to decentralize many other types of ledger keeping. Sometime in the next 10 to 20 years, blockchains could begin to profoundly supplant all types of middlemen who now control the flow of finances, the movement of goods and services, and the distribution of digital content. This includes eliminating the roles of business leaders the likes of Facebook CEO Mark Zuckerberg and Twitter CEO Jack Dorsey, whose companies control the flow of social discourse. Social commentators like Rifkin and technologist Andreas Antonopoulos have garnered global followings talking about how blockchain can empower people to control and monetize many aspects of their digital lives. For instance, I attended a provocative talk Antonopoulos gave on this topic in Seattle titled "Escaping the Global Banking Cartel."

Efforts are underway to develop and someday widely deploy public blockchains that could decentralize how legal documents are issued; distribute and keep track of digital IDs for impoverished people; and divide and distribute fragmented payments to participants in supply chains. Brainstorming has even commenced for making distributed ledgers the basis of fraud-proof blockchain voting systems. What makes private DLTs tick By contrast, private blockchains are essentially the product of the corporate sector recognizing something big is going on and reflexively scrambling for a foothold, so as not to be left behind. Private DLTs don't have any need for a proof-of-work mechanism. This is because a single corporate entity, or a group of entities, retains full control of validating new blocks of entries and adding them to the standing ledger. You have to be invited to participate in a private blockchain, and the view of the ledger is restricted to permissioned users. Of course, everyone in a private blockchain must agree to abide by a set of rules established and enforced by the governing corporate entity or entities. The big attraction for corporations to implement private blockchains is that the ledger data gets distributed across many machines, boosting the efficiency and flexibility of transactions in a way that is very accurate, and very difficult to maliciously alter. However, after an initial burst of exuberance, enterprises today are no longer racing after blockchain systems just to be able to say that they're doing something innovative, Forrester's Bennett told me. Fewer projects are getting launched by the corporate world, and the initiatives that are getting greenlighted tend to focus on mapping the cultural and technical obstacles that lay ahead and setting technical ground rules everyone can agree on. This queuing is most notably taking place within Hyperledger, a consortium hosted by the Linux Foundation whose founding members happen to be 30 corporate giants in banking, supply chains, manufacturing, finance, IoT, and technology, led by IBM and Intel. Since private blockchains don't use any type of proof-of-work mechanism – the very thing that makes public blockchains next to impossible to alter – traditional cybersecurity concerns apply. With no miners vying to win tokens and validating the accuracy of historical records, a trusted middleman is needed. And that trusted middleman remains the same as always: a vulnerable corporate entity. In fact, with so many more interfaces swirling through a blockchain system, it becomes even more important for enterprises to adhere to very strict cyber hygiene practices, and everything, security-wise, must go right for them. How often does that happen today? "Those involved in the most advanced privacy DLT initiatives have discovered that operationalizing and scaling this technology is a major challenge," Bennett says. "Some of these challenges will disappear over time as tooling improves, but others won't, such as making the system and all its interfaces secure." Open source collaboration kicks in This is the reason for Hyperledger, which is not a blockchain, per se, and cannot issue any type of cryptocurrency of its own. IBM and Intel would like nothing better than for Hyperledger to arise as the go-to framework for both public and private blockchains, standardizing, as much as possible, around reliable open-source components. Again, think back 20 years. This is exactly how Linux evolved from a hobbyists' operating system to a commercially viable OS widely used in enterprise networks.  Hojjati I ran this by Avesta Hojjati, head of research and development at DigiCert, a Lehi, Colo.-based supplier of digital certificates who's an active participant in Hyperledger. "You can think of Hyperledger Fabric as a car chassis that's been welded, painted and maybe has wheels on it," Hojjati told me. "You still need to add an engine and a number of different things to make it fully functional. But you're able to work with something that's very easy to maintain and deploy." Launched in 2016, Hyperledger has begun incubating projects such as Hyperledger Ursa, which is intended to be a go-to, shared cryptographic library. "In the past, utilizing such technology would have required subject matter expertise," Hojjati says, "whereas today, any developer can utilize the Ursa library and implement projects based on these capabilities." Capturing public-private synergies New tools under the Hyperledger umbrella could be used to tilt us into an age of much more democratized global commerce. Or they could turn out to be the tools that help today's corporate captains remain in power. I've come to believe that it's probably going to be something in between. Public and private distributed ledgers have already begun to converge. A ton of innovation is under way. Difficult tradeoffs must be made and pivotal architectural advances must be achieved. Enterprises will remain at the table because improved productivity and greater profits are possible. But is it conceivable that the hybrid blockchains of the near future could also blow up the existing digital gold mines and democratize who gets access to the gold dust? Forrester's Bennett has observed and analyzed emerging tech for 30 years, the past five looking at distributed ledgers. I asked her what role she thought blockchains will play 10 years from now. Her answer:  Bennett "The only thing we can say for certain is that it'll look nothing like what we've got today. I'm not anti-blockchain, I'm just aiming to be realistic. While the technology won't deliver miracles, it does provide us with the opportunity to do things differently – radically differently – from today. In other words, blockchains can support new business and trust models – but we need to design them first. And while some compromises will no doubt be necessary, the technology issues are more likely to be solved more quickly than all of the non-technical aspects." When you put it that way, it's difficult for me to visualize the complete extinction of today's top middlemen. But maybe they'll get shoved down a few notches by a new breed of middlemen. The blockchain revolution has commenced, folks. There's no turning back. It very well could take us to improved privacy and cybersecurity. Going forward, one thing is certain: It won't be dull. I'll keep watch.

Acohido Pulitzer Prize-winning business journalist Byron V. Acohido is dedicated to fostering public awareness about how to make the Internet as private and secure as it ought to be. (This column originally appeared on Avast Blog.) *** This is a Security Bloggers Network syndicated blog from The Last Watchdog authored by bacohido. Read the original post at: https://www.lastwatchdog.com/my-take-how-blockchain-technology-came-to-seed-the-next-great-techno-industrial-revolution/ |

| You are subscribed to email updates from "blockchain" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

- Get link

- X

- Other Apps

Some believe that this time around there won't be a handful of tech empresarios grabbing a stranglehold on the richest digital goldmines. Instead, optimists argue, individuals will arise and grab direct control of minute aspects of their digital personas – and companies will be compelled to adapt their business models to a new ethos of sharing for a greater good.

Some believe that this time around there won't be a handful of tech empresarios grabbing a stranglehold on the richest digital goldmines. Instead, optimists argue, individuals will arise and grab direct control of minute aspects of their digital personas – and companies will be compelled to adapt their business models to a new ethos of sharing for a greater good. In public blockchains, anyone can participate. The ledger is 100% decentralized, and a completely transparent view of all ledger entries is always accessible to one and all. Public blockchains typically rely on a computational contest, called

In public blockchains, anyone can participate. The ledger is 100% decentralized, and a completely transparent view of all ledger entries is always accessible to one and all. Public blockchains typically rely on a computational contest, called

Comments

Post a Comment