10 Bitcoin And Blockchain Leaders Made Forbes 30 Under 30 List - Forbes

- Get link

- X

- Other Apps

10 Bitcoin And Blockchain Leaders Made Forbes 30 Under 30 List - Forbes |

- 10 Bitcoin And Blockchain Leaders Made Forbes 30 Under 30 List - Forbes

- How Blockchain is Used for Protecting Transactions - Enterprise Security Mag

- Wyoming’s crypto-blockchain giveaway - WyoFile

- Exploring the Basic Concepts of Blockchain - CIO

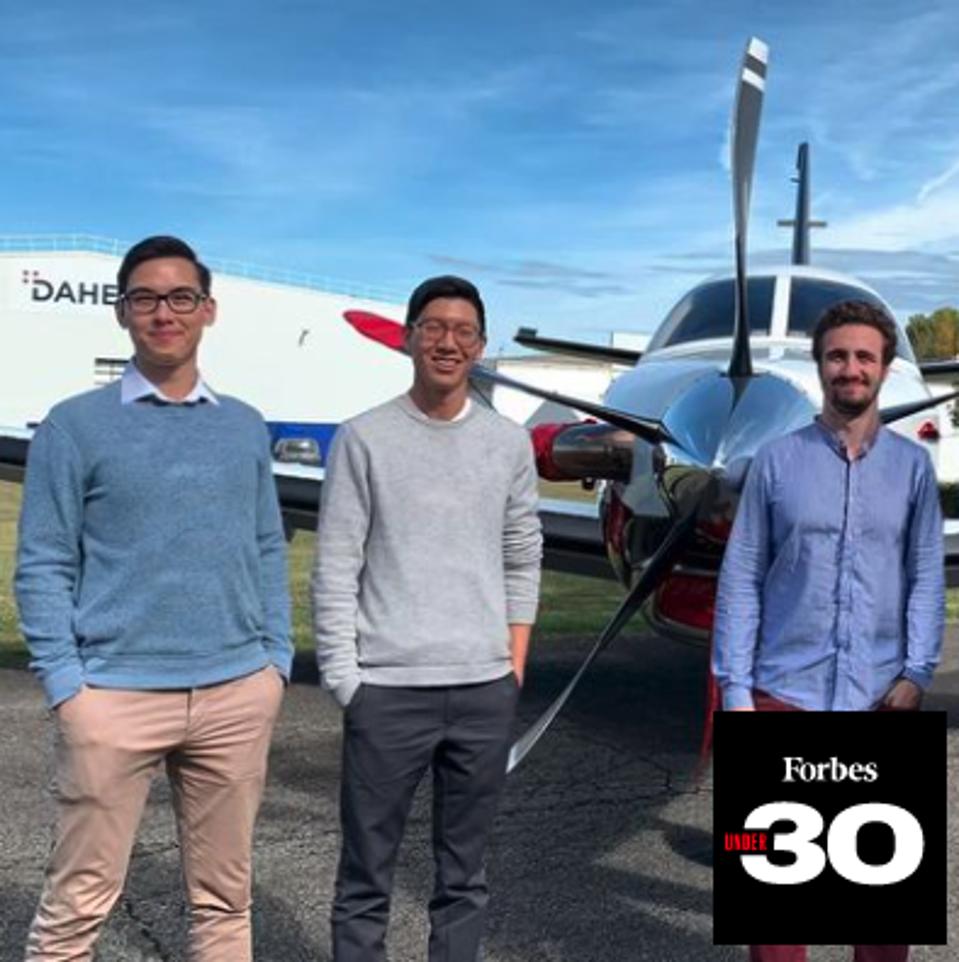

| 10 Bitcoin And Blockchain Leaders Made Forbes 30 Under 30 List - Forbes Posted: 01 Dec 2020 07:55 AM PST For the tenth anniversary of the Forbes 30 Under 30 list of business leaders paving the way for future generations, ten bitcoin and blockchain leaders were added to the list. While it took a couple years for Forbes to start counting bitcoin entrepreneurs—then any entrepreneur using the underlying blockchain technology—this year's list shows how important the sector created by the mysterious Satoshi Nakamoto has become. The most talented young leaders in the cryptocurrency space are truly among the most talented young leaders in the world. Period. As evidence of the breadth of impact crypto is having, this year's 30 Under 30 list included seven people in the finance category, one in venture capital, one in energy, and one in manufacturing. Click here to read the entire Forbes 30 Under 30 list. If crypto is your only passion, scroll down here to see who made this year's list.  Volt Capital Soona Amhaz, 27 Founding Partner, Volt Capital San Francisco, California Amhaz is the founder of Volt Capital, a contrarian crypto fund managing capital on behalf of investors like USV's Albert Wenger and Founders Fund's Brian Singerman. She has led eight investments to date, backing startups including Magic, Valiu, Cozy, BuyCoins and Matrix League. For Amhaz, crypto investing is personal: her family residing in Lebanon have suffered from the depreciation of the country's currency, driving Amhaz to help them convert some to bitcoin to preserve what they had left.  Alameda Sam Bankman-Fried, 28 Founder, FTX Hong Kong, Hong Kong The founder and CEO of quantitative crypto trading firm Alameda Research, managing $2.5 billion in assets, mostly from the Serum (SRM) coin that Bankman-Fried helped create. In 2019, he founded crypto-derivatives platform FTX, which recently raised $40 million at a $1.2 billion valuation. FTX trades futures on cryptocurrencies. He owns approximately 50% of the company, which generated roughly $50 million revenue so far this year, with a profit of $30 million.  Augur Joseph Krug, 25 Cofounder, Augur San Francisco, California The co-chief investment officer of Pantera Capital helps manage $442 million across three crypto-related funds. The largest fund increased 240% this year to $227 million in initial coin offerings (ICOs), including Ethereum competitor Polkadot, now valued at $5 billion and a cryptocurrencies fund increased 135% annually to $40 million. Before Pantera Krug organized the first ICO on Ethereum raising $5.7 million for Augur, a peer to peer betting platform with a total market value of $152 million.  Forbes Alexander Liegl, 28 Cofounder, Layer1 Technologies San Francisco, California "Mining bitcoin is about converting electricity into money," says Alexander Liegl. So it helps to be where the electricity is cheapest. Liegl is betting $50 million in funding from the likes of billionaire Peter Thiel that he's found the cheapest juice out in west Texas where wind turbines outnumber oil wells. In exchange for cheap power, Layer1 helps the local power grid manage their load. If the wind stops blowing, Liegl agrees to shut down his bitcoin mining machines. "We act as an insurance underwriter for the energy grid," says Liegl. It costs him about $1,000 to mine a single Bitcoin, which currently trades at roughly $13,000 on the open market.  Zap Jack Mallers, 26 Founder, Zap Solutions Chicago, Illinois CEO of Zap, a bitcoin investment and payments company that transacts over the Lightning Network. Zap recently closed a $3.5M seed round led by Greenoaks Capital and employs about 20 people. It recently announced it's working with Visa as the payments and credit card giant introduces clients to bitcoin. Mallers' father founded and sold one of the largest futures brokerages in Chicago and introduced him to bitcoin in 2013.  BlockFi Flori Marquez, 29 Cofounder, BlockFi Brooklyn, New York The cofounder of cryptocurrency lending platform BlockFi, which allows crypto holders to lend out cryptocurrency at rates as high as 8.6%. The platform also offers crypto trading services and has raised over $100 million in equity from venture capital firms including Galaxy Digital, Susquehanna, and Winklevoss Capital. After generating $4.5 million revenue in 2019, BlockFi has 100,000 funded accounts and is on track to earn $120 million revenue this year and is preparing for an IPO.  Paradigm Charlie Noyes, 21 Partner, Paradigm San Francisco, California An investment partner at crypto venture fund Paradigm Capital, currently overseeing $100 million in positions for the largest crypto fund in the world. Noyes was a personal seed investor in institutional cryptocurrency trading platform Tagomi, eventually resulting in a $12 million Series A in the firm and a 2020 exit to Coinbase. He also contributed to a $1 million seed investment in Uniswap, a token now trading at a $3 billion valuation.  CoinList Brian Tubergen, 29 Cofounder, CoinList New York, New York The founder of CoinList, an investment platform that helps promising crypto companies raise money and allows investors to trade those companies' cryptocurrencies. Since inception in 2017, CoinList has raised over $800 million for crypto companies, which are backed by venture firms including Sequoia, a16z, USV, GV, Bain and Lightspeed. A former intern at Google, Microsoft and Facebook, Tubergen kicked off his career as director of product at AngelList after graduating from Princeton University.  Amiti Uttarwar Amiti Uttarwar, 28 Bitcoin Protocol Engineer, Bitcoin Core Incline Village, Nevada The first known woman Bitcoin Core contributor received a joint $150,000 grant from OKCoin and HDR Global, in June, making her one of the few paid coders developing bitcoin's underlying code. The daughter of Indian immigrants, a graduate of Carnegie Mellon University and veteran of Silicon Valley startups, she represents a new movement of software engineers developing open-source money. She started The Bitcoin Zine a publication covering the lighter side of bitcoin development.  Authenticiti Andrew Yang, 27; Jeong Woo Park, 25; and Athanasios Karachotzitis, 26 Cofounders, Authenticiti This supply chain data platform powered by blockchain was launched in 2016. They've raised $2.1 million to centralize the siloed enterprise systems of modern supply chains and aggregate data to one source. A pilot project aggregated order-to-cash data between GE Aviation's and Lockheed Martin's siloed systems to provide real-time shared visibility into the shipment of gaskets. Revenue is expected to reach $2.6 million in 2020. |

| How Blockchain is Used for Protecting Transactions - Enterprise Security Mag Posted: 30 Nov 2020 09:21 PM PST By Enterprise Security Magazine | Tuesday, December 01, 2020

The companies can use blockchain technology to protect transactions and secure IT devices. FREMONT, CA: Blockchain technology is extensively related to cryptocurrencies like Bitcoin. Such currencies allow recording the transactions so that the cybercriminals cannot tamper with it easily. But there are also other broader implications of blockchain used to protect transactions and secure IT devices. What is blockchain Blockchain can be defined as a digital ledger. It is a collection of records of transactions, and every one of them is time stamped. However, the blockchain is different from any other transaction process because it is impossible to manage the records centrally but by a complete series of computers. It means that the data available in the chain is open for each system to see, but any sensitive information is encrypted, due to which it is not possible to read them. If any effort is taken to tamper with the information, it will become apparent immediately. Whenever a new transaction is initiated, a block is developed, and it can be verified by numerous other systems and added to a chain that is stored across the internet. Therefore, it can produce a unique record that has been verified several times separately. Every block is connected to the ones and before and after it. To falsify a document, it is necessary to modify the entire chain, and due to its size and distributed nature, it is impossible. The blockchain is better and efficient for financial transactions because every record is independently verified, and the chain develops a record of the transactions carried out. The technology can also be implemented in any commercial transaction. Therefore, blockchain can be utilized for building conditional contracts, shipping goods when a payment is received, and automatically commencing a service. Blockchain can also be used for securely storing data. The data can be directly stored in the blockchain across numerous devices instead of using a cryptographic key. If hackers try to destroy or tamper with the data, the system analysis of the stored chain and anything else that does not match will exclude. It is necessary to have access to each device to introduce a rogue record. |

| Wyoming’s crypto-blockchain giveaway - WyoFile Posted: 01 Dec 2020 03:22 AM PST  In recent years, Wyoming created some of the most attractive laws in the country for establishing blockchain and cryptocurrency companies in our state. But by allowing the laws to be shaped and written by those who benefit from them, our legislative hard work accomplished everything the blockchain industry wanted but nothing the state needs. Namely, jobs and revenue. Blockchain technology — a chain of digital records that is supposed to be near impossible to manipulate — offers a way to keep track of the ownership of a product throughout time. For example, a cow gives birth, the newborn eats Wyoming grass, is trucked to Nebraska and eventually ends up in a hamburger at an Orlando drive-through. With blockchain, we can know the history of that Whopper — and should it contain E. Coli, that might be useful to the CDC. Cryptocurrency uses blockchain technology to create new forms of digital currency, like the famous bitcoin, where again, the ownership and value of the unique digital coins are considered nearly impossible to manipulate. It's a booming industry and crypto fans cite South Dakota's experience with credit card laws as an example of how attracting the financial sector through favorable laws and rules can help Wyoming. In the late 1970s Citibank was losing enormous sums on their credit card operations because they couldn't charge a high enough interest rate. Lawmakers in South Dakota, a state on its ear financially, realized they could solve Citibank's problem by crafting regulations that would allow a bank in South Dakota to charge whatever it wanted to a customer in Los Angeles. Knowing this, the governor of South Dakota, Bill Janklow, told Citibank it would get the legislation it wanted, but only if Citibank promised to move at least 400 credit-card-processing jobs to South Dakota. Citibank agreed, along with Bank of America and others, eventually creating 20,000 well-paying jobs for the state. But unlike credit-card processing, blockchain doesn't open envelopes, answer phones or process checks. Instead it stores data on microchips which keep getting cheaper and easier to read from anywhere in the world. Blockchain doesn't create many jobs and the few it does create appeal to the kind of workers who want to live in London, not Rock Springs. Consider Kraken, the first company to take advantage of our new laws. The company domiciled its banking operation in Wyoming to great hoopla. But renting a post office box in Cheyenne does not create jobs for former trona miners or rail workers. Today, Kraken's website lists over 100 job openings in cities such as London, Singapore and San Francisco — as well as many remote opportunities. Out of all those jobs, only one is listed in Wyoming, and in bold print the application states: "Relocation to Wyoming is an option." Beyond insisting on jobs, South Dakota was not afraid to charge companies a fair price in return for a favorable business climate. As Gov. Janklow explained, "We had a 5% tax on the profits from these companies. They make $500 million, we get $25 million. That's a lot of money in South Dakota." If Janklow and the South Dakota Legislature were going to create value for banks in New York, they wanted something in return. Support informed commentary — donate to WyoFile today.But unlike South Dakota, Wyoming let industry write the legislation, and they chose not to charge themselves. As cofounder of the Wyoming Blockchain Coalition Caitlin Long, (who also founded her own cryptocurrency start-up Avanti), helped write the legislation. In her article for Forbes, Long boasts about Wyoming: "Basically, there are none [fees or taxes] at the state level—in most cases! … At the state level, Wyoming has no personal income tax, no corporate income tax, and almost none of the other 'gotcha' taxes that frequently hit businesses domiciled in other US states, such as franchise taxes or gross-receipts taxes." Unlike South Dakota and its wily governor and state legislators, we forgot that the goal was not to help billionaires in California or Teton County, but to help everyday Wyoming communities. Today we're one of about a dozen states that have passed favorable legislation for blockchain and cryptocurrency companies, which means that our only advantage over those other states is that we don't ask for anything in return — neither jobs nor revenue. That might be great for blockchain companies, but doesn't do the families of Wyoming any good. Which won't do a thing to help Gov. Mark Gordon offset $500 million in spending cuts on their way to our schools, roadways, healthcare system and those workers needing re-training. Don't get me wrong, I think there's a decent chance some people will make a lot of money off our legislation, but it won't be folks living in Rawlins or Evanston. |

| Exploring the Basic Concepts of Blockchain - CIO Posted: 01 Dec 2020 01:31 PM PST  Anyone who pays attention to emerging technologies knows there is a lot confusion around the concept of blockchain. While people have been talking about blockchain for years, and a wide range of industries are now using blockchain, many people aren't quite sure of what blockchain is and how it works. In this blog, I hope to clear up some of the confusion about this rapidly emerging technology. A definition So, what is blockchain? The short answer is that blockchain is a secure, poorly written database that nobody has to own. I say "poorly written" because there are some arguments that blockchain is not necessarily the best database structure out there — but it's not meant to be that. Basically, blockchain is a self-sustaining and self-governing database. At a more detailed level, a blockchain is a de-centralized data structure of transactional records that ensures security, transparency and immutability — meaning that records can't be changed. You can also think of a chain of records stored in the form of blocks, which are typically controlled by no single authority. Or you can think of blockchains as fairly simple databases wrapped in varying degrees of cryptography. Trust systems Blockchain is not trying to solve a database issue. It is trying to solve a trust issue. Blockchains are a type of distributed ledger system that grew out of a need for trust. Individual-multi corporation structures use imposed trust systems. You have a central clearinghouse or a single database and exchanges. This can be stock exchanges and the clearinghouses that support them. The Depository Trust and Clearing Corporation (DTCC), a clearinghouse that settles securities transactions for NASDAQ, is a trust system. Bitcoin is a trust system. The same for many other security groups — from central banks to toll roads and your local library. A trust system can be anything that is keeping track of records and the individuals or corporations that use them. A distributed trust system, distributed ledger or blockchain decentralizes the trust system. Everything goes to a peer-to-peer database with some form of trust built into it. Blockchains are one form of distributed trust, in that blockchains embed a cryptography in each block and they use a consensus algorithm. Blockchain vs. distributed ledger You'll often see the terms "blockchain" and "distributed ledger" used interchangeably. While it's true, that blockchains are mostly distributed ledgers, not all distributed legends are blockchains. You'll see people talking about a distributed ledger system, but it's not really using a blockchain. It's using some other form of distributed trust. Mistrust issues One of the key drivers for blockchain and distributed ledger solutions is some level of mistrust between different entities, whether that is companies, governance organizations, groups or individuals. This group of technologies could be one solution to allow different entities to cooperate, do business together and generate profits, even if they have reasons to be leery of one and other. Trust — and mistrust — play into your blockchain architecture choices around consensus and cryptography. The harder you make consensus, the more likely it is that consensus will be contested, and the more vigorous your cryptography has to be. The more the groups trust each other, the less vigorous your cryptography has to be. It all comes back to trust in a lot of ways. Key takeaways A blockchain is a database shared among different entities who have varying levels of trust, including no trust at all. This reality has a lot of architecture problems built into it. And that, at the end of the day, is what blockchain is all about. It is about overcoming those problems. Blockchain takes people and transactions that you have no reason to trust and builds trust into the system, locking it in place by rules of the database in a permission-less system. To learn more To explore innovative uses for blockchain in different industries, visit the Dell Technologies blockchain site. For more information on how you can accelerate your AI journey, visit Intel AI Builders and AI Solutions from Dell Technologies. |

| You are subscribed to email updates from "blockchain" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

- Get link

- X

- Other Apps

Comments

Post a Comment