Explained: Digital currencies and how they work - The Indian Express

- Get link

- X

- Other Apps

A cryptocurrency is a medium of exchange, such as the rupee or the US dollar, but is digital in format and uses encryption techniques to both control the creation of monetary units and to verify the exchange of money. Bitcoin is considered to be the world's best known cryptocurrency and is the largest in the world according to market capitalisation, followed by Ethereum.

In traditional financial deals, where two parties are using fiat money, a third-party organisation — usually a central bank — assures that the money is genuine and the transaction is recorded. With cryptocurrencies, a chain of private computers — a network — is constantly working towards authenticating the transactions by solving complex cryptographic puzzles. For solving the puzzles, these systems are rewarded with cryptocurrencies. This process is called mining.

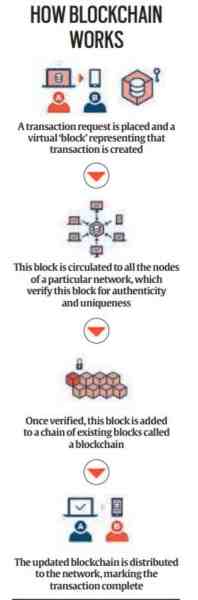

At the backend of these transactions is a technology called 'blockchain'.

What is blockchain?

Satoshi Nakamoto — the person (or a group of people) who is said to have conceptualised an accounting system in the aftermath of the 2008 financial crisis — had mooted an idea where the transactions and the value of money would be recorded digitally on a publicly available and open ledger that contains all the transactions ever made, albeit in an anonymous and encrypted form. This ledger is called the blockchain.

Bitcoin and the thousands of cryptocurrencies are essentially codes recorded on a blockchain that gets longer and longer as more people use them.

There have been voices calling for stablecoins as an alternative to volatile cryptocurrencies. What are stablecoins?

Stablecoins are digital currencies that are backed by a fiat currency such as the US dollar, thus giving it an intrinsic value. From an investor point of view, stablecoins become easier to understand considering the underlying reserve asset. There is also a case being made by sovereign governments for stablecoins such as Tether, USD Coin and Diem (proposed by Facebook's parent company Meta) given that it could increase the reach of their fiat currencies in the digital ecosystem.

How are cryptocurrencies bought?

There are two ways. The first is to buy it from someone and the second is to mine new crypto coins. Buying it from someone usually happens in two ways — an exchange-facilitated transaction or a peer-to-peer transaction. For Indians, the simplest way to invest or trade in cryptocurrencies has been through one of the many exchanges and trading platforms operating in India. These include WazirX, CoinDCX, CoinSwitch Kuber, Zebpay, Bitbns, Giottus, etc.

To be able to trade or invest in cryptocurrencies using INR, users need to register on one of the exchanges by completing a KYC process. Then, a user buying crypto for the first time will need to load INR money in the wallet of their cryptocurrency exchange. The cryptocurrency wallet is identified by a unique address represented by a randomly generated combination of numbers and letters. There are two ways to load money into a cryptocurrency wallet — through net-banking or through an e-wallet.

Here's where the first entry barrier arises. Despite the Supreme Court order that quashed the RBI directive prohibiting banks from allowing their systems to be used for virtual currency transactions, several large banks don't offer their financial infrastructure for investment or trade in crypto. Among the e-wallets that operate in the country, only MobiKwik is supported on platforms such as WazirX and CoinDCX. Once the transaction is through, the purchased cryptocurrency holding is reflected in the exchange's wallet.

How are they sold for INR?

The Indian exchanges allow sale of cryptocurrencies in exchange for INR as well but given that many of the smaller banks that support the transactions do not have the necessary digital infrastructure to handle the volumes of withdrawal and the volatility experienced by these virtual currencies, disruption in withdrawal services is a common occurrence.

The government plans to bring a Bill to prohibit "all private cryptocurrencies". What are private cryptocurrencies?

While there is no clarity yet on how private cryptocurrencies are defined, indications are that any digital currencies that are not issued by the State will be banned.

Newsletter | Click to get the day's best explainers in your inbox

- Get link

- X

- Other Apps

Comments

Post a Comment